The Best Interstate Restaurant Investment

You're supposed to be paying attention to the cars around you. With limited traffic at this time of night, your attention has been redirected to the passing white lines below. They mesmerize you enough that you begin to reflect on life. Your significant other breaks your concentration and announces that he or she is hungry. You realize you've been driving for seven hours straight with nothing more than a bag of pretzels. A bathroom wouldn't hurt, either. As you prepare to find the next exit offering food, you want to go with a reliable name.

Since tens of millions of people find themselves in a similar situation annually, investors have an opportunity to profit off a trend. Is Cracker Barrel Old Country Store the best option?

Impressive numbers

In fiscal-year 2013, Cracker Barrel's revenue increased 3% and net income improved 14%. The revenue increase wasn't just from eight new store openings -- comps also grew 3%. If you break down the comps performance, you will see that Cracker Barrel has been seeing strength in both its restaurant and retail segments. Restaurant comps moved 3.1% higher and retail comps netted a 2.9% gain.

Cracker Barrel attributes this solid performance to its six priorities. Below are the simplified versions:

Priority 1: Refresh menu in order to offer more affordability, customizable options for customers, and healthier food.

Cracker Barrel delivered by offering its Country Dinner Plates at $7.69, new customizable sides, and Wholesome Fixin's (meals of 600 calories or fewer).

Priority 2: Grow retail sales.

Give Cracker Barrel another check mark. It delivered by offering more merchandising that crosses generations and targets nostalgia. At the same time, Cracker Barrel has seen continued strength in Women's Apparel and Accessories.

Priority 3: Improve ad campaign.

Cracker Barrel delivered again with "Handcrafted by Cracker Barrel." Across the company's 1,600 billboards, Cracker Barrel used the slogans: "Homemade Doesn't Cost Extra" and "Fresh Meals. Friendly Prices." This is in addition to increased product news delivered through cable and radio.

Priority 4: Improve technology.

Cracker Barrel accomplished this goal with new equipment at its stores. Technological improvements have led to reduced labor costs, improved product management, and reduced food waste.

Priority 5: Return capital to shareholders.

Cracker Barrel increased its dividend to $0.75 in the fourth quarter, payable in the first quarter.

Priority 6: Expand brand via e-commerce and licensing.

According to Cracker Barrel's 10-K, the company has increased its engagement with customers online. This has the potential to lead to e-commerce growth in the future. For licensing, Cracker Barrel recently came to a multiyear agreement with John Morrell Food Group in which the latter will ship certain varieties of Cracker Barrel's bacon, ham, and turkey. Cracker Barrel doesn't expect this deal to have a significant impact in fiscal-year 2014. Instead, it's a building block for the company's licensing strategy.

Cracker Barrel has delivered in many areas, but is it the best interstate restaurant play?

Cracker Barrel vs. peers

Denny's is also a popular option for those traveling the open road. However, there are several differences between Cracker Barrel and Denny's. The former is a country-themed restaurant with a gift shop, while the latter is a diner. Denny's is also an international operation that recently entered into its 11th country: Chile. Thanks to a partnership with Musiet Group, Denny's plans to open 10 restaurants in Chile over the next 15 years.

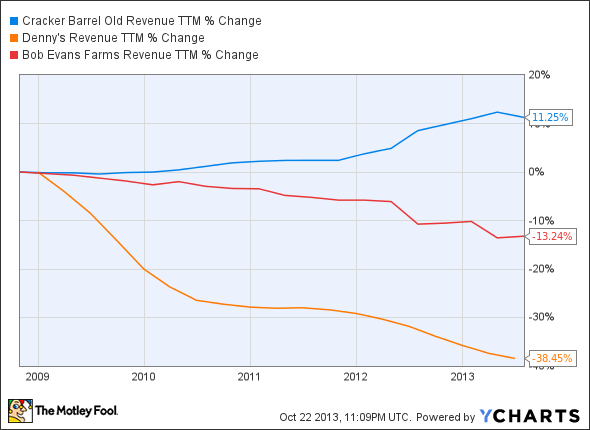

All of this is impressive, but what matters most is top- and bottom-line growth. To be blunt, Denny's hasn't delivered. Consider the performance comparisons below between not just Cracker Barrel and Denny's, but Bob Evans Farms as well:

Top line:

CBRL Revenue TTM data by YCharts.

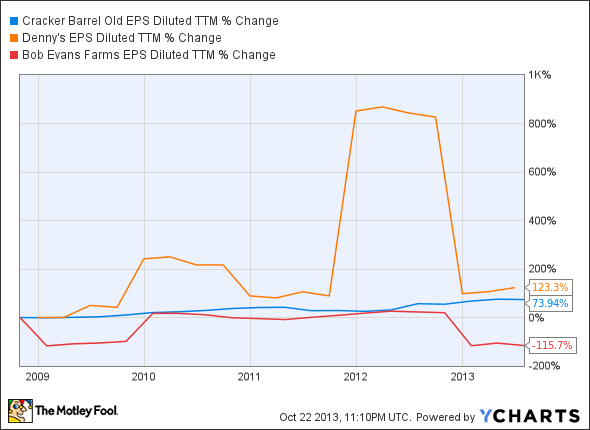

Bottom line:

CBRL EPS Diluted TTM data by YCharts.

Cracker Barrel is the only consistent performer of the three. And don't get too excited about that one-time spike for Denny's on the bottom line. It was the result of an $89 million tax benefit -- it doesn't indicate a sustainable trend.

As far as Bob Evans Farms is concerned -- a full-service restaurant with 560 locations in 19 states (many near the interstate) -- it's using various promotions in an effort to help drive foot traffic.

These Bob Evans Farms promotions include a $9.99 three-course dinner with sirloin steak, family meals to go for $19.99 (feeds four), kids eat free on Tuesday with the purchase of an adult meal, and the chance to win a $1,000 Visa Gift Card if you sign up as a member. The latter is a part of the company's 60th birthday celebration.

Bob Evans Farms is in reverse at the moment, and growing the top line will likely require a further hit to the bottom line. In other words, you might want to avoid Bob Evans Farms until it shows signs of turning itself around.

The bottom line

Cracker Barrel has delivered on all its priorities, and that is likely to continue. The company's top-line growth also relates to its restaurants' status as a landmark and tourist destination on U.S. highways. Also, Cracker Barrel is continuously finding ways to improve operations in order to improve the bottom line. All factors considered, the company should remain a long-term winner.

More long-term winners for your portfolio

As every savvy investor knows, Warren Buffett didn't make billions by betting on half-baked stocks. He isolated his best few ideas, bet big, and rode them to riches, hardly ever selling. You deserve the same. That's why our CEO, legendary investor Tom Gardner, has permitted us to reveal The Motley Fool's 3 Stocks to Own Forever. These picks are free today! Just click here now to uncover the three companies we love.

The article The Best Interstate Restaurant Investment originally appeared on Fool.com.

Fool contributor Dan Moskowitz has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.