Is SandRidge Energy Destined for Greatness?

Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does SandRidge fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

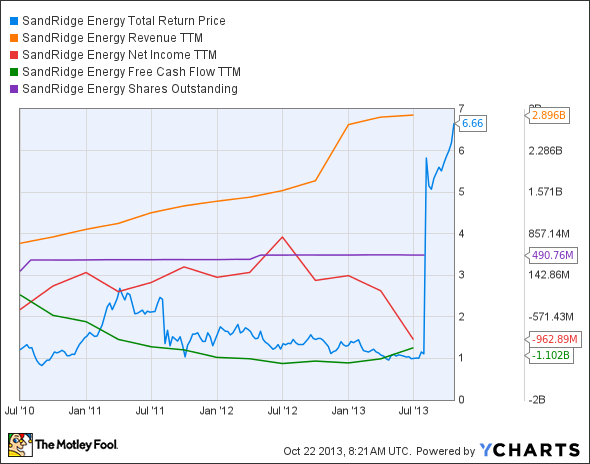

The graphs you're about to see tell SandRidge's story, and we'll be grading the quality of that story in several ways:

Growth: are profits, margins, and free cash flow all increasing?

Valuation: is share price growing in line with earnings per share?

Opportunities: is return on equity increasing while debt to equity declines?

Dividends: are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at SandRidge's key statistics:

SD Total Return Price data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | 318.8% | Pass |

Improving profit margin | 48.8% | Pass |

Free cash flow growth > Net income growth | (472.8%) vs. (114.5%) | Fail |

Improving EPS | 19% | Pass |

Stock growth (+ 15%) < EPS growth | 13.7% vs. 19% | Pass |

Source: YCharts. * Period begins at end of Q2 2010.

SD Return on Equity data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving return on equity | (114.8%) | Fail |

Declining debt to equity | 107.9% | Fail |

Source: YCharts. * Period begins at end of Q2 2010.

How we got here and where we're going

Last year, SandRidge earned six out of seven passing grades, but it has lost two passing grades in its second assessment -- despite the unusual (apparently a bugged result) spike in share price on the chart above, SandRidge has actually produced very modest shareholder returns, or it might have lost another passing grade. SandRidge's profit margins have actually improved over the last few years, but its nominal profit has been on the decline due to increasing costs of production and restructuring expenses. As a result, the company had to raise significant new debts to make a couple of acquisitions, which could help reverse the outflow of funds over the long run but which hinder it today. Will its major moves help SandRidge to overcome these fundamental weaknesses, or is the oil and gas producer going to tap a dry hole in the coming year? Let's dig a little deeper to see what might lie ahead.

Over the past few quarters, the U.S. has been playing spoiler to international energy markets due to rising domestic oil and natural gas production. However, global oil prices have remained around $100 per barrel, which has enabled smaller producers like SandRidge to justify high exploration costs. Fool contributor Robert Zimmerman notes that the company has sold its assets in the Permian Basin to narrow its focus to producing oil from the Mississippian Lime. SandRidge has already poured more than $530 million into over 130 wells and 850 miles of pipeline to dispose of water saturating the oil-bearing rocks, which should explain some of the big declines in profit and free cash flow of recent quarters.

Oil and gas supermajor Royal Dutch Shell has expressed its intentions to abandon both the Eagle Ford Shale and the Mississippian Lime, which might be a bad omen for SandRidge going forward. Fool contributor Matthew DiLallo notes that Shell had more than 600,000 acres with 45 oil-producing wells, but these assets weren't producing significant returns. Industry peers such as Chesapeake Energy, Encana and Apache have also been withdrawing from the Kansas portion of the Mississippi Lime for over a year. However, SandRidge continues to see the potential for around 3,000 wells within north Kansas acreage in the Mississippi Lime. New CEO James Bennett, who has driven SandRidge to slash its capital expenditures and refocus on drilling the Mississippi Lime, has been the major proponent of this strategy, and it appears to be working in terms of revenue, at least.

SandRidge has been planning to invest $1.45 billion to develop the Mississippi Lime in Oklahoma and Kansas to increase its production. However, the company will need at least $9 billion to dig 3,000 wells in its core Mississippian holdings. Matthew DiLallo notes that the company held enough cash to fund its operations through 2015, but it might hit a funding shortfall in 2016. Its debt, at $3 billion, is about the same level as its market cap, and since the company has bled out almost a billion dollars in free cash flow over the past four quarters, SandRidge will need to strike a better balance between expansion and sustainable profitability soon. It could always spin off another trust to raise cash -- SandRidge Mississippian Trust I , SandRidge Mississippian Trust II , and SandRidge Permian Trust combined are worth nearly $2 billion in market cap, and none carry any debt -- but if that spinoff strategy continues, SandRidge Energy itself might wind up too overburdened and underproductive to continue. At the very least, these three trusts all offer substantial dividends.

Putting the pieces together

Today, SandRidge has few of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

More on the American energy revolution

Record oil and natural gas production is revolutionizing the United States' energy position. Finding the right plays while historic amounts of capital expenditures are flooding the industry will pad your investment nest egg. For this reason, the Motley Fool is offering a comprehensive look at three energy companies set to soar during this transformation in the energy industry. To find out which three companies are spreading their wings, check out the special free report, "3 Stocks for the American Energy Bonanza." Don't miss out on this timely opportunity; click here to access your report -- it's absolutely free.

The article Is SandRidge Energy Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes has no position in any stocks mentioned. The Motley Fool owns shares of SANDRIDGE MISSISSIPPIAN TR II COM. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.