Ampco-Pittsburgh: A Family Business

Over the past few years, the steel industry has suffered as a lack of demand and increased supply has put pressure on prices. Ampco-Pittsburgh is well positioned to ride out the current storm, and to thrive when the next industry upturn eventually occurs. With the steelmaker's founding family divesting a big chunk of the company's stock, Ampco-Pittsburgh might even be a takeover target.

Company history

Ampco-Pittsburgh is a leading manufacturer of specialty steel products. The company is broken down into two different segments: Forged & Cast Rolls and Air & Liquid Processing.

Louis Berkman began peddling scrap from his father's horse drawn wagon in the mid 1920's. By the 1950's Berkman had become successful enough on his own to acquire other companies. Ampco-Pittsburgh, as we know it today, was the result of a 1970 merger of two Berkman companies: Screw & Bolt Corp of America and Ampco Metal Co. In 1979, Louis Berkman installed his son, Marshall Berkman, as the head of Ampco- Pittsburgh. Louis Berkman's son in law, Robert Paul, was also given a senior role within the company. In 1994, then CEO Marshall Berkman was killed in a plane crash in Pittsburgh. Robert Paul was then appointed CEO and Louis Berkman.

Profit pressure

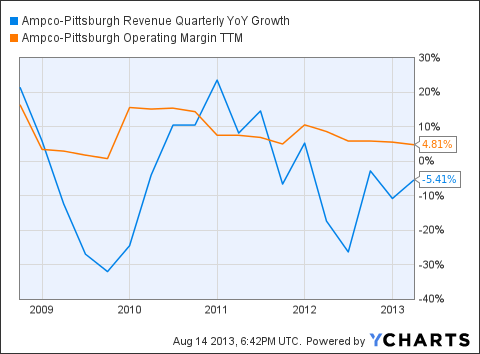

Over the past five years, as shown by the charts below, profits have come under pressure as revenues have fallen and margins have decreased. This is mainly the result of sluggish growth in China. As recently as 2010, profit margins for Ampco-Pittsburgh were close to 20%. However, due to pricing pressure, margins are now under 5%.

AP Revenue Quarterly YoY Growth data by YCharts

AP Net Income TTM data by YCharts

Ampco-Pittsburgh's results simply reflect how difficult the operating environment has been for the steel industry as a whole. It is difficult to argue that a major turn is just around the corner given market weakness. That said, for long-term investors, it is better to buy during bust periods than boom periods.

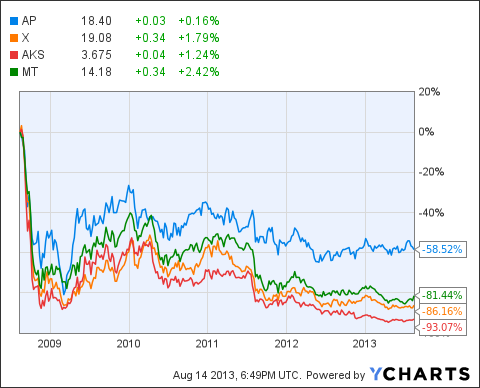

The current environment also makes consolidation more likely. As shown by the chart below, Ampco-Pittsburgh has outperformed other well-known, larger steel companies over the past five years.

It should be noted that Ampco-Pittsburgh's core business is actually slightly different than its larger rivals', since Ampco-Pittsburgh is focused on the fabrication side only. Because its products are custom-made, they're a lot less commoditized.

The company reported second quarter net income of $1.1 million or $0.11 per share. While this represents a drop from last year, any profitability should be viewed as a positive amid the industry's headwinds.

Ampco-Pittsburgh's stealthily strong balance sheet could help it survive the current industry downturn. The company has more than $82 million, or just under $8 per share, in cash. In addition to having a large cash position, Ampco-Pittsburgh has just $13 million in debt. Its conservative management is characteristic of a typical family business.

Is the family losing control?

CEO Robert Paul inherited the position after his brother in-law, Marshall Berkman, was killed in a tragic accident. Marshall Berkman was appointed CEO by his father, Louis Berkman. Currently, Robert Paul's sons Laurence Paul and Stephen Paul serve as directors of Ampco-Pittsburgh, in keeping with the family tradition. In early 2013, the patriarch of the family, Louis Berkman passed away at the age of 104. On August 1, 2013, it was announced that the Louis Berkman Trust would sell up to 215,000 shares of Ampco-Pittsburgh. If the Louis Berkman Trust continues selling stock, the family may lose its grip on the company. Currently, insiders at Ampco- Pittsburgh, three of which are members of the Paul family, own about 15% of the company.

Potential buyers

If anyone did want to buy Ampco- Pittsburgh, it might likely be steel giant Nucor . First, Nucor, like all other large steel companies, has a storied history of making acquisitions. Second, Nucor is in the best financial position of any large steel company. Simply put, rivals such as United States Steel Corp are not in a financial position to make a play for a company such as Ampco-Pittsburgh.

In addition to believing Nucor is a more likely acquirer than U.S. Steel, I also believe Nucor is a better investment than U.S. Steel. The primary reason for this is Nucor's strong balance sheet: Nucor has $3.4 billion in debt and a market cap of $15.8 billion. Comparably, U.S. Steel has $3.9 billion in debt and a market cap of just $2.95 billion. I am more confident that Nucor will be able to make it through the current downturn than U.S. Steel.

Implications

If the Paul family continues to divest its interest in Ampco-Pittsburgh, the company may become less like a family business where leadership passes along the bloodline and more like a traditional public company. Of particular note is the fact that Ampco-Pittsburgh will become an easier potential takeover target. Given Ampco Pittsburgh's small size, strong balance sheet, and profitable business, Nucor may be a potential buyer. If the Paul family maintains control over Ampco-Pittsburgh, shareholders will benefit over the long-term from the company's conservative, family business style of management.

More compelling ideas from Motley Fool

There's good reason to believe that the most successful investors over the next few decades will be those with exposure to China's massive and growing population of domestic consumers. And there are few things that these consumers are likely to purchase with more enthusiasm than cars and trucks. In this brand-new free report, our analysts get out in front of this trend by identifying two automakers that are poised to surge along with China's middle class. If you want to be among the smart investors who get rich from this growing trend, then you'd be well advised to instantly download our free report on the topic by clicking here now.

The article Ampco-Pittsburgh: A Family Business originally appeared on Fool.com.

Sammy Pollack has no position in any stocks mentioned. The Motley Fool recommends Nucor. The Motley Fool owns shares of Ampco-Pittsburgh. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.