Should You Look Beyond Restoration Hardware?

With high-end consumers becoming wealthier largely thanks to their stock and real estate investments, more discretionary income has been created. That discretionary income is then spent at places like Restoration Hardware , a luxury retailer in the home furnishings marketplace. Restoration Hardware expects the good times to continue, a potential positive for investors. However, there are several reasons why Restoration Hardware might not be the best long-term investment in home furnishings.

Feeling Confident

Restoration Hardware reported strong numbers in the second quarter, with net revenue and comps skyrocketing 30% and 26%, respectively, year over year. These impressive numbers are simply due to increased product demand. Diluted earnings per share came in at ($0.46) versus $0.48 in the year-ago quarter, but the decline was due to one-time items. Looking ahead at the bigger picture, Restoration Hardware upped its FY 2013 adjusted diluted EPS estimate to $1.65-$1.70 from $1.41-$1.47.

Strategic Growth

Restoration Hardware refers to its 70 retail stores as Full Line Design Galleries. These Full Line Design Galleries are placed in high-potential markets, which is a big part of the reason for the company's top-line growth.

Los Angeles and Houston have been top performing areas recently, and Scottsdale, Boston, and Indianapolis are exceeding the company's own expectations. What might make growth investors excited is that Restoration Hardware will soon open three more locations in Greenwich, Atlanta, and Los Angeles. Looking further out, the game plan is to open 10 locations per year beginning in 2015. Importantly, Restoration Hardware's next generation Full Line Design Galleries are expected to be larger while also requiring lower capital investment and offering a higher return on invested capital in each market.

Some investors suffered from acute paranoia when the company announced that it would eliminate its sourcebooks as a form of marketing. However, it's never a good idea to overreact to shocking news. When a company makes such a radical decision, there's often a reason. After two years of monitoring sourcebook performance, Restoration Hardware concluded that removing its sourcebooks will only lead to minimal sales erosion. In simplest terms, Restoration Hardware no longer saw its sourcebooks as worthwhile.

The focus above was on retail, which combined with outlet stores, accounts for 55% of sales. Restoration Hardware also has a strong online presence, with 45% of sales coming from e-commerce.

It's pretty evident that Restoration Hardware is performing well and making moves to improve. At the same time, it might not present the best investment option in home furnishings.

Different Tastes

Pier 1 Imports , with its imported decorative home furnishings found in 985 stores in the United States and 80 stores in Canada, targets more of the middle-income consumer. However, all types of consumers walk through its doors thanks to its moderate prices.

Pier 1 Imports might offer a different type of shopping experience -- not as personal as Restoration Hardware -- but it's still a unique home furnishings retailer, nonetheless. Therefore, it will be interesting to see how Restoration Hardware and Pier 1 Imports compare to Bed Bath & Beyond -- a more traditional home furnishings retailer -- on a fundamental basis:

Forward P/E | Net Margin | ROE | Dividend Yield | Debt-to-Equity Ratio | |

|---|---|---|---|---|---|

Restoration Hardware | 31 | (3.27%) | (10.45%) | N/A | 0.18 |

Pier 1 Imports | 13 | 7.00% | 25.09% | 1.00% | 0.02 |

Bed Bath & Beyond | 14 | 9.17% | 26.64% | N/A | 0.00 |

Restoration Hardware is the weakest in every area. Pier 1 Imports is impressive, but it's not quite as impressive as Bed Bath & Beyond, which turns the most revenue and investor dollars into profit and has a debt-free balance sheet.

All three companies have been strong on the top line:

RH Revenue TTM data by YCharts

The bottom line is a different story. Consider diluted EPS for Restoration Hardware over the past five quarters:

Q2 2012 | Q3 2012 | Q4 2012 | Q1 2013 | Q2 2013 | |

|---|---|---|---|---|---|

Diluted EPS | $0.48 | $0.05 | ($0.75) | $0.00 | ($0.46) |

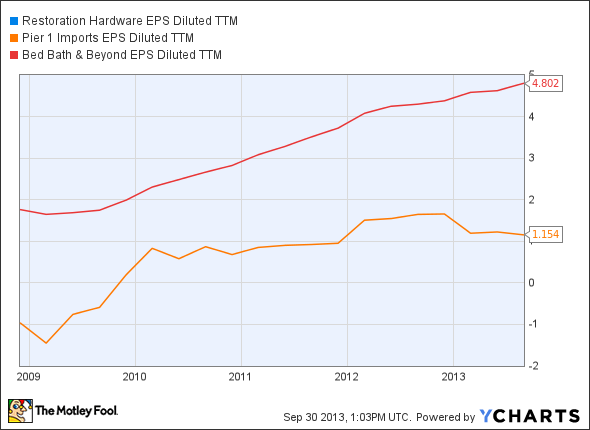

These numbers aren't terrible, but they definitely lack consistency and leave a lot to be desired. Now consider diluted EPS trends for Pier 1 Imports and Bed Bath & Beyond:

RH EPS Diluted TTM data by YCharts

Once again, Pier 1 Imports has performed well, but it's not quite as impressive as Bed Bath & Beyond. Additionally, Bed Bath & Beyond plans on increasing its North America store count from 1,008 to 1,300, which will boost its top-line potential. As far as the bottom line is concerned, Bed Bath & Beyond has delivered profits in every type of economic environment, and it consistently buys back shares. All that said, Bed Bath & Beyond is the best long-term investment option of the three aforementioned home furnishing companies because its broad product diversification at many different price points attracts all types of consumers on a regular basis.

The Bottom Line

Restoration Hardware is performing well, and the company itself expects that strong performance to continue. While this is possible, Foolish investors prefer to stick with fundamentally strong companies that offer consistent top and bottom-line growth over the long haul. Therefore, while not as unique or exciting as Restoration Hardware or Pier 1 Imports, Bed Bath & Beyond is likely to be the best long-term investment option of the three.

Investments That Build Wealth

The best investing approach is to choose great companies and stick with them for the long term. The Motley Fool's free report "3 Stocks That Will Help You Retire Rich" names stocks that could help you build long-term wealth and retire well, along with some winning wealth-building strategies that every investor should be aware of. Click here now to keep reading.

The article Should You Look Beyond Restoration Hardware? originally appeared on Fool.com.

Dan Moskowitz has no position in any stocks mentioned. The Motley Fool recommends Bed Bath & Beyond. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.