How Dividends Change the Game for Nike Shareholders

The wealth-building power of compound interest will never cease to amaze me. It's a story of patience and attention to detail, where small, short-term differences add up to massive divergence over decades. And in the end, the biggest winners don't always deliver the fattest share-price returns.

Nike may be a fresh face among the 30 Dow Jones tickers, but it's an old hand at the dividend game. Its fundamental credentials are impeccable: The sportswear giant has paid uninterrupted quarterly dividends since 1984, and has raised payouts in each of the last 10 years. Only five current Dow stocks have boosted their dividend policies faster than Nike over the last decade.

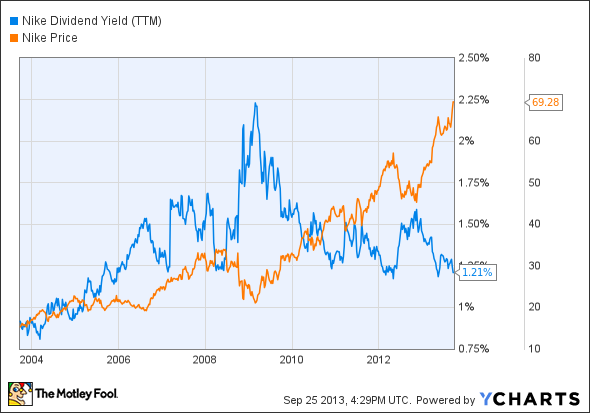

On the other hand, Nike offers one of the reformed Dow's lowest dividend yields today. The 1.2% yield beats the best savings and money market bank accounts on the market, but it's a far cry from the Dow's 2.6% average yield.

Weighing Nike's income-generating pros and cons is not a slam-dunk exercise. Does the low initial yield hold Nike's returns back in the long term or does its generous payout growth make up for the low starting point?

Here's how that story has played out over the last 10 years:

Reinvested Nike dividends would have boosted your returns from 355% to 428%, which is a 16% difference. At the same time, dividend reinvestments in the SPDR Dow Jones Industrial Average exchange-traded fund would have lifted your Dow returns by just 7.4%.

I think it's fair to say that Nike's dividend growth outweighs the soft starting yield. I'm actually impressed that Nike has manged to keep its yields above 1% while more than quadrupling share prices in the last decade. That's no easy feat, and it speaks highly of Nike's commitment to healthy dividend policies.

NKE Dividend Yield (TTM) data by YCharts.

Small World, Big Profits

Profiting from our increasingly global economy can be as easy as investing in your own backyard. The Motley Fool's free report "3 American Companies Set to Dominate the World" shows you how. The report will leave Nike owners smiling over their investment. Click here to get your free copy before it's gone.

The article How Dividends Change the Game for Nike Shareholders originally appeared on Fool.com.

Fool contributor Anders Bylund holds no position in any company mentioned. Check out Anders' bio and holdings or follow him on Twitter and Google+.Motley Fool newsletter services have recommended buying shares of Nike. Motley Fool newsletter services have recommended creating a diagonal call position in Nike. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.