10 Straight Years of Revenue Growth for This Company

Let's imagine you are the CEO of a leading consumer staples company. At the end of your company's 2002 fiscal year you meet with investors on the annual conference call and tell your investors that you expect to grow revenue every year for the next decade.

Many would simply not believe you, proclaiming that even the most consistent and prominent companies in the world slip up. Yet, believe it or not, one company in the consumer staples industry has been able to do just this, Church & Dwight (NYSE: CHD). Even two of Church's larger competitors, two of the largest and most-respected companies in the world, have not been able to accomplish this feat, further displaying the significance of Church & Dwight's accomplishment.

25 billion-dollar brands and counting

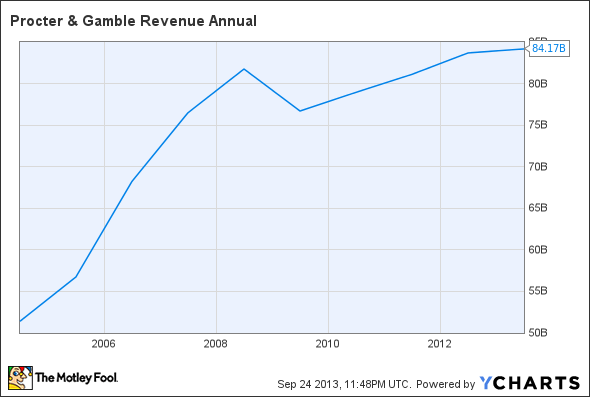

The largest consumer staples company in the world is Procter & Gamble . Since P&G's founding, this $215 billion company has managed to grow its product portfolio to include 25 billion-dollar brands. This broad and diversified portfolio has allowed Procter & Gamble to grow its revenue some 108% over the past 10 years, however it failed to extend the company's streak of revenue growth throughout the financial disaster in 2008. During that period, the top line fell some $4 billion.

PG Revenue Annual data by YCharts.

A focus on dental care and growth

If P&G had not been able to accomplish this feat, then how about Colgate-Palmolive , valued at over $55 billion? Colgate's product portfolio includes a number of brands throughout the oral care, personal care, home care, and pet nutrition segments. This portfolio has, in part, allowed the company to grow its revenue 80% over the past decade, however it also fell short of producing consistent year-over-year annual revenue growth in every single year since 2002. Like P&G, revenue for Colgate fell marginally from 2008 to 2009.

CL Revenue Annual data by YCharts.

The image of consistency

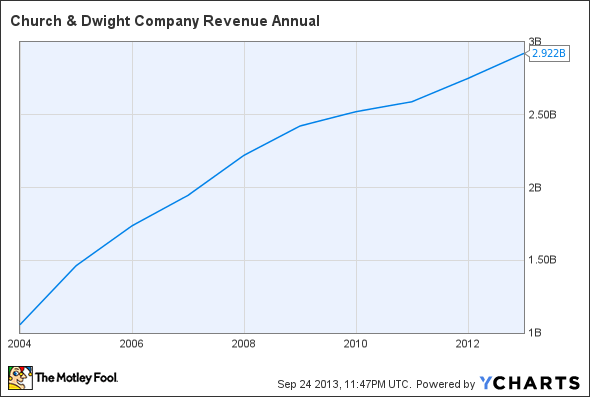

This relatively unknown consumer staple company does not even top the $10 billion mark in terms of market value, yet it has displayed a caliber of consistency unmatched by its larger competitors. Church & Dwight, which is primarily known for its cornerstone brand Arm & Hammer, possesses a product portfolio which also includes First Response, Nair, Orajel, OxiClean, Spinbrush, Trojan, and XTRA. While not nearly as large or distinguished as the portfolios of its competitors, Church & Dwight's portfolio has proven strong, resilient, and nimble in the past. It has allowed the company to grow its revenue an astounding 180% since 2002, and, more important, has it to increase its revenue annually every year for the past decade, even through the rough patch in 2008.

CHD Revenue Annual data by YCharts.

Where we are headed from here

Any company that has grown its annual revenue consistently over the past decade deserves some serious recognition. Church & Dwight has not only done this, it has grown at a faster pace than its rivals. This displays a company trumping its peers in both growth and consistency, the best of both worlds.

Will this trend continue? Industry analysts sure think so, with projections placing 2017 revenue at nearly $4 billion, with unhindered annual year-over-year growth expected. How is Church & Dwight going to accomplish this? Most likely the same way the company accomplished its magnificent feat over the past decade, by relying on the power of its brands and offering innovative products.

Thus, if this trend of stable and substantial top-line growth is sustained, Church & Dwight appears extremely attractive as an overall investment. With a price-to-earnings ratio of 23, Church & Dwight trades at a discount to Colgate's ratio of 25, and a slight premium to P&G's ratio of 20. While the company's dividend yield of 1.8% is subpar compared to the yields of P&G and Colgate, this yield more than offsets the rate of inflation.

The Foolish bottom line

The caliber of consistency P&G and Colgate have displayed over the past decade in revenue growth is admirable, however this pales in comparison to the levels of both growth and consistency presented by Church & Dwight since 2002 in this metric. The key thing is that Church & Dwight is perfectly positioned to sustain this trend well into the future as a result of its strong and nimble product portfolio.

As an overall investment, Church & Dwight passes with flying colors. While P&G and Colgate may be more attractive to yield investors, Church & Dwight, in my view, is a perfect combination of growth, stability, and consistency.

More consistently great companies

The best investing approach is to choose great companies and stick with them for the long term. The Motley Fool's free report "3 Stocks That Will Help You Retire Rich" names stocks that could help you build long-term wealth and retire well, along with some winning wealth-building strategies that every investor should be aware of. Click here now to keep reading.

The article 10 Straight Years of Revenue Growth for This Company originally appeared on Fool.com.

Fool contributor Ryan Guenette has no position in any stocks mentioned. The Motley Fool recommends Procter & Gamble. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.