Will Elon Musk Finish What He Started at Tesla and SolarCity?

Elon Musk has made billions of dollars creating businesses that upended industries. His first major success was selling Zip2, a Web software company, for $307 million to Compaq, resulting in a $22 million payday for Musk. PayPal put him on the map when he sold the payment processor to eBay for $1.5 billion, minting more than $150 million for Musk.

What Musk hasn't done is take a business to its final end game, or even consistent profitability. PayPal was barely profitable on an adjusted basis before it was bought out for about 7 times revenue, meaning eBay had a lot of work to do to make PayPal a worthwhile investment. For the Musk legend to grow, he's going to have to bring his two public companies -- Tesla Motors and SolarCity -- to profitability and somehow live up to lofty expectations.

The bar is set high

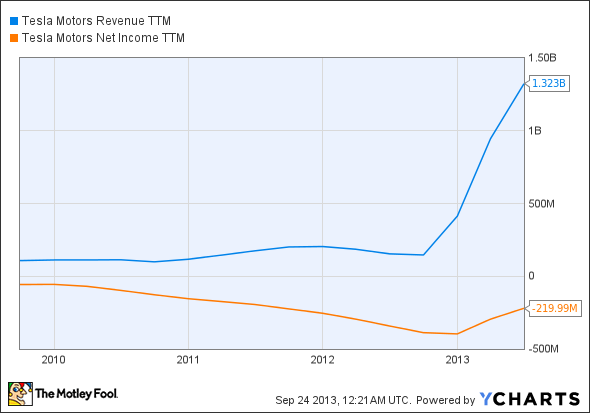

For Tesla, the bar is already incredibly high. The company has seen revenue explode in the past year with the launch of the Model S, but with a $22 billion market cap, trading at 17 times revenue, the company needs to come up with hit after hit.

TSLA Revenue TTM data by YCharts

Financially, Tesla also has yet to make more than a token profit in the first quarter, something that evaporated in the second quarter and probably won't be back until after Model X launches in late 2014. The lack of a profit doesn't mean that Tesla is doing poorly financially. The company is just spending money developing next-generation vehicles and investing in capital expenditures. The investment in the future is where Musk will really begin proving himself.

For Tesla to be a success story, the company needs to go from making 21,000 Model Ses in 2013 to making around 500,000 vehicles sometime in the future. Any less, and the company wouldn't be anything more than a bit player in the auto industry compared with giant rivals.

Let's say Tesla launches a third-generation platform in 2016 or 2017 as it predicts and makes three models that can sell 50,000 units each by then. That would put the company at an optimistic annual production of 150,000 units, about one-tenth of the number of BMWs made last year by BMW Group, a company that has a market cap just three times the size of Tesla's. That's an incredibly high bar for a start-up.

The bottom line for Musk and Tesla is that there's a lot of work to be done. The company has one hit car and has laid the foundation for more, but success won't be defined by one or two great vehicles, it will be defined by creating great vehicles for decades to come. I, for one, hope Musk is up to the task.

Solar is here to stay

The other company that's resulted in a fortune for Musk is SolarCity, the residential and commercial solar installer. Musk is the chairman of SolarCity and no doubt guides strategic direction, but unlike Tesla, he's not involved in day-to-day operations.

What SolarCity has been able to do is take residential solar from a pipe dream to a reality by lowering costs, expanding nationally, and offering leases that are attractive to both homeowners and investors. This may be just as transformative long-term as making electric vehicles competitive, and there's an equally large opportunity.

SolarCity has set its sights on solar domination with 1 million solar rooftops within five years. The goal is certainly achievable given the industry's growth, but Musk and SolarCity have a lot of work to do getting there.

Can Musk stay focused?

Elon Musk is a serial entrepreneur, who has never built and run a company for a long period of time. Will he be able to stay focused and engaged long enough to make Tesla or SolarCity successes long-term?

That may be the most important question for investors right now. He's already CEO of Tesla, chairman of SolarCity, and also CEO of SpaceX, and he recently added the Hyperloop as a pet project. Can he really juggle all of these major projects?

TSLA Market Cap data by YCharts

Anyone buying either Tesla or SolarCity today is clearly paying a premium to own a company controlled by Musk. In my opinion, he still has a lot to prove in building a company to last, much less three.

The next great growth stocks

If you're addicted to growth stocks then Motley Fool co-founder David Gardner, founder of the world's No. 1 growth-stock newsletter, has developed a unique strategy for uncovering truly wealth-changing stock picks. And he wants to share it, along with a few of his favorite growth stock superstars, with you! It's a special 100% free report called "6 Picks for Ultimate Growth." So stop settling for index-hugging gains, and click here for instant access to a whole new game plan of stock picks to help power your portfolio.

The article Will Elon Musk Finish What He Started at Tesla and SolarCity? originally appeared on Fool.com.

Fool contributor Travis Hoium has no position in any stocks mentioned. The Motley Fool recommends Tesla Motors and owns shares of SolarCity and Tesla Motors. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.