Chevron Up, Oil Prices Down as $19 Billion Trial Begins

Although we don't believe in timing the market or panicking over daily movements, we do like to keep an eye on market changes -- just in case they're material to our investing thesis.

Chevron is up today as the company goes to court over the $19 billion judgment against it in Ecuador. Chevron is alleging that its opponent's attorneys won the case through fraud and corruption, rather than facts. The start of the case has Chevron up, while the Dow Jones Industrial Average and oil prices are both down for the day. As of 1:15 p.m. EDT the Dow was down 45 points to 15,258. WTI crude was down 0.6% to $101.80, and Brent crude was down 0.6% to $110.34.

Stock markets, bond markets, and commodity markets are all selling off slightly today as we continue to wait for congressional action on the debt ceiling. Hopefully, you are well aware of how much of a disaster a default on the U.S.' obligations would be. Investors broadly assume that Congress will at least pass a continuing resolution to put off the debt ceiling decision till next month. Since talks began at the end of September, the Dow is down just 2%. The effects of the continued debate can best be seen in the Treasury bond market, where Treasuries expiring Nov. 7 yield 0.25%, while the six-month treasury yields 0.13%.

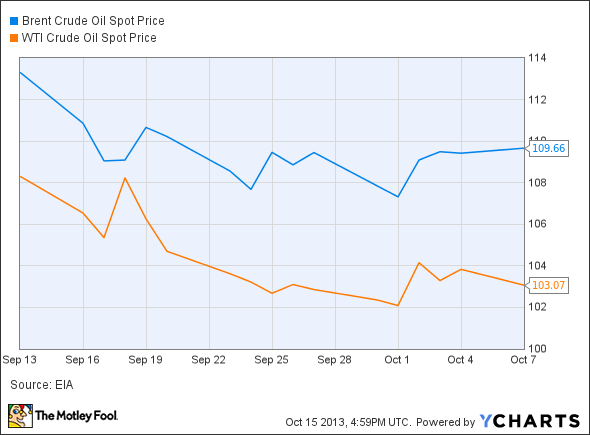

The effects can also be seen in the oil markets, where the spread between WTI crude and Brent crude has widened to $8 after narrowing to $1.

Brent Crude Oil Spot Price data by YCharts.

WTI has fallen as economic activity in the U.S. slows and demand for oil drops around the country. Last week the Energy Information Agency reported that crude inventories rose in the U.S. by 6.8 million barrels. Further, the government shutdown is estimated to hurt GDP growth by 0.1 to 0.15 percentage points a week. Now that we have just started the third week of the shutdown, the economic effects are rippling through the economy.

Chevron's case

Chevron is up today as the company goes to court in Manhattan to dispute the $19 billion judgment it faces in Ecuador. Texaco, which Chevron acquired in 2001, was sued 20 years ago in Ecuador over illegal dumping of drilling waste from 1964 to 1992. Fool analyst Isaac Pino took an in-depth look at both sides of Chevron's Ecuador legal battle. While Chevron lost the case in Ecuador, the company is now in court to argue that the lawyers for the Ecuadorians engaged in fraud and corruption to win the case. If Chevron loses the court battle in the U.S., the Ecuadorian lawyers will be free to try and enforce the judgment by seizing Chevron's assets around the world so long as Chevron refuses to pay the full judgment. We will have to wait and see what happens.

As we have seen in the past few years -- and now, in the Chevron-Ecuador legal battle -- the exploration and production game is fraught with risk. There are many different ways to play the energy sector, and The Motley Fool's analysts have uncovered an under-the-radar company that's dominating its niche. This company is a leading provider of equipment and components used in drilling and production operations, and poised to profit in a big way from it. To get the name and detailed analysis of this company that will prosper for years to come, check out the special free report: "The Only Energy Stock You'll Ever Need." Don't miss out on this limited-time offer and your opportunity to discover this under-the-radar company before the market does. Click here to access your report -- it's totally free.

The article Chevron Up, Oil Prices Down as $19 Billion Trial Begins originally appeared on Fool.com.

Dan Dzombak can be found on Twitter @DanDzombak or on his Facebook page, DanDzombak. He has no position in any stocks mentioned. The Motley Fool recommends Chevron. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.