Dow Unchanged as High Mortgage Rates Slow Housing Growth

Although we don't believe in timing the market or panicking over daily movements, we do like to keep an eye on market changes -- just in case they're material to our investing thesis.

High mortgage rates slowed but did stop home price growth in July. The news was not enough of a surprise to have a noticeable effect on the Dow Jones Industrial Average . As of 1:15 p.m. EDT the Dow was up 17 points to 15,419. The S&P 500 was up 3 points to 1,513.

There were three U.S. economic releases today.

Report | Period | Result | Previous |

|---|---|---|---|

Case-Shiller 20-City Home Price Index | July | 1.8% | 2.2% |

FHFA House Price Index | July | 1% | 0.7% |

Consumer Confidence Index | September | 79.7 | 81.8 |

Today's housing-price data shows the effect of the jump in mortgage rates that started in May.

US 30 Year Mortgage Rate data by YCharts.

While neither home price index showed a decline, both indexes showed slower month-over-month growth. The Case-Shiller 20-City Home Price Index rose 1.8% in July, up 12.4% year over year.

Case-Shiller Home Price Index: Composite 20 data by YCharts.

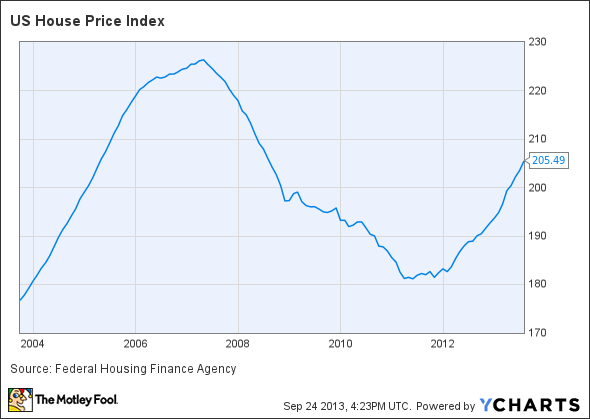

The FHFA House Price Index rose a seasonally adjusted 1% in July, up 8.8% year over year. The index is now 9.6% below the peak it hit in April 2007 and is currently at the same level as in March 2005. Prices were up across the country except in the South Central regions.

US House Price Index data by YCharts.

In other news, the Conference Board's Consumer Confidence Index declined in September to 79.7, in line with analyst expectations of 79.5. The Conference Board's director of economic indicators, Lynn Franco, said:

Consumer Confidence decreased in September as concerns about the short-term outlook for both jobs and earnings resurfaced, while expectations for future business conditions were little changed. Consumers' assessment of current business and labor market conditions, however, was more positive. While overall economic conditions appear to have moderately improved, consumers are uncertain that the momentum can be sustained in the months ahead.

Today's data confirms what we have already known. While mortgage rates are higher, they are still near multiyear lows, the housing market continues its slow recovery, and consumers are uneasy about the economy as a whole. None of this information should change your investment process. Stick to your investment plan, keep learning, and remain focused.

Want to Retire Wealthy?

Over the long term, the compounding effect of dividend stocks, as well as their growth, adds up faster than most investors imagine. With this in mind, our analysts sat down to identify the absolute best of the best when it comes to rock-solid dividend stocks, drawing up a list of nine that fit the bill. To discover the identities of these companies before the rest of the market catches on, you can download this valuable free report by simply clicking here now.

The article Dow Unchanged as High Mortgage Rates Slow Housing Growth originally appeared on Fool.com.

Dan Dzombak can be found on Twitter @DanDzombak or on his Facebook page, DanDzombak. He has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.