Hi-Crush: The Frac Sand MLP

Hi-Crush Partners is a domestic producer of specialized sand used as a proppant to enhance the recovery rates from unconventional oil and gas wells. Growing shale activity along with increasing complexity of rigs and wells is increasing the demand for what Hi-Crush provides. Hi-Crush is a small-cap partnership with a market cap of about $770 million. It's also very young, founded in 2011.

Hi-Crush is actually a master limited partnership, or MLP, not a corporation. So it does not pay a corporate tax. Like other MLPs, Hi-Crush pays a high distribution yield to its unitholders. It currently yields 7.1%.

Growth story

Everyone in shale drilling will need this company's sand to fracture the rock. In fact, frac sand activity is multiplied by increases in shale-drilling activity. For example, as laterals get longer, the amount of proppant needed for each additional well progressively increases. With more fracking "stages," there is also a proportional need for more proppant. So, proppant per stage increases when a stage is added. Another trend in unconventional drilling is toward more wells per rig, which in turn increases the need for proppant per rig. As we can see, Hi-Crush is in a very high service intensity niche.

Investor Presentation, September 2013

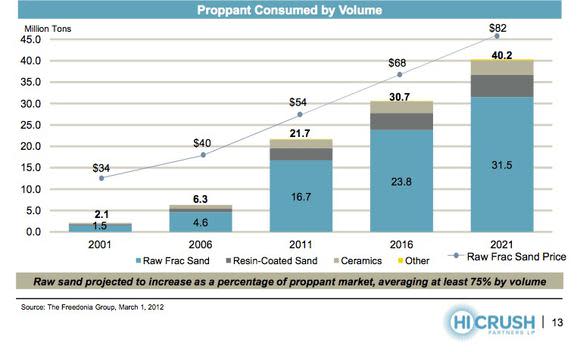

According to Hi-Crush, the need for raw frac sand will nearly double between 2011 and 2021, hinting that the partnership's own growth should follow a similar trajectory. Personally, I think the numbers above are conservative. This estimate probably assumes drilling activity in the US will remain flat. But with the distinct possibility of additional shale plays coming online in the future, the need for proppant could very well be higher than estimated.

A bet on the Northeast

Hi-Crush has recently completed its acquisition of D&I Silica for $125 million and management has indicated it would like to acquire other companies when possible.

D&I Silica has a different skill set than that of Hi-Crush. The former does not process sand. D&I just handles logistics and delivery of sand to customers concentrated in the Utica and Marcellus shales. The Marcellus is the biggest shale gas play in the US, and the liquids-rich Utica is just getting started. Hi-Crush is buying the leading frac sand distribution network for both places.

Vertical integration

Based on internal feedback, servicers and producers increasingly want "one stop shopping" and a simpler supply chain to meet frac sand needs. Hi-Crush now has the ability to produce and deliver, perhaps better than anyone else, in the Northeast.

By taking a whole book of distribution customers, Hi-Crush will stand a good chance to fill its new Augusta, Wisconsin processing capacity with nearby Northeast customers. That makes a lot of economic sense. Such is the strategic rationale, here.

This nascent industry has many players. Just a cursory search on my part pulled up no less than 37 different miners. But frac sand mining is inherently an "economies of scale" business. Significant administrative and overhead efficiency gains as well as expanded capabilities through vertical integration will provide a catalyst for further acquisition activity. All signs point to an industry with fewer, bigger players. Even though it is only a small-cap company with a market cap of some $700 million, Hi-Crush is actually one of the biggest players. If it can continue actively acquiring, and doing so in a disciplined manner, Hi-Crush stands a good chance to be one of the few bigger players left when the smoke clears.

Valuation

Units of Hi-Crush have nearly doubled since the beginning of the year. Yes, that is a big jump. But one has to consider the market cap and valuation here. At only $770 million, Hi-Crush could be a much bigger company. It's not unreasonable to expect sustained, double-digit earnings growth here. Even with the overhang of secondary offerings, Hi-Crush could be a lot higher.

Keep an open mind

This industry is a "fractured" space with many small, private players who have limited capabilities. These names will all be acquisition targets in the future. When the smoke clears I believe there will be three big players in the frac sand space: US Silica (NYSE: SLCA), Hi-Crush, and Carbo Ceramics to round out the three. All of them will have integrated capabilities, and they should all be multi-billion dollar companies.

One way or another Hi-Crush will get there from its market cap of $770 million right now. It will have to acquire, vertically integrate and build more processing capacity, while avoiding being acquired itself. I believe it will do just that.

How to prepare for higher oil prices

Think the days of $100 oil are gone? Think again. In fact, the market is heading in that direction now. But for investors that are positioned to profit from the return of $100 oil, it can't come soon enough. To help investors get rich off of rising oil prices, our top analysts prepared a free report that reveals three stocks that are bound to soar as oil prices climb higher. To discover the identities of these stocks instantly, access your free report by clicking here now.

The article Hi-Crush: The Frac Sand MLP originally appeared on Fool.com.

Casey Hoerth has no position in any stocks mentioned. The Motley Fool owns shares of HI-CRUSH PARTNERS LP UNIT LTD PARTNER INTS. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.