Should You Invest in This Big British Pharmaceutical Company?

There isn't much love for big pharmaceutical companies these days. Patent cliffs, uncertain pipelines, and drastic downsizing efforts aren't exactly appealing reasons to invest in this sector.

The British giants, GlaxoSmithKline and AstraZeneca , are also unloved, yet I believe that the former could actually be a better investment than the latter. So let's compare GlaxoSmithKline to its primary competitors -- AstraZeneca, Pfizer , and Merck -- and discuss the strengths that some investors might be overlooking.

The Foolish fundamentals

Let's first take a look at GlaxoSmithKline's fundamentals in comparison to these three companies.

Company | 5-Year PEG | Forward P/E | Quarterly Revenue Growth (YOY) | Quarterly Earnings Growth (YOY) | Forward Dividend Yield |

GlaxoSmithKline | 3.52 | 12.71 | 2.4% | (15.6%) | 4.4% |

AstraZeneca | (0.84) | 10.39 | (6.4%) | (48.5%) | 3.5% |

Pfizer | 4.59 | 12.45 | (7.1%) | 333.3% | 3.3% |

Merck | 4.93 | 13.16 | (10.6%) | (49.5%) | 3.6% |

Advantage | GSK | AstraZeneca | GSK | Pfizer | GSK |

Source: Yahoo! Finance as of Oct. 11.

Not only does GlaxoSmithKline have the strongest forward growth potential based on its lower five-year PEG ratio, but it was also the only company to report positive revenue growth last quarter. Considering that Pfizer's 333% jump in earnings growth was mainly due to the spin-off of its animal health unit, Zoetis, last quarter, GlaxoSmithKline's earnings growth compares favorably. GlaxoSmithKline also offers the highest forward annual dividend yield.

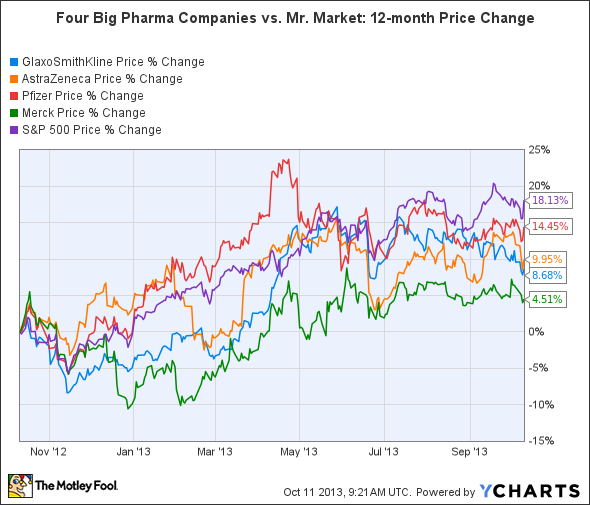

Looking at GlaxoSmithKline's price growth over the past 12 months, it appears those reasons aren't convincing investors that it is time to purchase the stock, which has underperformed the market by a wide margin.

Source: YCharts.

Therefore, let's dig deeper into its second quarter to see what the problems are, and I'll show you why GlaxoSmithKline's pharmaceutical business could be poised for stronger growth.

The problem of flat growth

One major concern is that its sales are peaking. The company, which reports its revenue in two main segments -- pharmaceuticals & vaccines and consumer health care -- doesn't have any major products posting the double- or triple-digit gains that investors like to see in a portfolio.

Therefore, sales growth has been fairly anemic, as seen in the following chart.

Business Segment | Second-Quarter Revenue | Growth (YOY) | Percentage of Total Revenue |

Pharmaceuticals & Vaccines | $8.2 billion | 1% | 80.3% |

-- Pharmaceuticals | $6.4 billion | 62.7% | |

-- Vaccines | $1.2 billion | 11.8% | |

-- ViiV Healthcare (85% GSK, 15% Pfizer) | $522 million | 5.1% | |

Consumer Healthcare | $2.0 billion | 2% | 19.6% |

Source: Company earnings report, author's calculations.

Of these segments, the company's pharmaceuticals segment is the largest one, and within it, its respiratory treatments, which account for 46% of the segment's revenue, is the key growth driver. In that segment, one drug -- the COPD (chronic obstructive pulmonary disease) and asthma treatment, Advair (also known as Seretide) -- accounts for 71% of respiratory treatment sales and 20.5% of the GlaxoSmithKline's total revenue.

