Is Buffalo Wild Wings Destined for Greatness?

Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Buffalo Wild Wings -- or B-Wild -- fit the bill? Let's look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell B-Wild's story, and we'll be grading the quality of that story in several ways:

Growth: Are profits, margins, and free cash flow all increasing?

Valuation: Is share price growing in line with earnings per share?

Opportunities: Is return on equity increasing while debt to equity declines?

Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's look at B-Wild's key statistics:

BWLD Total Return Price data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | 101.5% | Pass |

Improving profit margin | (14.4%) | Fail |

Free cash flow growth > Net income growth | (69.9%) vs. 72.4% | Fail |

Improving EPS | 67.9% | Pass |

Stock growth (+ 15%) < EPS growth | 196.2% vs. 67.9% | Fail |

Source: YCharts.

*Period begins at end of Q2 2010.

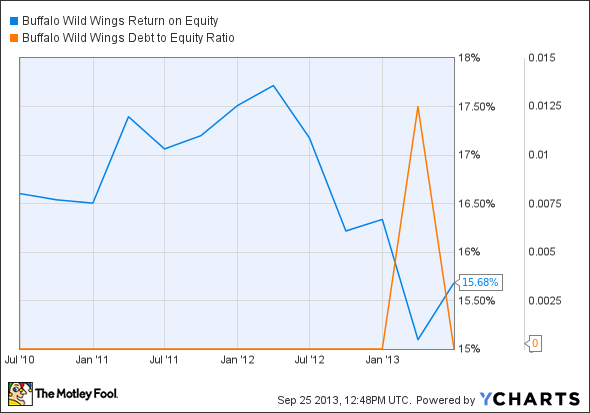

BWLD Return on Equity data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving return on equity | (5.5%) | Fail |

Declining debt to equity | No debt | Pass |

Source: YCharts.

*Period begins at end of Q2 2010.

How we got here and where we're going

B-Wild has a number of hallmarks of a fast-growing consumer business -- its revenue has soared, but profitability and free cash flow have both been hindered by the need for greater infrastructure. That's resulted in a mediocre score of only three out of seven passing grades. However, there is ample opportunity for B-Wild to improve over the coming year. The company could tighten its supply chain or otherwise streamline its operations for higher margins, and the fall in free cash flow could easily be reversed once frenetic build-outs calm down somewhat. The only real cause for concern is the divergence between share price and EPS growth, which indicates some tough times ahead for shareholders if the company suffers a period of underwhelming progress. So what might lie ahead for B-Wild? Let's take a closer look.

Over the past few years, the restaurant industry has faced enormous challenges, which include the need to cope with food-price inflation, coping with changing consumer tastes, and the balancing act between maintaining profitability and encouraging greater customer interest. The company's profitability has been hindered by high chicken wing prices, but Fool contributor Steve Symington notes that B-Wild has been trying hard to cut its operational costs through supply chain streamlining, efficiency improvements, and select price increases.

Fool contributor Ayush Singh notes that B-Wild has been aggressively expanding its U.S. footprint as consumers are gradually willing to spend more on dining out. The company has already opened 41 new locations, both franchised and company-owned, and management expects to launch 62 more restaurants by the end of this year. B-Wild has also partnered with Philippines-based restaurant franchiseeBistro Group to open restaurants in Makati City and the Manila area. However, B-Wild might face stiff competition from fast-food behemoth McDonald's and Philippine-based Jollibee, which operate 380 and 2,000 restaurants in the Philippines, respectively.

McDonald's has already launched its own Mighty Wings domestically, which points toward some modest threat to B-Wild's chicken wings business. However, it's unlikely that these two businesses will clash to any great degree, as sports fans aren't very likely to visit McDonald's for their football fix, and fast-food diners aren't likely to suddenly decide to sit down at a restaurant instead. B-Wild is also moving a bit upscale with its own specialty beer called Game Changer Ale, which is being brewed by Craft Brew Alliance's Red Hook and is served at more than 925 restaurants in Canada and the U.S. That further helps the company separate itself from other wing purveyors.

Putting the pieces together

Today, Buffalo Wild Wings has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

Looking for more great growth stocks?

Motley Fool co-founder David Gardner, founder of the world's No. 1 growth-stock newsletter, has developed a unique strategy for uncovering truly wealth-changing stock picks. And he wants to share it, along with a few of his favorite growth stock superstars, with you! It's a special 100% free report called "6 Picks for Ultimate Growth." So stop settling for index-hugging gains, and click here for instant access to a whole new game plan of stock picks to help power your portfolio.

The article Is Buffalo Wild Wings Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes has no position in any stocks mentioned. The Motley Fool recommends and owns shares of Buffalo Wild Wings and McDonald's. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.