Better Buy: UnitedHealth Group, WellPoint, or Cigna?

Major health insurers are rationalizing membership and pricing to reflect shifting health care spending trends and demographics. As a result, insurers UnitedHealth Group , WellPoint , and Cigna have all embraced the Affordable Care Act with caution, focusing primarily on the largest markets most likely to provide sales and earnings growth.

Those larger markets are important because the industry has been -- and will remain -- an industry driven by scale. That's why the allure of reform is so attractive to these companies, because it gives them another way to insulate risk away from large individual claims.

Debating earnings

UnitedHealth, Wellpoint, and Cigna have all been growing membership this past year. UnitedHealth added 4.35 million to its member rolls this year. WellPoint's enrollment grew 6% to 35.5 million members thanks to its acquisition of Medicare insurer Amerigroup. And the number of people enrolled in Cigna's global health care division climbed 2.3% from last year.

So far, it appears UnitedHealth, WellPoint, and Cigna are all doing a good job at controlling costs tied to serving these members. The three companies' medical loss ratio, or MLR, are tracking within the Affordable Care Act's mandated 80% to 85% range.

That ratio, which shows how much insurers are spending on patient care relative to how much they're collecting in premium revenue, is particularly strong at UnitedHealth, which posted an MLR of 80.6% in its third quarter. At 84.9%, WellPoint had the highest ratio, and Cigna split the difference at 82.9%.

However, while those ratios are where you would like to see them, you'll want to know if other costs are being kept in line, too. One of my favorite ways to determining this is by comparing operating margins because leaner operations should provide greater earnings leverage. Across these three insurers, UnitedHealth is tops at converting sales into profit, with a trailing 12 month operating margin of 7.77%.

CI Operating Margin (TTM) data by YCharts.

The consistency of those margins, combined with rising revenue from membership growth, and share repurchases, has helped each of the companies grow earnings per share over the past decade. The fastest earnings growth has come from UnitedHealth, which has seen compounded EPS gain an average 16.91% over the past five years. At WellPoint, earnings have grown 8.32%, and at Cigna, they've increased 23.1%. Based on operating margin and earnings growth, it appears that WellPoint comes up short.

CI EPS Diluted (TTM) data by YCharts.

WellPoint's trailing margin and earnings results are also reflected in Wall Street analysts' earnings expectations. Analysts expect EPS will fall by 1.3% at WellPoint next year, and increase at both UnitedHealth and Cigna.

Company | Beats (past year) | Current year | Next year | Change |

UnitedHealth | 2 | $5.49 | $5.69 | 3.6% |

WellPoint | 4 | $8.50 | $8.39 | (1.29%) |

Cigna | 4 | $6.65 | $7.25 | 9.02% |

Source: Yahoo! Finance.

Debating valuation

It's probably not surprising to see Cigna, which has the highest expected earnings growth for the coming year, trading at the highest price to sales. It's also not a shock to see WellPoint, where earnings are expected to slip, as the least expensive on a P/S basis. UnitedHealth arguably has the most running room based on its 10-year range.

UNH PS Ratio (TTM) data by YCharts.

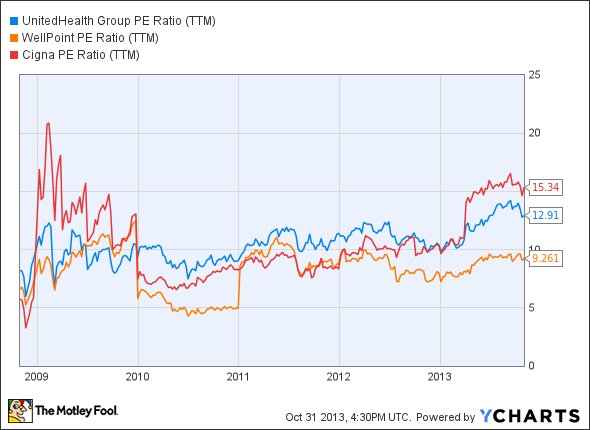

A look at the three companies P/E ratios suggests none are particularly cheap. If you consider the P/E ratio based on forward earnings estimates, divided by the five-year P/E low, United Healthcare is arguably most attractive, while Cigna is most expensive. Conversely, comparing current P/E ratios to trailing ratios over the past five years shows each is already at or nearing highs.

UNH P/E Ratio (TTM) data by YCharts.

Finally, forward P/E to growth ratios, or PEG, for the three suggests investors are paying the most for WellPoint's future opportunity and least for Cigna's.

UNH PEG Ratio (Forward) data by YCharts.

Conclusion

The implementation of the Affordable Care Act is a major concern for the industry, because insurers ability to profit will ultimately be driven by how many members sign up. Assuming those launch headaches dissolve and membership climbs, UnitedHealth, WellPoint, and Cigna should all benefit from rising revenue and stable MLRs. However, it appears investors are already pricing in that growth based on P/E and P/E to growth ratios. Of the three, Cigna appears to have the edge, given its price to growth, and strong earnings outlook.

Knowing the Affordable Care Act beyond insurers

Obamacare seems complex, but it doesn't have to be. In only minutes, you can learn the critical facts you need to know in a special free report called Everything You Need to Know About Obamacare. But don't hesitate; because it's not often that we release a FREE guide containing this much information and money-making advice. Please click here to access your free copy.

The article Better Buy: UnitedHealth Group, WellPoint, or Cigna? originally appeared on Fool.com.

Todd Campbell has no position in any stocks mentioned. Todd owns E.B. Capital Markets, LLC, an institutional research firm. E.B. Capital's clients may or may not own shares in the companies mentioned. Todd also owns Gundalow Advisors, LLC, a high net worth advisory focusing on ETFs. Gundalow's clients do not own shares in the companies mentioned. The Motley Fool recommends UnitedHealth Group and WellPoint. The Motley Fool owns shares of WellPoint. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.