This Drugstore Offers More Potential Than Its Peers

For investors, drugstores have become pretty transparent. With Walgreen , you have a company that is now benefiting from its resolution with Express Scripts, which has driven many former customers back to its stores. Its Alliance Boots partnership has also exceeded expectations, yielding $154 million in sales versus earlier expectations of $125 million to $150 million.

Then there's CVS Caremark , a solid company that has rewarded investors over the long haul. It's losing a little steam due to Walgreen's resolution with Express Scripts.

Finally, there's Rite Aid , which has become a gambler's paradise. Over the past several years, the gamblers have been winning in a big way. However, this doesn't guarantee positive future results.

The good news for Rite Aid

Rite Aid recently reported same-store sales for September. Overall, the numbers impressed:

Metric | Year-Over-Year Results |

|---|---|

Total sales | 1.9% |

Prescription count | 0.9% |

Pharmacy sales | 3.1% |

Front-end sales | (0.5%) |

Source: Rite Aid press release.

While fewer people are buying items from the front end of the store due to increased competition, Rite Aid performed well in all other areas. The company has also seen four consecutive months of comps growth and has delivered profits in the last four quarters. This was mostly due to cost reductions, such as indirect drug procurement and supply chain improvements.

Looking ahead, Rite Aid expects more good news. It has upped its fiscal year 2014 earnings-per-share guidance to $0.18-$0.27 from $0.01-$0.16. Rite Aid's Wellness+ loyalty program (implemented in 2010) and flu immunizations have driven demand. These positive trends combined with the aforementioned cost reductions are expected to aid the bottom line. Furthermore, the Wellness+ program was responsible for 79% of sales in fiscal year 2013, up substantially from 68% of sales in fiscal year 2012. The program can now be deemed a success.

The bad news for Rite Aid

If you look at the bigger picture, however, Rite Aid hasn't delivered a strong enough performance to give potential investors conviction. For instance, if you look at year-to-date same-store sales the numbers aren't quite as impressive:

Metrics | Year-to-Date Results |

|---|---|

Total sales | (0.4%) |

Prescription count | 0.1% |

Pharmacy sales | (0.6%) |

Front-end sales | 0.0% |

Source: Rite Aid press release.

This information doesn't discount Rite Aid's strong performance in September; it should merely serve as big-picture information so you're not potentially swayed by short-term trends. While Rite Aid has the potential to build on its recent strong performance, its peers have been more consistent over the long haul.

Peer comparisons

First, let's consider top-line performance:

RAD Revenue TTM data by YCharts.

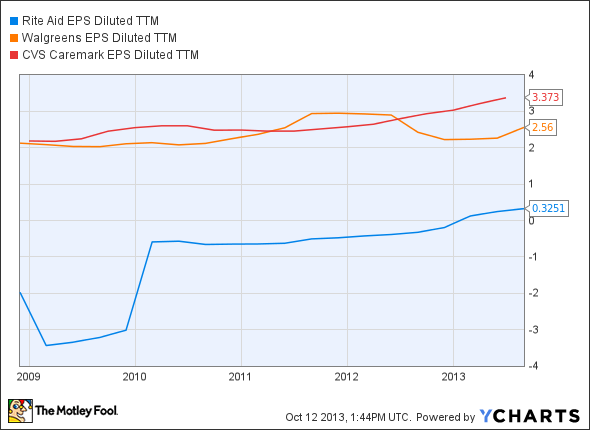

As you can see, Rite Aid has lagged its peers. Since the company has become more bottom-line-focused, let's see how it has performed compared to peers on this metric (actual diluted EPS):

RAD EPS Diluted TTM data by YCharts.

Rite Aid has made a lot of progress because it has successfully reduced costs. In addition, Rite Aid has reduced its store count to 4,603 from 4,639 over the past year.

Walgreen also recently reported September same-store sales. Below is a quick overview:

Metrics | Results |

|---|---|

Total comps sales | 7.4% |

Prescriptions filled | 9.6% |

Total pharmacy sales | 10.4% |

Front-end comps | 2.9% |

Source: Zacks.com.

These numbers are clearly more impressive than Rite Aid's. Walgreen also opened 17 locations and closed just one in September -- a sign that management is confident in the company's growth potential.

September same-store sales numbers aren't available for CVS, but its net revenue increased 1.7% in the second quarter, and EPS jumped 19.5%. However, CVS has reduced its adjusted EPS guidance to $3.90-$3.96 from $3.89-$4.

CVS has been the top performer on the top and bottom lines over the past several years. That prestige could swing to Walgreen thanks to its resolution with Express Scripts.

Looking at some key metric comparisons, one of these three companies looks more appealing than the others:

Company | Net Margin | Dividend Yield | Cash and Short-Term Equivalents | Long-Term Debt |

|---|---|---|---|---|

Rite Aid | 1.22% | N/A | $144.17 million | $6.05 billion |

Walgreen | 3.39% | 2.30% | $2.11 billion | $5.05 billion |

CVS | 3.41% | 1.60% | $1.18 billion | $9.38 billion |

Source: Company financial statements.

Walgreen and CVS do better than Rite Aid at turning revenue into profit. Walgreen and CVS also offer dividend payments, with Walgreen being the most impressive in this area. Walgreen also offers the strongest balance sheet and has the most cash on hand.

The bottom line

Rite Aid certainly has potential to continue its turnaround. However, Walgreen and CVS are clearly stronger and more fundamentally sound companies. Walgreen is likely to be the best long-term investment option. Not only does it offer a generous yield, but it's expanding its store base while also reaping the benefits of returning Express Scripts customers.

Some of the strongest dividend investments can be found here

Dividend stocks can make you rich. It's as simple as that. While they don't garner the notoriety of high-flying growth stocks, they're also less likely to crash and burn. And over the long term, the compounding effect of the quarterly payouts, as well as their growth, adds up faster than most investors imagine. With this in mind, our analysts sat down to identify the absolute best of the best when it comes to rock-solid dividend stocks, drawing up a list in this free report of nine that fit the bill. To discover the identities of these companies before the rest of the market catches on, you can download this valuable free report by simply clicking here now.

The article This Drugstore Offers More Potential Than Its Peers originally appeared on Fool.com.

Fool contributor Dan Moskowitz has no position in any stocks mentioned. The Motley Fool recommends Express Scripts. The Motley Fool owns shares of Express Scripts. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.