The 4 Biggest Coal Stocks Are Getting Even Bigger

U.S. coal production is down over the last five years, but that hasn't stopped the biggest corporations from consolidating power across the competitive market. With coal's future in flux, let's dive deeper into this market's moves.

The Big Boys

For the first time in recent history, the four largest coal producers accounted for more than 50% of total production in 2011, and preliminary 2012 estimates paint a similar picture. While overall tonnage has dropped nearly 200 million short tons since 2008, the biggest companies are increasing their sector stakes at higher rates than ever.

Source: EIA.gov

Currently, Peabody Energy , Arch Coal , Alpha Natural Resources , and Cloud Peak claim the four top spots for coal king .

Peabody has maintained its No. 1 position "for decades," according to the Energy Information Administration, and has been a powerhouse producer in the West and Midwest. But unlike some other coal companies, Peabody maintains international diversity, as well. For the second quarter of 2013, Peabody pulled in $971 million from U.S. operations and added another $745 million from Australian operations.

While Peabody has upped production at its existing mines, both Arch Coal and Alpha Natural Resources have maintained their positions through artificial expansions. Rio Tinto sold off a Wyoming mine to Arch in 2009, and Alpha merged with Foundation Coal Holdings in the same year. That merger shot Alpha up from 14th place to fourth place, and another 2011 acquisition further solidified its spot.

Meanwhile, Cloud Peak is an example of a full-fledged spinoff. Rio Tinto Energy of America created Cloud from thin air in 2009, a not-uncommon trend as energy companies eased back on expansion to stick to their strengths.

Source: EIA.gov

Is bigger better?

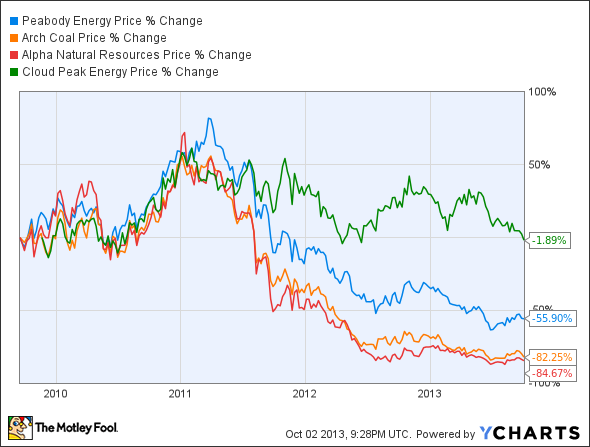

It's been a rough five years for coal stocks, but companies have been crushed to different degrees. With smallest Cloud Peak dropping just 2% and largest Peabody taking second place at a 56% loss, scale alone can't explain stock moves.

U.S. coal demand is in the dumps, and the biggest indicator of future growth is export capability. While Cloud Peak ships 85% of its coal straight to high-demand Asia and Peabody maintains a global network of production and sales through its Australian operations , Arch exports just 10% of total production . And although Alpha Natural nabs 42% of revenue from overseas , its sales rely heavily on global steel production .

Can coal cut it?

Throughout the global financial crisis and recovery, Mr. Market has kept coal stocks in the dumps. And while the scale and specialization of these four coal kings presents unprecedented opportunity for market ownership and fat margins, it inherently increases investor risk. Energy is already a volatile sector, and coal investors need to know that Big Coal isn't a safe bet in and of itself.

Diversify beyond energy

If you're investing in energy, it's essential you diversify your portfolio with a solid set of dividend stocks. While they don't garner the notoriety of high-flying growth stocks, they're also less likely to crash and burn. And over the long term, the compounding effect of the quarterly payouts, as well as their growth, adds up faster than most investors imagine. With this in mind, our analysts sat down to identify the absolute best of the best when it comes to rock-solid dividend stocks, drawing up a list in this free report of nine that fit the bill. To discover the identities of these companies before the rest of the market catches on, you can download this valuable free report by simply clicking here now.

The article The 4 Biggest Coal Stocks Are Getting Even Bigger originally appeared on Fool.com.

Fool contributor Justin Loiseau has no position in any stocks mentioned. You can follow him on Twitter @TMFJLo and on Motley Fool CAPS @TMFJLo.The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.