Advair's top spot in GlaxoSmithKline's portfolio will likely remind investors of Merck's struggles with losing patent protection for top asthma medication Singulair, AstraZeneca's loss of antipsychotic drug Seroquel and antacid Nexium, and Pfizer's loss of cholesterol-lowering drug Lipitor. Each of those expirations cost the companies billions in annual revenue.

Advair sales have hit all-time highs over the past two years, with annual sales of $8.05 billion in 2011 and $8.1 billion in 2012. But, here's the part that scares GlaxoSmithKline shareholders -- the patent for Advair's medication expired in the U.S. in 2010, and will expire in Europe later this year. However, no generic versions have been produced, due to the need for Advair to be administered through a complex proprietary inhaler known as a Diskus, which is patent protected until 2016. The Diskus is notoriously difficult to replicate, and no generics manufacturer has successfully manufactured one yet.

New respiratory and skin cancer drugs could be key to future growth

Even though GlaxoSmithKline might have a few more years of strong Advair sales to support its top line, it hasn't become complacent in regards to future growth. To prepare for the eventual loss of exclusivity of Advair, GlaxoSmithKline has four new potential blockbuster treatments on the way, three of which are already approved, and two of which have already launched in the U.S.

These four treatments are the COPD drugs Breo Ellipta and Anoro Ellipta, both developed with its partner Theravance, and the skin cancer drugs Tafinlar and Mekinst. According to the following chart, these drugs could eventually hit combined peak sales of $5.1 billion.

Drug | Indication | Status | Projected peak sales |

Breo Ellipta | COPD | Approved in US/Japan (not launched) | $1.3 billion |

Anoro Ellipta | COPD | NDA submitted (FDA recommended) | $1.4 billion |

Tafinlar | metastatic melanoma | Launched in U.S. | |

Mekinst | metastatic melanoma | Launched in U.S. | $2.4 billion (both treatments) |

Total | $5.1 billion |

Sources: Company and industry websites, author's calculations.

However, GlaxoSmithKline won't rule these markets unopposed. AstraZeneca's Symbicort is another top COPD treatmen that generated $3.2 billion in sales in 2012. Symbicort faces patent expirations between 2014 and 2018, which could cause even more generic COPD treatments to enter the market. Meanwhile, Novartis' new COPD treatment, the Ultibro Breezhaler, was approved in Europe last month.

In metastatic melanoma, GlaxoSmithKline will have to compete against Roche and Bristol-Myers Squibb, which produce the two leading skin cancer treatments on the market -- Zelboraf and Yervoy.

The Foolish takeaway

Although I am not suggesting that GlaxoSmithKline will be a high growth stock, I believe that its downside is fairly limited. Fears about Advair facing generic competition are overblown, and the company's strong additions to its respiratory and oncology portfolios are keeping its revenue growth on track. Therefore, GlaxoSmithKline should not be tossed in the same pile as Merck and AstraZeneca, which are both being squeezed hard by patent expirations and failed pipelines.

Other divestments of non-core assets should also help it preserve earnings. In September, GlaxoSmithKline reached an agreement to sell its Lucozade and Ribena beverage businesses to Suntory Beverage for $2.16 billion, and also sold two blood thinners -- Fraxiparine and Arixtra, and their related manufacturing sites -- to Aspen Global for $1.1 billion.

When GlaxoSmithKline reports its third-quarter earnings on October 23, investors should see if bribery allegations in China, which accounted for over a fourth of its sales last quarter, affected sales in the region. In addition, investors should keep an eye on the competition that GlaxoSmithKline faces in the COPD and skin cancer areas, since it is counting heavily on these treatments to pick up the slack once Advair fades.

More dividend stock ideas for your portfolio

One of the best parts of owning big pharma stocks is their attractive dividends, but smart investors know the importance of diversifying -- seeking high-yielding stocks from multiple industries. The Motley Fool's special free report "Secure Your Future With 9 Rock-Solid Dividend Stocks" outlines the Fool's favorite dependable dividend-paying stocks across all sectors. Grab your free copy by clicking here.

The article Should You Invest in This Big British Pharmaceutical Company? originally appeared on Fool.com.

Leo Sun has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.