Why American Workers Earn Less Now Than Ever

Reports of your current income's historical weakness abound:

Real median wages fell nearly 3% since 2009.

The typical household makes less today (about $51,000) in real income than it did in 1989 (about $51,700).

As of last year, Americans have rebuilt less than half of the wealth lost during the last recession.

Labor's share of GDP has fallen from more than 66% in 2001 to a little more than 62% in 2011.

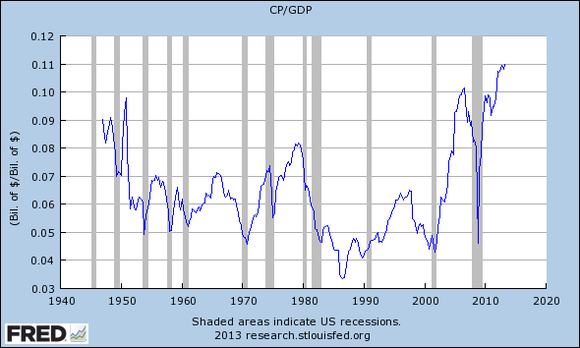

Meanwhile, corporate profits as a percent of GDP are at historic highs, near 11%.

What has caused this shift toward richer companies and poorer workers? Many say it's a decline in labor unions. But the latest study proves that weaker labor unions have little to do with it. The real culprit? A common political hot topic: offshoring.

Labor daze

The easiest way to conceive labor's weakened position compared to corporations is with two charts. The first shows labor's share of GDP:

The second, corporations' share:

But corporations aren't taking all those labor losses

While this may suggest that corporations and labor are the only opposing forces, corporations haven't actually booked all of the gains. Why? Because they're spending more on structures and equipment -- typically as they build up operations in other countries where labor is cheaper.

This behavior keeps U.S. income lower than it has been historically. It also means households have less to spend domestically. But while U.S. consumers have less to spend, more offshore workers means more international sales, and companies can capture this international revenue to offset a stagnant domestic demand.

And it's not all bad

While this corporate behavior eats at our own income, economist Tyler Cowen notes: "This trade is still output-expanding and welfare-improving by traditional criteria, at the global scale. It simply has within-nation distribution effects, which not everyone likes, though global inequality falls." This means that while American workers may be less well-off, workers in other countries are better off. And while this may increase inequality within our own country, it levels income differences globally.

There are also signs that this trend may be leveling off, especially as the cost of doing business abroad comes in line with the cost of staying home. For example, Ford returned production of some trucks to Ohio and Michigan from Mexico, keeping 3,200 jobs in the U.S. One factor leading to this decision was that Ford can hire new workers for $14 an hour with its latest labor agreement, made in 2011, and the company promised to add 12,000 hourly jobs through 2015.

Another example is General Electric's move of production from China and Mexico to its "Appliance Park" in Kentucky. The reason behind this, The Economist cites, is to keep its manufacturing, design, and development operations closer together and to be more responsive to customers. GE stated in 2010 that it would invest $1 billion in its U.S. appliance business, and it added 2,500 U.S. jobs in 2012.

Hedging your income

The balancing of global incomes means there is downward pressure on the relatively high U.S. wages. But you can protect yourself in one simple way: Offset your falling income by investing in companies that are reaping the rewards of globalization and offshoring. If you can't fight a flatter world, join it.

Companies Winning at Globalization

You don't have to invest internationally to win from international markets. There are plenty of American companies profiting from our increasingly global economy. The Motley Fool's free report "3 American Companies Set to Dominate the World" shows you some of the best picks. Click here to get your free copy.

The article Why American Workers Earn Less Now Than Ever originally appeared on Fool.com.

Fool contributor Dan Newman has no position in any stocks mentioned. The Motley Fool recommends Ford. The Motley Fool owns shares of Ford and General Electric Company. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.