BP Leads Big Oil Into Earnings Season

It was a strange day on Wall Street, to say the least. The Nasdaq Composite and Nasdaq 100 were shut down for nearly an hour because of a data-feed issue, but investors charged forward as if nothing happened. The Dow Jones Industrial Average has been higher since the open, and as of 3:15 p.m. EDT the index is up 0.57%, led by strong earnings reports from Pfizer and IBM.

On the energy side of the index, Chevron and ExxonMobil are up 0.3% and 0.5%, respectively, despite a 0.5% slide in oil. One of the reasons is a stronger-than-expected earnings report from BP , which may be a sign of what's to come from the Dow's oil giants.

BP's net income fell 34% in the third quarter to $3.5 billion, or $1.01 per share. Adjusting for one-time items, the company earned $3.7 billion, which was above the $3.4 billion analysts expected -- and that's why investors are excited today.

An earnings beat is often good news but I think it's important to keep in mind the macro trends Big Oil companies are facing right now. BP's oil production fell 2.3% from a year ago; this is partly due to asset sales, but production is definitely not growing at a rapid rate. Chevron said earlier this month that oil production was down to 449,000 barrels per day from 455,000 a quarter ago. ExxonMobil's production was down slightly in its second quarter and I wouldn't expect a big production jump for the third quarter.

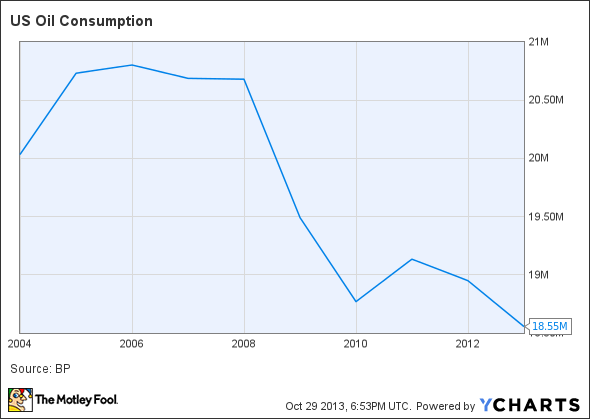

On a macro level, crude-oil prices are being hurt by an increase in inventory, which means even more supply may be bad for Big Oil. Stockpiles rose 2.35 million barrels last week to 382.1 million barrels, which is pushing oil lower today. This isn't a new trend, either. As you can see below, oil consumption has been falling in the U.S., which is big news considering that 21% of the world's oil is consumed here.

US Oil Consumption data by YCharts.

BP may have surprised investors on the upside today, and Chevron and ExxonMobil may do so later this week, but keep an eye on the trends for all three companies. Oil production is flat to declining, and high oil prices are squeezing refining margins. That points to lower earnings, something I don't see turning around anytime soon.

An oil stock for the new oil market

Energy industry trends are moving away from big oil, but they're helping some industry players. Imagine a company that rents a very specific and valuable piece of machinery for $41,000... per hour (that's almost as much as the average American makes in a year!). And Warren Buffett is so confident in this company's can't-live-without-it business model, he just loaded up on 8.8 million shares. An exclusive, brand-new Motley Fool report reveals the company we're calling OPEC's Worst Nightmare. Just click HERE to uncover the name of this industry-leading stock... and join Buffett in his quest for a veritable LANDSLIDE of profits!

The article BP Leads Big Oil Into Earnings Season originally appeared on Fool.com.

Fool contributor Travis Hoium has no position in any stocks mentioned. The Motley Fool recommends Chevron. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.