Big Oil Advances as Dow Declines

Although we don't believe in timing the market or panicking over market movements, we do like to keep an eye on big changes -- just in case they're material to our investing thesis.

The Dow Jones Industrial Average is down slightly, but stronger-than-expected earnings from big oil have pulled energy stocks higher. The Dow will jostle around on initial jobless claims -- which were down 10,000 to 340,000 last week -- or the Federal Reserve's latest move, but at the end of the day companies are valued on earnings. For big oil, all investors are hoping for is a little better news than expected in a challenging environment. That's exactly what they got today.

ExxonMobil is one of the Dow's leaders, gaining 1.8% today. The driver was third-quarter net income of $7.87 billion, or $1.79 per share, which was $0.02 ahead of EPS estimates. Revenue was down 2.4%, and net income dropped 21.6%, but the short-term reaction is simply to beating guidance.

Competitor ConocoPhillips saw its shares rise 1.1% after reporting a 5% increase in revenue to $15.5 billion and a 38% increase in earnings to $2.48 billion, or $2 per share. Adjusting for asset sales, net income would have been up 5% in the quarter to $1.46 per share, a penny ahead of estimates.

The big difference between the two was ExxonMobil's exposure to refining. That segment saw earnings drop 81% from a year ago to $592 million. That accounted for almost all of the drop in income at the oil giant.

We can expect similar results from Dow component Chevron , which reports earnings before the market opens tomorrow.

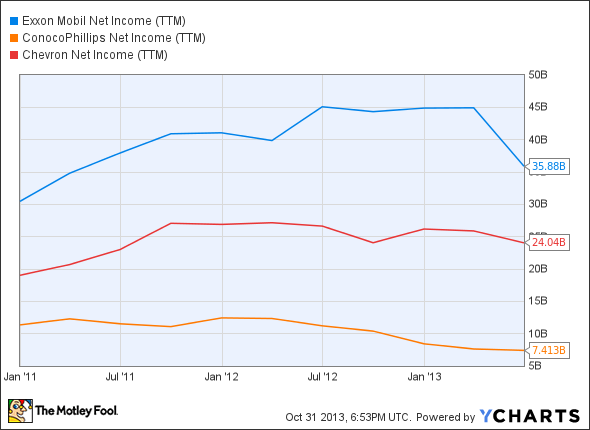

Beating estimates is well and good, and the market will react positively to it in the short term. But in the long term, ExxonMobil, ConocoPhillips, and Chevron are struggling with trends that have sent earnings lower.

XOM Net Income (TTM) data by YCharts.

Whether it's lower refining earnings for ExxonMobil and Chevron, or more expensive exploration for ConocoPhillips, big oil is under pressure. Watch for long-term trends as well, because that's what will drive company value and stock prices.

One great stock in energy

There are energy companies who are growing because of energy trends. To get the name and detailed analysis of one company that will prosper for years to come, check out the special free report: "The Only Energy Stock You'll Ever Need." Don't miss out on this limited-time offer and your opportunity to discover this under-the-radar company before the market does. Click here to access your report -- it's totally free.

The article Big Oil Advances as Dow Declines originally appeared on Fool.com.

Fool contributor Travis Hoium has no position in any stocks mentioned. The Motley Fool recommends Chevron. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.