Is Rambus Destined for Greatness?

Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Rambus fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Rambus' story, and we'll be grading the quality of that story in several ways:

Growth: Are profits, margins, and free cash flow all increasing?

Valuation: Is share price growing in line with earnings per share?

Opportunities: Is return on equity increasing while debt to equity declines?

Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Rambus' key statistics:

RMBS Total Return Price data by YCharts.

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | (7.6%) | Fail |

Improving profit margin | (214.2%) | Fail |

Free cash flow growth > Net income growth | (102.1%) vs. (205.5%) | Pass |

Improving EPS | (204.3%) | Fail |

Stock growth (+ 15%) < EPS growth | (46.9%) vs. (204.3%) | Fail |

Source: YCharts. * Period begins at end of Q2 2010.

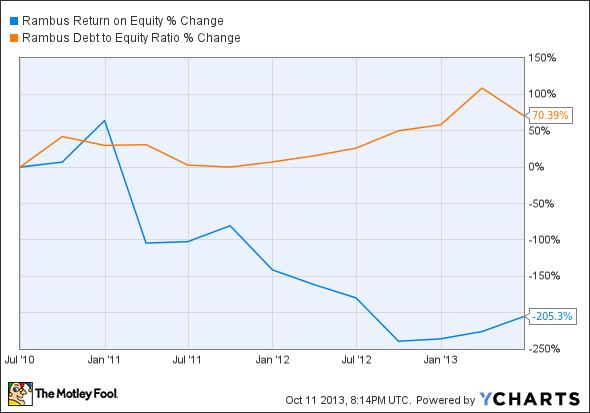

RMBS Return on Equity data by YCharts.

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving return on equity | (205.3%) | Fail |

Declining debt to equity | 70.4% | Fail |

Source: YCharts. * Period begins at end of Q2 2010.

How we got here and where we're going

Things don't look good at all for Rambus today. The memory chipmaker mustered only one out of seven possible passing grades, and even that was granted more on a technicality than on real improvement. Over the past couple of years, Rambus' bottom line and free cash flow have both collapsed into negative territory due to a combination of weakness in the PC market and high operational costs including R&D and legal activities. Can Rambus overcome these challenges? Let's take a closer look at what the company might have planned for the future.

Over the last decade, Rambus filed a number of lawsuits against semiconductor companies for violating its memory and chip technology patents, but it has lost notable legal battles to Micron and SK Hynix. The company filed a $4 billion antitrust lawsuit against these two rivals, but courts ultimately the claim that Micron and Hynix colluded to fix the prices of DRAM undercut Rambus-developed RDRAM. It certainly did not help that Rambus intentionally destroyed evidence in the lawsuit.

However, Rambus has still managed to obtain some victories of varying quality. The company agreed to settle a long-running patents infringement lawsuit earlier this year by entering a patent licensing agreement with LSI that will run through 2018. Rambus also settled a patent dispute over memory-chip technology by signing a five-year patent licensing agreement with SK Hynix for $240 million. The company also inked a comprehensive agreement to settle pending disputes with STMicroelectronics, which will allow ST to use Rambus' memory and interface technologies across a wide range of products. Microsemi has also inked an agreement with Rambus to secure CRI design tools that will allow Microsemi to create tamper-resistant semiconductors and chips. Rambus has also expanded its business relationships with Freescale Semiconductor, which will allow Freescale to employ Rambus' resistive memory technology in its embedded applications.

The net outcome of these various battles appears to be negative: the company recently cut 15% of its total workforce , which will allow it to save between $30 million to $35 million annually. Rambus also divested its display-patent assets to a subsidiary of Acacia Research Corporation.

Rambus did retain its LED-lighting patent portfolio, which it continues to develop as an avenue of future growth. In the past few months, the company has introduced in-lamp color adjustment technology , and also launched LED bulbs with built-in MicroLens optical technology , which boast features such as broad dimmer compatibility and effective thermal management. This diversification could be a reaction to Micron's recent acquisition of Elpida, which signals tougher competition in the memory-chip market that has long been Rambus' bread-and-butter. However, LED lighting is no less competitive, and several larger manufacturing concerns have been building their capabilities in this field for years. There may not be much space for Rambus to find a foothold.

Putting the pieces together

Today, Rambus has few of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

More compelling ideas from Motley Fool

Tired of watching your stocks creep up year after year at a glacial pace? Motley Fool co-founder David Gardner, founder of the No. 1 growth stock newsletter in the world, has developed a unique strategy for uncovering truly wealth-changing stock picks. And he wants to share it, along with a few of his favorite growth stock superstars, WITH YOU! It's a special 100% FREE report called "6 Picks for Ultimate Growth." So stop settling for index-hugging gains... and click HERE for instant access to a whole new game plan of stock picks to help power your portfolio.

The article Is Rambus Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.