Is Caterpillar's Dividend Streak in Jeopardy?

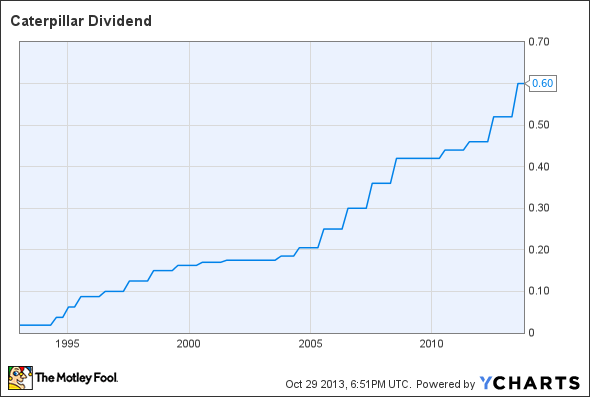

Caterpillar's fortunes have soared over the past 20 years, as the rise of emerging economies creating brand-new markets for the heavy-equipment manufacturer. Those opportunities helped Caterpillar become a dividend giant, establishing a 20-year track record of annual payout increases that has boosted its quarterly dividend more than 30-fold over that time frame. But now that Caterpillar's earnings have fallen substantially, dividend investors need to watch to make sure the stock's payout remains secure.

The same trends that helped Caterpillar rise so sharply since the early 1990s are now creating challenges for the company, as sluggish construction and infrastructure activity in China and the rest of the emerging market world has weighed on its growth prospects. At the same time, plunging commodity prices have led to problems for Caterpillar as well as mining equipment specialist Joy Global and engine producer Cummins , which supplies motors for excavators and other mining equipment. With Caterpillar expecting weak earnings into the future, will the double hit from construction and mining force the heavy-equipment giant to rein in its dividend growth? Let's take a closer look at Caterpillar to see how healthy its dividend looks right now.

Dividend Stats on Caterpillar

Current Quarterly Dividend Per Share | $0.60 |

Current Yield | 2.8% |

Number of Consecutive Years With Dividend Increases | 20 |

Payout Ratio | 46% |

Last Increase | July 2013 |

Source: Yahoo! Finance. Last increase refers to ex-dividend date.

Why Caterpillar has some breathing room

Caterpillar has treated long-term investors well, with solid share price gains adding to its steadily growing dividend. But more recently, Caterpillar's stock has dropped substantially since early 2012, ever since the slowdown in the Chinese economy really took hold. The equipment maker has been among the worst performers in the Dow, losing ground even as the broader stock market has climbed to record-high levels.

Caterpillar's third-quarter results reveal most of the construction equipment giant's challenges. Net income plunged by 44% on an 18% pullback in revenue, and the company cut its earnings guidance for the full year. That's consistent with the results that Joy Global gave, with a 42% drop in bookings coming from its underground mining segment, and Cummins also blamed mining for its earnings miss and guidance cut. Yet even outside mining, tough conditions have weighed on results, as Deere recently reported an 11% drop in revenue for its construction and forestry segment and expects further declines for the full 2013 year.

Still, the hope for Caterpillar is that once conditions start to improve in key markets like China, it could end up recovering more quickly than Deere or Joy Global. One reason for optimism is that Caterpillar is still working hard to keep its margins up, staring down weak demand by nevertheless imposing price increases on most of its machine line for next year. That sort of long-term perspective separates Caterpillar from less experienced companies that might be tempted to offer discounts to counter flagging sales.

CAT Dividend data by YCharts.

Caterpillar hasn't let its recent struggles stop it from delivering exceptional dividend growth, with a 15% increase in its July dividend payment marking the second straight double-digit percentage rise for Caterpillar's payout. Deere and Cummins boast an even stronger track record over the past few years, but neither they nor Joy Global has demonstrated the long-term commitment to shareholders to deliver consistent dividend increases over time.

When will Caterpillar boost its payout?

Because the Dividend Aristocrats look at annual payouts rather than quarterly ones in determining streaks of increases, Caterpillar's mid-year dividend increase in July actually gives it the ability to wait until 2015 for its next boost without jeopardizing its streak. Based on past experience during troubled times, Caterpillar might well take advantage of that latitude to shore up its earnings and prevent its payout ratio from getting too high. That might not make dividend investors happy, but in the long run, it should lead to more sustainable payouts for Caterpillar that could prevent a more disruptive dividend cut down the line.

Is Caterpillar the best dividend stock out there?

Caterpillar looks like it should keep its dividend intact for now, although not everyone would agree about its long-term prospects. Still, there's one thing most investors can agree on: Dividend stocks can make you rich. It's as simple as that. While they don't garner the notoriety of high-flying growth stocks, they're also less likely to crash and burn. And over the long term, the compounding effect of the quarterly payouts, as well as their growth, adds up faster than most investors imagine. With this in mind, our analysts sat down to identify the absolute best of the best when it comes to rock-solid dividend stocks, drawing up a list in this free report of nine that fit the bill. To discover the identities of these companies before the rest of the market catches on, you can download this valuable free report by simply clicking here now.

Click here to add Caterpillar to My Watchlist, which can find all of our Foolish analysis on it and all your other stocks.

The article Is Caterpillar's Dividend Streak in Jeopardy? originally appeared on Fool.com.

Fool contributor Dan Caplinger has no position in any stocks mentioned. You can follow him on Twitter @DanCaplinger. The Motley Fool recommends and owns shares of Cummins. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.