A Health Care Portfolio for the Ages

For the broader market, the government shutdown and threat of a debt crisis has been scary. For many Fools, this pullback represents a great buying opportunity. As a fan of health care stocks and all they have to offer, this seemed as good a time as any to build a virtual, diversified health care portfolio as a case study in Foolishly investing in biotech. From fast growers to dividend plays, to companies with disruptive technology, join me each week as I add 10 health care stocks to my virtual portfolio. Follow the progress each week on my HealthyMoney page on Motley Fool CAPS, check out the progress in my personal CAPS page, or start your own and test your ideas.

Let's start with the anchors: big biotech.

A proven track record

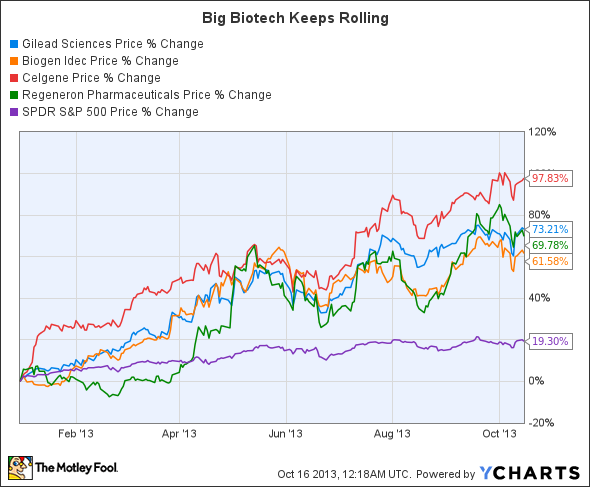

Big biotech has seen jaw-dropping growth in the last year, and investors have already been rewarded bountifully compared to those invested in the broader S&P 500.

Gilead Sciences , Biogen , Celgene , and Regeneron are all very well-managed companies with strong pipelines, and would make great investments. But with quality comes a premium price, and investors will have to pay up to own a piece of these growth stories. This price appreciation has come on the heels of huge catalysts and earnings growth. While prices have risen to trailing P/Es above thirty for each of these companies, forecasted earnings growth gives them PEG ratios that are a bit easier to swallow.

Market Cap | Trailing P/E | 5-Year PEG | |

Gilead | $97.35 billion | 35.59 | 1.22 |

Biogen | $56.20 billion | 35.03 | 1.39 |

Celgene | $63.85 billion | 43.41 | 1.09 |

Regeneron | $28.37 billion | 38.40 | 3.38 |

Source: Yahoo! Finance as of Oct. 15.

Regeneron's massive growth appears to be priced into its stock more than its peers, so I'll withdraw it from contention.

Antiviral king

Gilead made a name for itself in the HIV market with its drugs Atripla and Complera. Now Gilead hopes to turn components of those treatments, which it shares with Bristol-Myers Squibb and Johnson & Johnson, into a single wholly owned oral pill, Stribild. Stribild was approved in August 2012, and is expected to bring in peak annual sales of $3.5 billion by 2018.

The big buzz now surrounds Gilead's hepatitis C drug Sofosbuvir. Already touted as a megablockbuster, an FDA decision on sofosbuvir is expected in December, around the time competitor Johnson & Johnson hears about its simeprevir. The average analyst estimate for peak sales of sofosbuvir is $7.4 billion.

But antivirals aren't the only prospect putting Gilead at the top of our list. Its relatively new focus on oncology has started with a bang. Earlier this week, Gilead stopped a phase 3 trial after an interim analysis showed that idelalisib in combination with Roche's Rituxan had significantly higher efficacy than Rituxan alone for the treatment of chronic lymphocytic leukemia. With a pipeline of four other clinical-stage oncology drugs in six indications, Gilead's oncology franchise won't be disappearing any time soon.

Based on this, I decided to add it to my virtual portfolio.

Celgene or Biogen?

With one spot left for the big biotech portion of our portfolio, let's dissect the differences between Celgene and Biogen. A few months ago a fellow Fool laid out his arguments for each, and I agree with his assessment. Both companies have strong balance sheets built for growth; Celgene has around six times more cash and short-term investments, but Biogen has around seven times lower debt-to-equity.

The pipeline potential is really what separates the two. Biogen's earnings growth rests on the success of its groundbreaking oral multiple sclerosis drug Tecfidera -- which is in the infancy of its marketing and is thought to reach $4.2 billion to $5.2 billion in sales -- and on its two hemophelia drugs with $1 billion potential.

Celgene, on the other hand, has a far more diversified pipeline with 17 clinical-stage drug candidates. Headed up by Revlimid, Celgene's focus is on cancers of the blood and a dedication to label expansion for approved drugs. Revlimid brought in $3.76 billion in 2012 (a 17% increase over 2011), and label expansion into 10 additional potential indications will help that number grow.

The real short-term catalyst for Celgene, though, is the pending FDA decision on anti-inflammatory therapy apremilast. As an oral therapy for rheumatoid arthritis and psoriasis, apremilast could take a major bite out of sales of injectable blockbusters Humira from AbbVie and Enbrel from Amgen -- two of the best-selling drugs in the world.

For the second spot in my Health Care Portfolio, I decided to add Celgene.

The bottom line

In the end, each of these companies are in wonderful financial positions to drive their pipelines through successful growth. Though these companies are a bit pricey, the potential in their pipelines can continue to send earnings and share price higher, as indicated by their PEG ratios. Some remain concerned of a biotech bubble, though, so check back next week as I insulate this virtual portfolio with dividend-paying health care stalwarts. Teaser: One of them is a surprising omission from our big biotech segment.

Two more biotechs to get on your radar

As I unfold a Health Care Portfolio for the Ages, I'll have many companies to choose from. There are health care providers, insurance companies, medical device companies-but the ones I'm excited about are the biotechs with game-changing platforms. In the Motley Fool's brand-new FREE report "2 Game-Changing Biotechs Revolutionizing the Way We Treat Cancer," find out about a new technology that big pharma is endorsing through partnerships, and the two companies that are set to profit from this emerging drug class. Click here to get your copy today.

The article A Health Care Portfolio for the Ages originally appeared on Fool.com.

Seth Robey has no position in any stocks mentioned. The Motley Fool recommends Celgene and Gilead Sciences. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.