A Closer Look at 4 Pharmaceutical Giants

The health care sector can be a scary place. Pre-revenue biotechs rally and crash on approvals and rejections, and are sometimes impossible to measure on a fundamental basis. For investors who can't stomach that kind of volatility, four large pharmaceutical companies -- Johnson & Johnson , Pfizer , Merck , and GlaxoSmithKline -- could be worth a look.

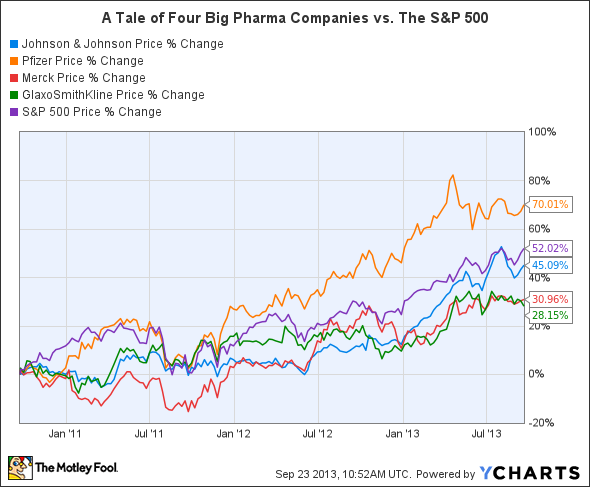

Source: YCharts.

The Foolish fundamentals

J&J and Pfizer have notably outperformed the S&P 500 over the past 12 months, while Merck and GlaxoSmithKline have lagged the market. Why have these two larger companies fared better than the two smaller ones? First, let's compare their basic fundamentals.

Company | Forward P/E | 5-Year PEG | Price to Sales | Debt to Equity | Profit Margin | Fwd. Dividend Yield |

J&J | 15.41 | 2.64 | 3.63 | 21.51 | 21.51% | 2.90% |

Pfizer | 12.60 | 4.62 | 3.38 | 46.78 | 46.62% | 3.30% |

Merck | 13.05 | 5.08 | 3.14 | 56.16 | 11.44% | 3.60% |

GlaxoSmithKline | 12.92 | 3.50 | 2.87 | 256.27 | 15.24% | 4.40% |

Advantage | Pfizer | J&J | GSK | J&J | Pfizer | GSK |

Source: Yahoo! Finance, as of Sept. 23.

Based on analyst projections reflected in its PEG ratio, J&J has the highest potential for growth. However, since J&J is heavily diversified across consumer health care, pharmaceuticals, and medical devices, its margins are not as robust as those of Pfizer, which is primarily focused on pharmaceuticals. Pfizer is also considered the cheapest stock based on its forward P/E valuation.

GlaxoSmithKline has the highest forward dividend yield and the most undervalued price-to-sales ratio, but it also has the highest levels of debt. Merck, on the other hand, doesn't stand out in any particular category, but its five-year PEG ratio of 5.08 indicates sluggish growth compared to its peers.

Moreover, the top and bottom line growth of these four companies, (last quarter), reveals why J&J and Pfizer have been outperforming Merck and GlaxoSmithKline.

J&J | Pfizer | Merck | GlaxoSmithKline | |

Earnings Growth (YOY) | 172.20% | 333.30% | (49.50%) | (15.60%) |

Revenue Growth (YOY) | 8.50% | (7.10%) | (10.60%) | 2.40% |

Source: Yahoo! Finance, as of Sept. 23.

However, these numbers tell half the story.

Patent cliffs and PR trouble

To understand how these four companies work, investors must understand how these companies generated sales in the past and how they plan to do so in the future. Patent expirations are the main problem for large pharmaceutical companies. All four of these companies face major patent expirations, which could affect future sales.

Pfizer's loss of patent exclusivity for its cholesterol drug Lipitor, the best-selling drug in pharmaceutical history, is a textbook example. Lipitor once had peak sales of $13 billion, but its patent expirations in 2011-2012 caused sales to fall to $3.95 billion in fiscal 2012 -- a 59% year-over-year plunge from 2011.

For Johnson & Johnson and Merck, the upcoming patent expiration of Remicade -- one of the top-selling arthritis and Crohn's disease drugs in the world --is a major issue. Last year, Remicade generated $6.14 billion and $2.08 billion in sales for J&J and Merck, respectively; they split the sales globally.

Remicade's European patent was set to expire in 2014, but it was granted a six-month extension to February 2015, temporarily holding off South Korean drugmaker Celltrion, whose biosimilar version of Remicade is awaiting approval in Europe.

Merck faces similar problems of its own. The pharma has been struggling ever since its best-selling asthma treatment, Singulair, went off patent last year. Sales of Singulair plunged 80% year over year to $281 million last quarter. Merck has been trying to offset that loss with its diabetes treatments Januvia and Janumet, but has been dogged by claims that the two drugs could cause pancreatic cancer.

GlaxoSmithKline's chronic obstructive pulmonary disease, or COPD, treatment, Advair, generated $8.1 billion in sales last year, accounting for nearly a fifth of its top line. Advair comes in two parts -- a patented Diskus inhaler and the medication inside. Although the patent for the medication expired in 2010 in the U.S., generic companies have failed to create a generic version due to the complexity of the Diskus dispenser, which is patent protected until 2016. Even so, the company has prepared for the eventual loss of Advair by partnering with Theravance to create two new treatments for COPD -- Breo Ellipta and Anoro Ellipta.

In addition to those patent expirations, investors should also pay attention to major news items regarding these companies. J&J is still having trouble breaking its three-year long streak of recalls in the consumer health segment, which accounted for 20% of its sales last quarter. Merck still hasn't shaken off eight years of litigation costs from its discontinued anti-inflammatory drug Vioxx, which was found to cause serious heart disease and death. GlaxoSmithKline and Pfizer have both faced serious bribery charges abroad. All of these news stories have varying effects on the companies' bottom lines and should be closely followed.

The Foolish takeaway

In closing, big pharma might appear to be safer investments than smaller biotech companies, but they also face major challenges. Just as smaller companies are hungry for approval and collaborations, large companies need to sustain their growth by introducing new products to the market in a timely manner, to replace fading ones. They must also maintain that growth at a disciplined pace and avoid quality control and legal problems.

Of course, this only briefly touches on the future of these four companies. Investors who are interested in investing in them should do their own due diligence and dig deeper to see if they are truly worthy investments.

More compelling dividend stocks

One of the best parts of owning big pharma stocks is their attractive dividends, but smart investors know the importance of diversifying -- seeking high-yielding stocks from multiple industries. The Motley Fool's special free report "Secure Your Future With 9 Rock-Solid Dividend Stocks" outlines the Fool's favorite dependable dividend-paying stocks across all sectors. Grab your free copy by clicking here.

The article A Closer Look at 4 Pharmaceutical Giants originally appeared on Fool.com.

Leo Sun has no position in any stocks mentioned. The Motley Fool recommends Johnson & Johnson. The Motley Fool owns shares of Johnson & Johnson. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.