The Key to Market Crushing Returns

In hindsight, it seems like it should be easy seeing revolutionary products or companies coming. It seems obvious now that the automobile, airplane, Internet, and smartphone are obvious advancements waiting to happen. But in practice, the companies that make these products are fighting an uphill climb against common perception and ingrained behavior.

Innovators like Steve Jobs, Elon Musk, Jeff Bezos, Mark Zuckerberg, and Reed Hastings didn't make fortunes because they followed the trends where business was headed; they saw a need before people knew they had it, and created a product to fill the unknown need. As investors, if we can spot these innovators and the companies they lead, the long-term profit potential is astounding.

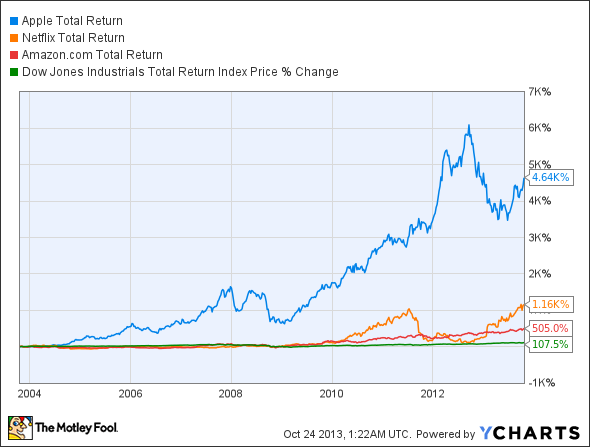

Below is the 10-year price chart for Apple, Netflix, and Amazon versus the Dow Jones Industrial Average . You can see that even the worst performing -- Amazon -- outperformed the index nearly 5:1.

AAPL Total Return Price data by YCharts

In investing, it's often the obvious solution that ends up being wrong. If everyone sees something coming, the market has probably already priced that expectation into the market, and often, the masses turn out to be wrong. Whether it's the notion that housing prices never go down, inflation will be rampant if deficits remain high, or the recent prediction that markets would panic ahead of the debt limit, conventional wisdom is often wrong.

Below are a few of the areas I think are ripe for innovation and may be a little out of the norm, providing an opportunity for investors.

An energy revolution is here

Looking out 20 years, I see a massive shift coming in the energy industry. The main driver won't be regulation of carbon emissions, but the fact that solar power and electric vehicle costs have, and will continue to, fall like a rock. GTM Research, and the Solar Energy Industries Association, recently reported that solar system costs have fallen 40% since the beginning of 2011, and 50% since the beginning of 2010. Those costs are revolutionizing the energy industry. But that's not the only energy revolution that's coming.

Now that solar power is becoming cost competitive with the electrical grid, the industry faces another challenge -- energy storage. Batteries are still prohibitively expensive for providing storage power for a home or business, but as the solar and EV industries grow, there will be an economic need for energy storage.

To put the potential market in perspective, the U.S. Department of Energy has a database of 420 energy storage projects in development in 34 countries worldwide, with 123 GW of storage capacity. Most of those projects are pumped hydro, which is dependent on geography; but it gives a scale of what might be needed long term. California has already put a requirement in place for 1.3 GW of energy storage by 2020, so the market leader in solar has its eyes on energy storage, as well. If we assume 60 GW of demand is possible by 2020, that's a potential market of $60 billion that doesn't even exist right now.

Who might lead this market? SunPower and SolarCity have already begun early phases of installing energy storage, and it's in the long-term plan to increase those installations.

Tesla Motors may also be a company to watch. Electric vehicles have long been viewed as a storage medium for the solar industry, charging during the day, and providing power at night. Elon Musk is also a majority shareholder in both Tesla Motors and SolarCity, and the two companies have worked together on charging systems for Tesla vehicles. A partnership on energy storage seems natural.

It'll be years before we know the winners of the revolution in energy, but I'd like to be with the companies leading the charge... not following it.

Netflix may not be the streaming king

Ten years ago, streaming TV, on-demand, and digital downloads were a dream for consumers. Today, they're probably something you do every day. This creates both opportunities and challenges for content owners and distributors.

Netflix has been the clear leader in streaming, but there are few barriers to entry with apps on Google, Apple, Hulu, and other devices. So, who will lead the streaming revolution?

HBO is actually developing a blueprint that other content owners can follow, charging a monthly fee for content that can be streamed on its own app. The company hasn't broken the requirement of a cable subscription, but there's really no need to go to cable to watch HBO content if you have the app. A new deal with Comcast bundles HBO Go with broadband, not going directly to the source, but close.

No matter how the streaming revolution plays out, I see two big winners: Disney and Apple. Disney has more high-value content than any other company, and Apple has a huge ecosystem of devices and apps to provide streaming infrastructure. Netflix will also continue to play a role in streaming, but the real gold is in content. As for Apple, the company's app reach goes further than any other company, and Apple TV is already showing what the future of TV may look like.

The factory of the future

The manufacturing industry has gone through a number of fads to increase efficiency, including Six Sigma, LEAN, Just-In-Time, and other systems that try to cut costs and inventory. But what if the entire manufacturing industry could create parts on-demand with only a few hours notice?

That's what rapid prototype companies like 3D Systems and Stratasys have in mind. They make equipment that builds plastic parts layer by layer, creating almost anything that can be made by injection molding. The technology has been around for years, but recently, the materials have improved, and costs have come down so far that it's finally economical to make some parts with these machines.

As the technology improves, the sky's the limit for the 3-D printing market. The entire market is only worth about $3 billion right now, but given another 10 or 20 years to improve speed and materials, this could be worth hundreds of billions of dollars. 3D Systems and Stratasys aren't cheap; but if you're buying into a company that could revolutionize manufacturing as we know it, they may still be a steal.

Foolish bottom line

Looking around corners to find investing opportunities is what finds the big winners... not following the crowd. I think energy storage, streaming media, and manufacturing provide huge opportunities for investors.

The best place to find growth stocks

Motley Fool co-founder David Gardner, founder of the No. 1 growth stock newsletter in the world, has developed a unique strategy for uncovering truly wealth-changing stock picks. And he wants to share it, along with a few of his favorite growth stock superstars, WITH YOU! It's a special 100% FREE report called "6 Picks for Ultimate Growth." So stop settling for index-hugging gains... and click HERE for instant access to a whole new game plan of stock picks to help power your portfolio.

The article The Key to Market Crushing Returns originally appeared on Fool.com.

Fool contributor Travis Hoium manages an account that owns shares of Apple, SunPower. He is personally short shares of Amazon.com, owns SunPower and has the following options: long January 2015 $5 calls on SunPower, long January 2015 $7 calls on SunPower, long January 2015 $15 calls on SunPower, long January 2015 $25 calls on SunPower, and long January 2015 $40 calls on SunPower. The Motley Fool recommends 3D Systems, Amazon.com, Apple, Netflix, SolarCity, Stratasys, and Tesla Motors. The Motley Fool owns shares of 3D Systems, Amazon.com, Apple, Netflix, SolarCity, Stratasys, and Tesla Motors and has the following options: short January 2014 $36 calls on 3D Systems and short January 2014 $20 puts on 3D Systems. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.