Why Can't This Company Get Its Act Together?

After four years of recalls, Johnson & Johnson still can't get its act together. The company's list of high profile recalls is long -- Tylenol, K-Y Jelly, contact lenses, artificial hips, blood-glucose meters, and vaginal mesh implants among many others -- and the list still keeps getting longer.

Earlier this month, 200,000 bottles of liquid Motrin for infants were recalled after tiny pieces of plastic were found in the medicine. A week later, its antipsychotic medication Risperdal Consta -- which generated $1.4 billion in sales last year -- was also recalled due to mold.

What does J&J need to do to patch up its battered ship before it sinks into a sea of bad PR?

The root of the problem

J&J has promised to repair production problems at three of its plants taken over by the FDA in 2011, but the problems keep cropping up.

With $67.2 billion in revenue last year, J&J has apparently grown so large that it cannot properly oversee the outsourcing of its products to third-party manufacturers. For example, the plastic in Motrin was traced to an unnamed third-party supplier of ibuprofen, the drug's active ingredient.

Therefore, it's becoming increasingly confusing just where J&J is acquiring the active ingredients in its drugs -- a dangerous practice considering the company's need for higher margins and better bottom line growth.

Last April, the company attempted to assuage investor fears by replacing CEO William Weldon with longtime executive Alex Gorsky. Weldon had been blamed for overzealous cost-cutting measures, which exacerbated the company's quality control problems. Gorsky stated that fixing the company's quality control issues would be his top priority.

Yet rather than streamlining its supply chain so it can better oversee quality control, J&J spent $30 million on a sentimental new ad campaign with the slogan, "For all you love, Johnson & Johnson," in an effort to improve its tarnished image.

Source: Johnson & Johnson.

However, this expensive campaign is nothing more than a Band-Aid for a broken production system which accidentally churned out frightening products like liver-damaging Tylenol and plastic-filled Motrin.

Focusing on consumer health care

To get a better idea of where J&J stands against its competitors, we should compare its consumer health segment to three other major companies in the space -- GlaxoSmithKline , Merck , and Perrigo .

Consumer Healthcare Revenue (most recent quarter) | Growth (%) (YOY) | Percentage of Quarterly Sales | |

Johnson & Johnson | $3.6 billion | 1.1% | 20% |

GlaxoSmithKline | $2.1 billion | 2% | 19.8% |

Merck | $490 million | (11%) | 4.5% |

Perrigo | $563 million | 16% | 58.2% |

Sources: Company quarterly reports and author's calculations.

Although J&J's consumer health care business is the largest, it isn't growing as fast as Glaxo and Perrigo's, but it is faring better than Merck's smaller consumer segment.

For many years, Merck was partnered with J&J in consumer products in a joint venture, J&J-Merck Consumer Pharmaceuticals. However, Merck sold its 50% interest back to J&J in 2011 to focus on building up its own consumer products division that it gained from its merger with Schering-Plough in 2009.

The bigger they are, the more products they recall

The number of recalls appears to increase relative to a company's size, and J&J isn't the only company that is struggling with quality control problems.

Over the past three years, GlaxoSmithKline has also recalled several consumer products across the world, including Poligrip/Fixodent denture cream, Sensodyne toothpaste, and the pediatric antibiotic Augmentin. Poligrip and Sensodyne were recalled for zinc poisoning and scratched gums, respectively , while Augmentin was found to contain plasticizers.

Merck hasn't reported any consumer segment recalls after its split with J&J, although it has experienced several major recalls in its pharmaceuticals business. Perrigo ran into the same problem with contaminated ibuprofen as J&J in 2010, except that its ibuprofen contained metal shards instead of plastic. Perrigo recalled its acetaminophen tablets in 2006 for the same reason.

The Foolish bottom line

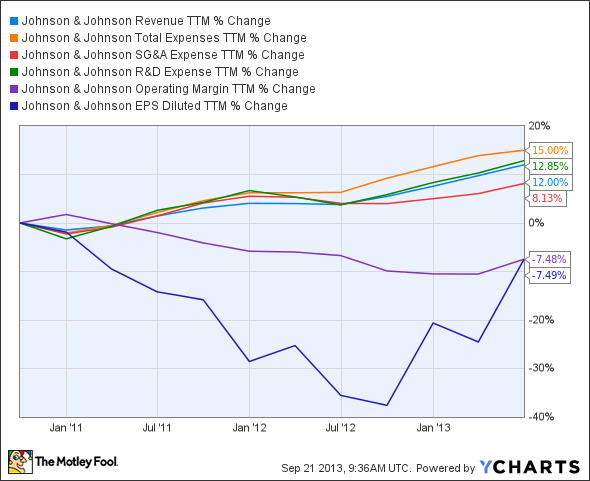

Change won't come overnight for J&J -- yet investors are getting tired of the streak of recalls that the company just can't seem to break. This simple chart illustrates the main problem that J&J faces -- its total expenses are outpacing its revenue growth as margins and earnings growth remain sluggish.

Source: YCharts.

That means there isn't much wiggle room for J&J to go around shutting down plants and restructuring its operations, which could further weigh on its margins. That's why J&J has been treading water and using its new ad campaign to buy itself some time to improve its image.

For now, spending $30 million on new ads might seem like a cheaper option to draw some attention away from its string of recalls, but it ultimately solves none of its long-term problems.

One of the best parts of owning big pharma stocks like J&J is their attractive dividends, but smart investors know the importance of diversifying -- seeking high-yielding stocks from multiple industries. The Motley Fool's special free report "Secure Your Future With 9 Rock-Solid Dividend Stocks" outlines the Fool's favorite dependable dividend-paying stocks across all sectors. Grab your free copy by clicking here.

The article Why Can't This Company Get Its Act Together? originally appeared on Fool.com.

Leo Sun has no position in any stocks mentioned. The Motley Fool recommends Johnson & Johnson. The Motley Fool owns shares of Johnson & Johnson. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.