Is U.S. Steel Destined for Greatness?

Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does U.S. Steel fit the bill? Let's take a look at what its recent results tell us about the company's potential for future gains.

What we're looking for

The graphs you're about to see tell U.S. Steel's story, and we'll be grading the quality of that story in several ways:

Growth: are profits, margins, and free cash flow all increasing?

Valuation: is share price growing in line with earnings per share?

Opportunities: is return on equity increasing while debt to equity declines?

Dividends: are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at U.S. Steel's key statistics:

X Total Return Price data by YCharts

Passing Criteria | Three-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | 23.2% | Fail |

Improving profit margin | 83.1% | Pass |

Free cash flow growth > Net income growth | 107.4% vs. 79.1% | Pass |

Improving EPS | 78.5% | Pass |

Stock growth (+ 15%) < EPS growth | (37.6)% vs. 78.5% | Pass |

Source: YCharts. * Period begins at end of Q2 2010.

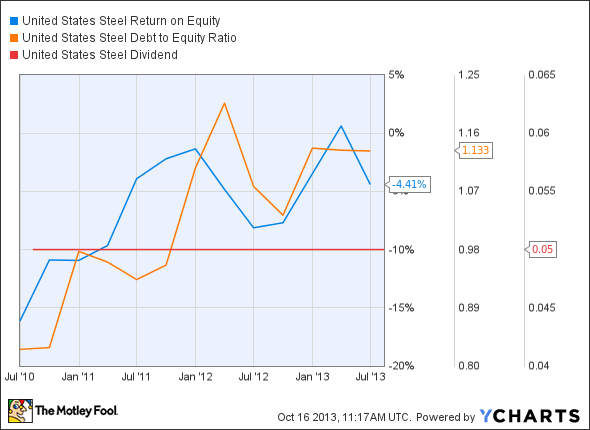

X Return on Equity data by YCharts

Passing Criteria | Three-Year* Change | Grade |

|---|---|---|

Improving return on equity | 107% | Pass |

Declining debt to equity | 37.2% | Fail |

Dividend growth > 25% | 0% | Fail |

Free cash flow payout ratio < 50% | 29.3% | Pass |

Source: YCharts. * Period begins at end of Q2 2010.

How we got here and where we're going

U.S. Steel doesn't come through with a superlative performance, but six out of nine possible passing grades is surprisingly strong for one of the leaders of a beleaguered steel industry. However, it's important to keep in mind that U.S. Steel's bottom line and free cash flow rebounds have merely been a process of crawling out of a deep hole and toward a distant light. U.S. Steel isn't back into positive territory on net income, but its free cash flow has nudged into the green lately -- a promising sign for a company that not long ago was bleeding out more than $1 billion a year in cash. Can U.S. Steel turn its fortunes around, or are industry-wide troubles going to keep it from reaching its potential again? Let's dig deeper to find out.

U.S. Steel has continued to underperform over the past few quarter as demand for steel remains depressed due to a combination of persistent European economic weakness, disappointing Chinese growth, and falling consumption rates here at home. U.S. imports of steel have also surged by 17% year over year, according to the American Institute for International Steel, which has put pressure on domestic prices and thus deprived U.S. Steel of the opportunity to capitalize on rising demand in one of the world's few bright economic spots. Fool contributor Sean Williams points out that China might exceed its previous GDP growth projection of 7.5% this year, which will fuel steel demand -- however, the best result of this might be a global rise in steel prices, as foreign producers face stiff tariffs from the Middle Kingdom.

According to the World Steel Association, global steel consumption is set to increase by 3.1% this year and another 3.3% next year. This is barely in line with the generally expected rate of inflation, and absent the benefit of positive Chinese pressures, ongoing structural issues and political instability in emerging markets present more of a headwind than a source of steel industry strength. U.S. Steel has also been struggling due to a blast furnace outage at its Great Lakes Works facility, which has crimped the production of flat-rolled sheets. Labor troubles -- workers have been locked out of its Lake Erie mill, which accounted for about 10% of U.S. Steel's output in 2012 -- have also hindered production, as the aggrieved employees recently rejected the steelmaker's contract proposal.

However, U.S. Steel is poised to benefit from increased oil drilling activities, which will improve demand for tubular products. The company has been investing heavily to enhance its capabilities and capacity at the Lorain Tubular Works facility to meet demand for tubular steel in the market. However, excessive supply in the tubular products market is already a fact of steelmaking life, as 10 new tubular production units will be operational in the U.S. over the next three years.

Rival ArcelorMittal , which has been hit hard by the economic slowdown in Europe, recently divested a partial stake of about 7% in Turkish steelmaker Erdemir to reduce its heavy debt burden. Far from retrenching, ArcelorMittal also inked an agreement with Algeria's Sider, which aims to more than double the country's flagship production facility's capacity from 1 million tons to 2.2 million tons by 2017. ArcelorMittal also has plans to ramp up production in its Canadian mines and connect these with a new rail line, which will allow it to capture more North American markets. This global reshuffling shows that the steel industry is far from settled, and U.S. Steel will have to avoid falling behind in global price and production wars.

Putting the pieces together

Today, U.S. Steel has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

Bet on a brighter future

With American markets reaching new highs, investors and pundits alike are skeptical about future growth. They shouldn't be. Many global regions are still stuck in neutral, and their resurgence could result in windfall profits for select companies. A recent Motley Fool report, "3 Strong Buys for a Global Economic Recovery," outlines three companies that could take off when the global economy gains steam. Click here to read the full report!

The article Is U.S. Steel Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.