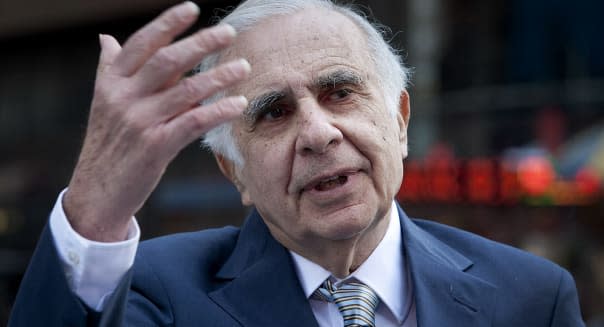

Icahn Raises Apple Stake, Pushes Cook Again on Buyback

By Jennifer Ablan

Billionaire investor Carl Icahn fired his latest salvo at Apple chief executive Tim Cook on Thursday, urging the iPhone maker again to initiate a $150 billion buyback through a tender offer -- but pledging to keep his own stock out of it.

In a public letter dated Oct. 23 but published on Icahn's new investor-focused website Thursday, the famously outspoken activist repeated calls for deep-pocketed Apple to use surplus cash to buy back shares. He said a $150 billion move could ratchet the stock to an all-time high of $1,250 over three years.

Icahn also revealed he had increased his stake by about 22 percent to just over 4.7 million shares since dining privately with Cook in September -- underscoring his belief that the stock is undervalued.

"Irrational undervaluation as dramatic as this is often a short-term anomaly. The timing for a larger buyback is still ripe, but the opportunity will not last forever," Icahn warned in his letter, issued alongside the launch of his new website, Shareholders Square Table.

"While the board's actions to date ... may seem like a large buyback, it is simply not large enough given that Apple currently holds $147 billion of cash on its balance sheet, and that it will generate $51 billion" of earnings before interest and taxes, based on Wall Street estimates.

Icahn jumpstarted discussion about the pace at which Apple is returning cash to shareholders in August, when he tweeted he had taken a substantial position in the company. He has since kept Twitter followers informed of efforts to meet with Cook, and reiterated his view about the need for a $150 billion share repurchase.

On Thursday, Bill Gross, co-chief investment officer at PIMCO and a prolific Tweeter, said via Twitter:

Gross: Icahn should leave #Apple alone & spend more time like Bill Gates. If #Icahn's so smart, use it to help people not yourself.

- PIMCO (@PIMCO) October 24, 2013

Icahn's new website, the launch of which was plagued with early glitches that barred access, seemed intended to further his goal of attacking underperforming corporate boards. It carries a quote from Icahn himself on the home page, from Texaco's 1988 annual meeting: "A lot of people died fighting tyranny. The least I can do is vote against it."

Analysts have said Icahn's newfound interest in Apple is helping improve sentiment on the stock. Icahn had argued as early as in August that it could be worth $700 with a larger stock buyback program.

Apple's (AAPL) shares were up 1.1 percent at about $531 at midday. The company this week announced a new line-up of iPads for the holidays, along with plans to offer Mac users free operating and work software for life.

Icahn's latest proposal for Apple outlines a tender offer in which he himself won't participate.

In a tender offer, a company offers to purchase some or all of its investors' shares. Though tender offers usually come at a premium to the current share price, Icahn wants Apple to borrow money to make its offer at $525 a share, the level at which shares of Apple are currently trading.

In the letter, Icahn revealed he now owns 4.73 million shares of Apple stock, up from a previous total of 4 million. %VIRTUAL-article-sponsoredlinks%That means he owns nearly $2.5 billion worth of shares of the iPhone maker.

Apple is already in the process of spending $100 billion through 2015 on share buybacks, as well as dividend payouts. But Icahn believes Apple should increase its share buyback program and spend $150 billion on its share buyback.

"Per my investment thesis, commencing this buyback immediately would ultimately result in further stock appreciation of 140 percent for the shareholders who choose not to sell into the proposed tender offer," Icahn said.

"Furthermore, to invalidate any possible criticism that I would not stand by this thesis in terms of its long term benefit to shareholders, I hereby agree to withhold my shares from the proposed $150 billion tender offer," Icahn said. "There is nothing short term about my intentions here."

-With additional reporting by Soham Chatterjee in Bangalore.