Why Deere's Dividend Is Poised to Grow

Heavy-equipment maker Deere has capitalized on the success of the agricultural industry in recent years, using improving financial conditions in the sector to its advantage in boosting sales of its products to cash-flush farmers. Along the way, the company has rewarded shareholders with consistent dividend increases over the past decade. Even though Deere's shares have pulled back somewhat in light of weakening economic growth in key international markets, its dividend nevertheless offers advantages compared to heavy-equipment peers Caterpillar and Joy Global .

Deere has had to face many of the same threats as Caterpillar and Joy Global, which have suffered from slower economic growth in China, as well as the fallout from dropping prices for the commodities that their mining-equipment customers rely on to finance major capital expenditures. Deere doesn't face the same challenge from the hard-hit mining industry, but it has increasingly relied on South American markets for growth, especially in its key agriculture and turf segment. Let's take a closer look at Deere and how its prospects for future growth could affect its dividend in the future.

Dividend stats on Deere

Current Quarterly Dividend Per Share | $0.51 |

Current Yield | 2.4% |

Number of Consecutive Years With Dividend Increases | 10 |

Payout Ratio | 23% |

Last Increase | March 2013 |

Source: Yahoo! Finance. Last increase refers to ex-dividend date.

Are cloudy days coming for Deere?

From a fundamental perspective, Deere has continued to have success recently. The company announced record earnings of $997 million in its fiscal third-quarter report back in August, up 26% from the year-ago quarter on a 4% rise in revenue. CEO Sam Allen pointed to "considerable strength in the farm sector" in the Americas as enabling the move higher.

Yet when you look more closely at Deere's results, you can see the big divide between the company's major segments. Agriculture-and-turf division sales rose 8%, but Deere's forestry and construction division experienced an 11% drop in revenue. That's consistent with the problems that Caterpillar and Joy Global have faced, as they don't have the ag-industry presence to offset the weakness on the industrial side of their respective businesses. Poor guidance for the current quarter, with expectations for continued pressure from the construction and forestry business, hurt Deere's share price after the announcement, and it could weigh on the company's overall results for years to come.

Another potential threat comes from lesser-known competitors in the agriculture industry. Even as Deere was guiding its future results lower, both CNH Global and AGCO ramped up their guidance. That raises questions about Deere's market-share sustainability, although just earlier this week, AGCO missed analyst estimates in its third-quarter report, disappointing those who'd ratcheted up their views for the remainder of the year.

For its part, Deere has worked to make smart strategic decisions. In September, it said it would look at options like potentially selling off its irrigation business, which reported a loss in Deere's most recent quarter. It also sold a majority stake in its landscapes business to a private equity firm for $300 million earlier this week. In broader terms, Deere hopes that South America will be the gateway to accelerating growth, even as Brazil has seen its growth rate pull back in recent years.

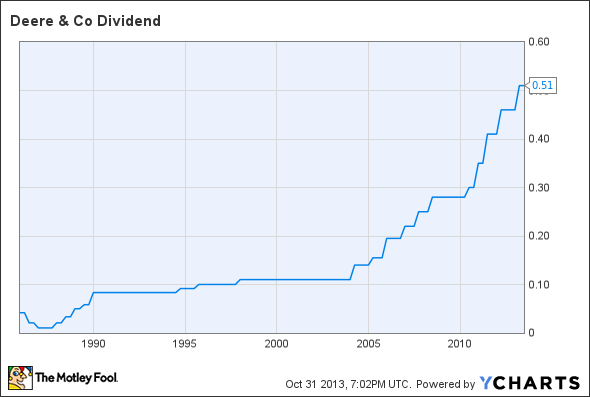

Deere Dividend data by YCharts.

When you put Deere's long-term performance into context, it's not surprising to see how much the company's dividend has risen, especially in the past decade. Yet thanks to the rapid pace of Deere's earnings growth, the ag-equipment giant pays out less than a quarter of its earnings, leaving plenty of room for future growth.

When will Deere boost its payout?

With Deere just having made a more than 10% increase to its quarterly payout back in March, investors shouldn't expect another increase before 2014. Looking forward, though, an increase to $0.56 or $0.57 per share on a quarterly basis would still leave Deere with a sizable margin of safety compared to its earnings. It would also push Deere's yield up toward the 2.8% that Caterpillar currently pays. As long as the agricultural industry keeps thriving, Deere shareholders should continue to enjoy solid payouts.

Is Deere your best dividend play?

Dividend stocks can make you rich. It's as simple as that. To help you get the full benefit that the right dividend stocks can provide, our analysts sat down to identify the absolute best of the best when it comes to rock-solid dividend stocks, drawing up a list in this free report of nine that fit the bill. To discover the identities of these companies before the rest of the market catches on, you can download this valuable free report by simply clicking here now.

Click here to add Deere to My Watchlist, which can find all of our Foolish analysis on it and all your other stocks.

The article Why Deere's Dividend Is Poised to Grow originally appeared on Fool.com.

Fool contributor Dan Caplinger has no position in any stocks mentioned. You can follow him on Twitter @DanCaplinger. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.