This Is a Perfect Pick for Your Growth Portfolio

U.S. consumer spending has been increasing, but at a very slow pace. Although the unemployment rate has been decreasing, people continue to be cautious about their spending and they are very sensitive to price increases. It has been estimated that the upcoming fall season will not see a lot of footfall this year since customers are not expected to splurge . Hence, dollar stores that offer daily requirements at low prices will continue to be important.

The economic slowdown was the biggest opportunity for dollar stores when people started visiting these stores in order to spend each penny judiciously. Companies such as Dollar Tree , Dollar General , and Family Dollar Stores witnessed an increase in footfall, which led to higher revenue.

The past

Each player has tried to attract the biggest crowd possible by offering the maximum discounts and the lowest prices. Not only did these companies benefit, but so too did their investors as the companies provided great returns.

Each player's stock price appreciation in the last five years is indicated in the chart below:

Dollar Tree has been the best performer compared to its peers, providing the highest return of 245.1%. Family Dollar and Dollar General also performed well, with returns of 149.6% and 147.9%, respectively. Dollar Tree has been focusing on providing refrigerated and frozen foods and the company has installed coolers in many stores so that it can increase its top line further.

The present

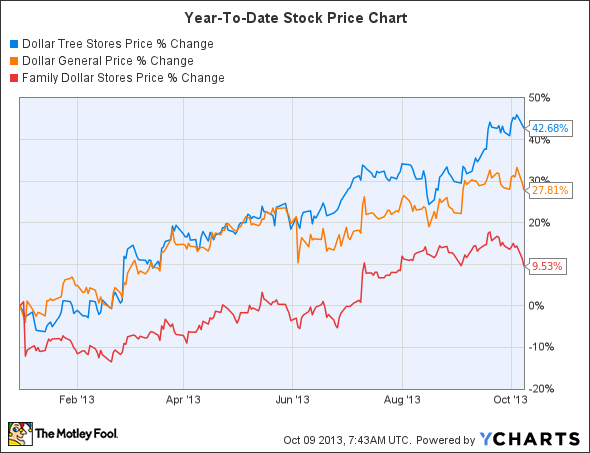

Although Dollar General has provided the lowest returns over the last five years, things have been turning in its favor. The company's strategies have been paying off, leading to improved performance in the last year. Dollar General has been able to outperform Family Dollar over the last few months, as reflected in the chart below:

Dollar General's stock price has increased 27.8% since the beginning of the year, whereas Family Dollar's stock price is up by only 9.5%. However, Dollar Tree continues to lead the pack with stock price appreciation of 42.7%.

Dollar General has been performing very well. In its recently-ended quarter it reported same store sales growth of 5.1%, much higher than Dollar Tree, which posted 3.7% growth, and Family Dollar Stores, which reported 2.9% growth.

One of the key drivers for Dollar General's performance is the addition of tobacco to its offerings, which is luring more customers to its stores. Moreover, the company announced that people who come to buy tobacco end up buying some other products as well, which adds to its top line. Additionally, the company has already opened 375 new stores in the first half of the year, and plans to open a total of 650 new stores during the fiscal year.

The future

Dollar General has the lowest P/E ratio, on a trailing twelve month basis, of 19.37. Dollar Tree and Family Dollar have multiples of 20.45 and 20.36, respectively. Dollar General is cheaper than its peers even when the forward P/E ratio is considered. The forward P/E multiple is 15.44 for Dollar General, lower than Dollar Tree at 17.33 and Family Dollar at 17.88.

The PEG ratio of these three players strengthens the belief that Dollar General is cheaper compared to its peers. Dollar Tree and Family Dollar have PEG ratios of 1.22 and 1.75, respectively, whereas Dollar General's is quite low at 1.16. Hence, investing in Dollar General will be cheaper for the same amount of earnings growth.

Takeaway

Dollar General looks increasingly attractive, with higher same store sales growth than its peers. Its expansionary initiatives, store remodeling, and the addition of fresh food and tobacco will add to its growth. Moreover, Dollar General is cheaper than its peers and it is expected to grow the most. Investors should definitely invest in this dollar store in order to get great returns.

Dollar stores aren't the only growth stocks out there

Tired of watching your stocks creep up year after year at a glacial pace? Motley Fool co-founder David Gardner, founder of the No. 1 growth stock newsletter in the world, has developed a unique strategy for uncovering truly wealth-changing stock picks. And he wants to share it, along with a few of his favorite growth stock superstars, WITH YOU! It's a special 100% FREE report called "6 Picks for Ultimate Growth." So stop settling for index-hugging gains... and click HERE for instant access to a whole new game plan of stock picks to help power your portfolio.

The article This Is a Perfect Pick for Your Growth Portfolio originally appeared on Fool.com.

Pratik Thacker has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.