Is Harley-Davidson Destined for Greatness?

Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Harley-Davidson fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

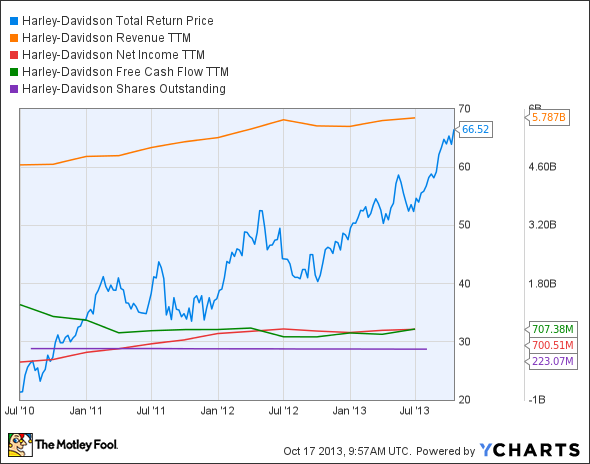

The graphs you're about to see tell Harley-Davidson's story, and we'll be grading the quality of that story in several ways:

Growth: Are profits, margins, and free cash flow all increasing?

Valuation: Is share price growing in line with earnings per share?

Opportunities: Is return on equity increasing while debt to equity declines?

Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Harley-Davidson's key statistics:

HOG Total Return Price data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | 24.3% | Fail |

Improving profit margin | 744.1% | Pass |

Free cash flow growth > Net income growth | (45.3%) vs. 898.5% | Fail |

Improving EPS | 895.4% | Pass |

Stock growth (+ 15%) < EPS growth | 211.5% vs. 895.4% | Pass |

Source: YCharts. * Period begins at end of Q2 2010.

HOG Return on Equity data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving return on equity | 748.4% | Pass |

Declining debt to equity | (26.6%) | Pass |

Dividend growth > 25% | 110% | Pass |

Free cash flow payout ratio < 50% | 23.3% | Pass |

Source: YCharts. * Period begins at end of Q2 2010.

How we got here and where we're going

Harley-Davidson got off to a great start, but its declining free cash flow presents the only real source of weakness in an otherwise sterling performance. Harley-Davidson earned seven out of nine passing grades regardless, and it has a very good chance to achieve a perfect score next time around with just a modest improvement on the top line and on free cash flow.

How might Harley-Davidson rev its engines over the next few quarters? Let's dig a little deeper to see what lies ahead.

Harley-Davidson's ubiquitous brand has long been its driving force, which has helped it to expand its business in international markets -- these markets now account for more than 35% of its total sales. My Foolish colleague Brian Hill notes that Harley-Davidson has an ambitious plan to expand its overseas business to 150 dealerships by 2014.

It has also expressed its intentions to set up a manufacturing plant in India , which would allow it to compete with Japanese and European bike makers. The company has been aggressively courting a rising middle class in India, which has been busily engaged in new highway construction. The company is developing a low-cost 500cc motorcycle at a base price of less than $7,000, of which it expects to sell around 10,000 units over the next two to three years.

Harley-Davidson also expects its Chinese sales to increase by 35% every year, but regulations in some Chinese cities have hindered the growth of leisure motorcycling there.

Harley-Davidson has gained market share in Europe, but its motorcycle sales nevertheless declined by 7% in the region due to an ongoing economic crunch. As a part of an ongoing restructuring process, the company hopes to save around $320 million a year, which ought to offset any European weakness. It looks like India might be its brightest star for the time being.

But Harley-Davidson hasn't forgotten its roots -- the company is also trying to capitalize on female bikers in the United States, which has involved the promotion of female-centric cycle training classes. The company also introduced eight new 2014 model bikes at its Project Rushmore , which will help it to bolster its position in the luxury touring and performance segments.

However, Harley-Davidson's rival Polaris recently launched its 2014 Indian Chief models, which has put it in direct competition with Harley's offerings. Fool contributor William Bias notes that Polaris recalled its Kings Mountain- era Indian motorcycles, after the company noticed a possible defect in the rear rim. These were older bikes, but Harley-Davidson was forced to initiate a recall of its 2014 touring motorcycles , because of the possibilities of defective hydraulic clutch system.

This seems more a net negative for Harley-Davidson, since Polaris' newest models got superb reviews from many bike enthusiasts, including longtime Harley-Davidson loyalists. On the other hand, Harley-Davidson may soon see a rebound in its RV segment, as wholesale shipments are expected to soar by 12% over the course of this year, and by 5% in 2014, according to the Recreational Vehicle Industry Association.

Putting the pieces together

Today, Harley-Davidson has many of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

The article Is Harley-Davidson Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes has no position in any stocks mentioned. The Motley Fool recommends Polaris Industries. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.