Why the Dow Is Down Today

Although we don't believe in timing the market or panicking over daily movements, we do like to keep an eye on market changes -- just in case they're material to our investing thesis.

A weaker than expected jobs report for September, coupled with the government shutdown, is weighing on the Dow Jones Industrial Average today. As of 1:15 p.m. EDT the Dow was down 66 points to 15,125, while the S&P 500 had dropped four points to 1,691.

There was one U.S. economic release today.

Report | Period | Result | Previous |

|---|---|---|---|

ADP private-sector employment | September | 166,000 | 159,000 |

ADP issued its private-sector employment report, revising its estimate for August downward from 176,000 jobs added to 159,000. For September, ADP reported that the economy added a seasonally adjusted 166,000 jobs, below analyst expectations of 180,000. Private-sector jobs growth has been relatively weak this year and that trend persists.

ADP Change in Nonfarm Payrolls data by YCharts.

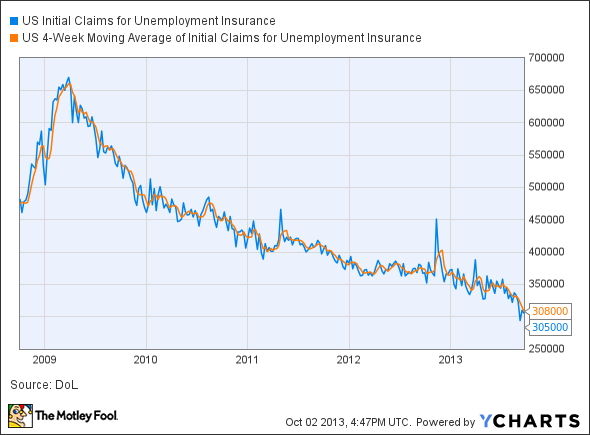

If the government shutdown continues we will not on Friday get the nonfarm payrolls report, which includes both public and private sector jobs as well as the overall unemployment rate. We will, however, still see the weekly unemployment report tomorrow for the week ending Sept. 28. New unemployment claims have been steadily trending lower this year though that will change in two weeks or so if the furlough continues.

US Initial Claims for Unemployment Insurance data by YCharts.

While rules vary state by state, starting next week 800,000 currently furloughed federal employees will be able to collect unemployment, which may spike the level of initial unemployment claims at least temporarily to the levels seen at the depth of the recession. Any spike will likely be temporary, as I doubt the government shutdown will last much longer than a month.

Economists estimate the government shutdown will have a weekly 0.12 percentage point to 0.15 percentage point effect on third-quarter GDP. The big threat to the stock market is still the Oct. 17 deadline for raising the debt ceiling; otherwise, the Treasury Department at that point will not be able to pay all of its bills and the country will risk a technical default on its debt.

Don't freak out

I don't intend to scare people, because we will no doubt get through this at some point. Life will go on, entrepreneurs will still work to create great companies, and the world will become a better place. That said, in both the public sector and the private sector, governance functions best when stakeholders educate themselves, take an active interest in what's going on, and hold their representatives accountable.

Educate Yourself

You can educate yourself by reading The Motley Fool's new free report, "Everything You Need to Know About the National Debt," which walks you through with step-by-step explanations about how the government spends your money, where it gets tax revenue from, the future of spending, and what a $16 trillion debt means for our future. Click here to read the full report!

The article Why the Dow Is Down Today originally appeared on Fool.com.

Dan Dzombak can be found on Twitter @DanDzombak or on his Facebook page, DanDzombak. He has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.