This 1 Simple Tool Will Lead You to Cheap Dividend Stocks

Over the past year, investors have been fleeing to the "safety" of dividend stocks. Yet overpaying for yield, can quickly turn your "safe haven" into a trap.

Correct valuation is the key to dividend investing success. Unfortunately, when it comes to valuing stocks, opinions are in greater supply than answers.

I want to help us get closer to answers. Here is a tool that can help us determine a tangible price for dividend stocks.

The Dividend Discount Model

The dividend discount model, is one time tested tool for dividend valuation. It only values the worth of an asset relative to its income, so for income investing, it's about as tangible as it gets.

You'll need to make a few estimates for this model to work. Calculate what your required return on investments is, and what the anticipated dividend growth rate of the stock in question will be.

Then you simply divide this years expected dividends, by the required return minus the expected dividend growth rate. Your formula should look like the following.

Expected dividends this year

___________________________________________

(Required return-Expected growth rate of dividend)

Dividend values in the food

By screening with the dividend discount model, using 10% as our required return, it becomes clear that there are some values in food staples.

Two names that jump out, on paper, are General Mills and PepsiCo: . Let's use these stocks as examples of how to complete a valuation, beyond what the formula tells us.

Here's where they stand:

With its stable of household brand foods like Cheerios, Betty Crocker, and Pillsbury, General Mills, delivers steady cash flows through its brand moat. It's returned that cash to shareholders, increasing its dividend 11% annually the past five years.

If you plug-in its annual dividend of $1.52 per share, and assume its 11% dividend growth rate continues, our model shows says the stock is undervalued by about 40%! This valuation model places a premium on dividend increases and stability; with two dividend increases just this year, General Mills is a value.

That's an incredible value, matched only by Pepsi. By using this dividend discount model, Pepsi's 8.35% five year dividend growth rate and $2.27 annual dividend, we arrive at a fair value around $150. Wow!

Of course, it's not as simple as it appears

First, let me state the obvious: not every stock in this sector is a cheap by this metric. Stocks such as Beam, Hillshire, and Hormel, seemed overvalued for the same reasons that Pepsi and General Mills seemed cheap. They lack dividend certainty.

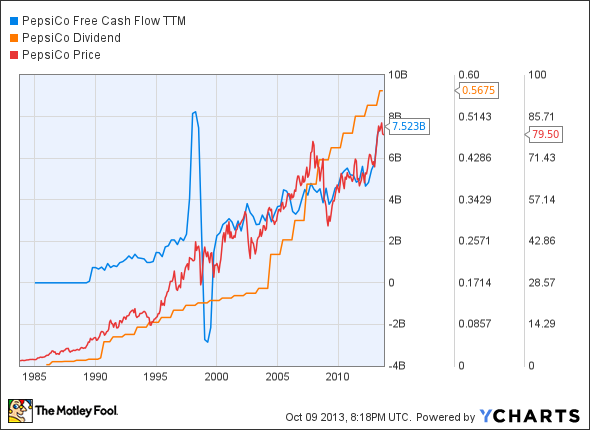

Is this model perfect? No. But just look at the correlation in the chart below. Pepsi's stock price didn't really accelerate until its dividend growth rate did, even though free cash flow was rising all along. If we know that dividend growth will boost the stock price, like Pepsi's has since the nineties, then the ability to continue doing so deserves a premium.

PEP Free Cash Flow TTM data by YCharts

Everything has a value. Pepsi's dividend consistency also has lead to stunning compound returns, which is why the "certainty" of its dividend increases is so valuable.

Valuation: an art, not a science

The fact that Pepsi and General Mills seem so cheap, by the dividend discount model's measure, doesn't mean that we should skip some "borderline" stocks that show promise.

Take a stock like Campbell Soup for instance. The stock pays a hefty annual dividend of $1.25 yet, if we expect its five year divided growth rate of 5.68% to stay flat, we would value it at just $30. However, Campbell's just increased its dividend by 7.6%.

So which is it? The model cannot determine our predictions, so this is where valuation becomes more art than science.

If you are optimistic about Campbell's future, as I am, and feel the 7.6% growth rate will continue, the stock would be valued at $56. Depending on your expectations for returns, and dividend growth, borderline stocks like this can swing from expensive to cheap.

What to look for

Since any discounting valuation model involves making projections, let's discuss a few other variables to look for with the dividend discount model.

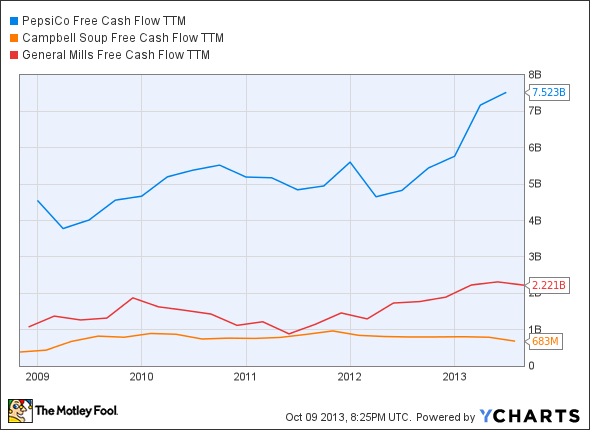

We'll need to see if these companies are growing free cash flow, after-all, that's where dividends come from. As you can see by the chart below, Pepsi is the king of cash flow and Campbell's is the laggard of the group. However, all three stocks have at least been able to show gains since the "great recession." This is a good sign, especially given the increased pay-outs with these three stocks.

PEP Free Cash Flow TTM data by YCharts

Finally, we need to consider earnings and revenue growth. If these businesses aren't moving forward, the dividend increases will stop.

Luckily, there's evidence that these three businesses are on the right side of growth trends.

My biggest question, when it comes to buying food companies, is are they prepared for a more health conscious consumer? The world is changing. Organic foods are gaining market share, and recent polls have shown that consumers are becoming skeptical of GMO's and preservatives.

Healthy food=healthy returns.

I think these businesses are positioned well for the future. Recently, General Mills made a commitment to source 100% of its 10 "priority" ingredients in a sustainable manner by 2020.

Campbell's has added "organics" to its recent acquisition spree, with its purchase of organic baby-food maker plum organics, and Pepsi's CEO, Indra Nooyi has made healthy eating, sustainability, and social consciousness a priority since joining the firm.

These businesses aren't leaders in the organic movement. However, it's good to know that leadership at least sees the importance of appearing to be on the right side of these trends.

Tools, not "tricks"

I'm not recommending that you buy these three stocks today. However, they do make good subjects when discussing the additional steps required to valuing a stock, with the dividend discount model.

I think we should use this model as one of many tools in our quest for valuing stocks. It is a tool, and not a "trick." Think of it as a starting point, a tangible starting price, to a much bigger dividend valuation story.

More tools to identify dividend dynamos

If you're an investor who prefers returns to rhetoric, you'll want to read The Motley Fool's new free report "5 Dividend Myths... Busted!" In it, you'll learn which stocks provide premium growth and whether bigger dividends are better. Click here to keep reading.

The article This 1 Simple Tool Will Lead You to Cheap Dividend Stocks originally appeared on Fool.com.

Adem Tahiri has no position in any stocks mentioned. The Motley Fool recommends PepsiCo. The Motley Fool owns shares of PepsiCo. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.