Does This High-Flying Health Care Stock Need to Take a Breather?

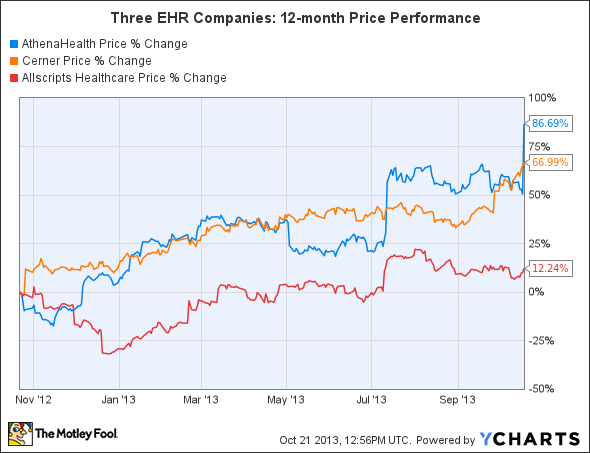

Shares of cloud-based electronic health records, or EHR, provider athenahealth soared 24% on Friday after the company reported strong top and robust bottom line growth during the third quarter. However, the stock is now up more than 80% over the past 12 months, and many investors are wondering if it's finally time for it to take a breather.

Let's dig deeper into athenahealth's fundamentals to see if this stock still has room to soar.

Double-digit top and bottom line growth

During the third quarter, athenahealth earned an adjusted $0.21 per share, a 15.5% year-over-year increase from the prior-year quarter. Revenue rose 43.1% to $151.5 million.

Athenahealth provides three major health care data services -- athenaCollector (physician practice/billing management), athenaClinicals (EHR services), and athenaCommunicator (a patient communication web portal). It also owns Epocrates, a popular medical reference app for mobile devices.

Athenahealth only reports revenue in two business segments -- business services and implementation & other revenues.

Its business services, which consists of its three main services and Epocrates, comprises 93% of the company's total sales. Revenue at this segment rose 38.2% from the prior-year quarter to $141.3 million. Meanwhile, implementation and other revenues nearly tripled to $10.2 million.

Double-digit growth in providers and physicians

The key to athenahealth's double-digit revenue growth is the expansion of its network to include more health care providers and physicians. Over the past year, the company has signed several major deals including one with Ascension Health Alliance, which added an additional 4,000 providers and 2,700 physicians to athenahealth's network in July. Analysts believe that the deal will boost athenahealth's annual revenue by 10%.

Athenahealth's year-over-year growth in adding medical providers has been impressive.

Q3 2012 -- number of medical providers | Q3 2013 -- number of medical providers | Growth (YOY) | |

athenaCollector | 47,195 | 38,145 | 24% |

athenaClinicals | 15,483 | 10,062 | 54% |

athenaCommunicator | 23,024 | 12,149 | 90% |

Sources: Company third-quarter report, author's calculations.

Of these providers, the vast majority are physicians, as seen in the next chart.

Q3 2012 -- number of physicians | Q3 2013 -- number of physicians | Growth (YOY) | |

athenaCollector | 33,764 | 27,013 | 25% |

athenaClinicals | 11,401 | 7,340 | 55% |

athenaCommunicator | 17,330 | 8,739 | 98% |

Sources: Company third-quarter report, author's calculations.

Since July, athenahealth has also added Hallmark Health Partners, Riverside Medical Group, and Hospital Physician Partners to its client base.

Tying everything together in various packages

In addition to these three core products, athenahealth also offers specialized and combination services, such as the payment service athenaClarity and athenaCoordinator, a cloud-based service which coordinates multiple services together.

Athenahealth hopes that physicians will eventually use more of its services together, and emphasized that 83% of all new athenaCollector deals included athenaClinicals, 1 percentage point higher than the prior-year quarter. 78% of new athenaCollector deals also included the addition of athenaClinicals and athenaCommunicator, up from 66% a year earlier.

In other words, athenahealth has been growing its user network by double digits while convincing more customers to buy combination packages of more than one service -- both very strong positive catalysts for customer loyalty and future top line growth.

Mobile initiatives could run into problems

However, athenahealth's investment in Epocrates faces a murkier future.

Epocrates, which the company acquired for $293 million in January, is one of two popular mobile health care reference apps -- the other one being WebMD's Medscape Mobile. Epocrates is more widely used on mobile platforms, commanding 70% and 50% market shares in smartphones and tablets, respectively.

Both apps, which are available across most mobile platforms, offer their services to medical students and physicians for free, and are supported through sponsored "drug suggestions" rather than display ads. That business model has been criticized in the past as being potentially harmful to patients.

In addition, Epocrates is a stand-alone app that is not directly connected to the rest of athenahealth's EHR and cloud-based services. Prior to being acquired by athenahealth, Epocrates was developing a mobile EHR app, but later sold the rights to EHR maker Kareo, which finished it and released it for free.

By comparison, Medscape Mobile integrates horizontally into WebMD's medical reference website and mobile app.

The Foolish fundamentals reveal some major flaws

However, a clearer picture for athenahealth doesn't emerge until we compare it fundamentally to two large EHR rivals: Cerner and Allscripts .

5-Year PEG | Forward P/E | Price-to-Sales | Revenue Growth | Profit Margin | |

athenahealth | 4.58 | 94.12 | 9.00 | 43.10% | (0.85%) |

Cerner | 2.33 | 34.80 | 7.31 | 10.60% | 15.99% |

Allscripts | 4.92 | 27.18 | 1.89 | -6.80% | (3.52%) |

Advantage | Cerner | Allscripts | Allscripts | athenahealth | Cerner |

Source: Yahoo! Finance as of Oct. 21.

Besides strong revenue growth (partially boosted by its acquisition of Epocrates), athenahealth is a slow growth stock that is overvalued at current prices, as indicated by its high PEG ratio and premium forward P/E. In addition, its negative profit margin indicates that it will still struggle to achieve profitability.

On a fundamental basis, only Cerner looks like a viable investment, but that still hasn't stopped athenahealth from outperforming both companies over the past twelve months. In addition, Cerner is a much larger company, with a market cap of $19.8 billion compared to athenahealth's $4.9 billion and Allscripts' $2.7 billion.

Source: YCharts.

The Foolish takeaway

Athenahealth is simply a hot tech company. Its stock keeps rising despite a lack of fundamental scaffolding, and it is churning out double-digit revenue growth while struggling to achieve positive margins and profitability.

In my opinion, athenahealth still has a lot to prove going forward. It must prove that it can monetize Epocrates and integrate it effectively into the rest of its ecosystem, and perhaps cut costs and raise service prices to achieve profitable margins.

Don't let this growth pass you by

Millions of Americans have waited on the sidelines since the market meltdown in 2008 and 2009, too scared to invest and put their money at further risk. Yet those who've stayed out of the market have missed out on huge gains and put their financial futures in jeopardy. In our brand-new special report, "Your Essential Guide to Start Investing Today," The Motley Fool's personal finance experts show you why investing is so important and what you need to do to get started. Click here to get your copy today -- it's absolutely free.

The article Does This High-Flying Health Care Stock Need to Take a Breather? originally appeared on Fool.com.

Leo Sun has no position in any stocks mentioned. The Motley Fool recommends Athenahealth. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.