Why You're Spending Less at Olive Garden and Red Lobster

Image source: Darden Restaurants.

It was a brutal summer for Darden Restaurants . The company saw profits tank after customers shunned its flagship restaurant chains over the past few months.

Earnings fell by 38% at Darden overall, as Olive Garden booked a 4% dip in sales and Red Lobster saw a 5% drop. July was particularly slow: 8% fewer customers packed into booths at either of the national chains.

Here's a look at the recent traffic trend for these two struggling brands.

Source: Darden Restaurants' filings.

An industry trend

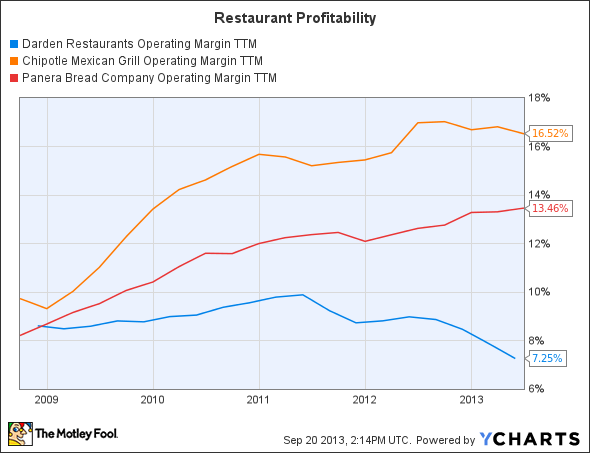

Sure, a lot of this drop isn't unique to Darden. Full-service restaurants have been losing market share to fast-casual operators for a while now, and that trend continued in the second quarter as the sector jumped by 8%, while sales growth at full-service shops remained flat.

Chipotle and Panera Bread are big beneficiaries of the move toward quicker, cheaper eating. They each improved sales by 5.5% and 3.8% last quarter, while Darden's comparable sales shrunk by 3.3%.

Menu missteps

However, Darden has made things harder on itself by pricing many of its customers off its menu. The company stumbled in its recent promotions, misreading how value-sensitive diners are these days. Darden admitted as much last winter, when it decided to retool its menu and promotions so that they "better fit customers' current financial realities and expectations."

That push toward more affordable options has sped up Darden's dip in profitability. While its operating margin almost hit 10% in 2011, it has been on a downward trend ever since.

DRI Operating Margin TTM data by YCharts

Looking ahead

Unfortunately for Darden, things could get worse from here. The company pointed out that its sales and traffic trends in August were less bad than those of the industry as a whole, suggesting that it might be on the cusp of a recovery.

However, Darden plans to cut its workforce as part of a bid to save $50 million a year and hit its 2013 earnings growth target. While that might be a good decision for the short term, it's hard to see how Darden can improve its guest experience while gutting labor spending.

In my view, the company would be better off following something like Buffalo Wild Wings' latest strategy. B-Dubs just started employing what it calls "guest experience captains" who are responsible for keeping customers engaged in the brand while they're in the store. Despite the increased labor expense, B-Dubs plans to have those new positions in place at all of its restaurants by the end of next year.

Sure, Darden's falling profits are a problem, but I'd argue that its guest experience levels are much more important. It might want to look at spending more on labor, not less, as it tries to lure customers back into its Olive Garden and Red Lobster locations.

Still hungry?

Millions of Americans have waited on the sidelines since the market meltdown in 2008 and 2009, too scared to invest and put their money at further risk. Yet those who've stayed out of the market have missed out on huge gains and put their financial futures in jeopardy. In our brand-new special report, "Your Essential Guide to Start Investing Today," The Motley Fool's personal finance experts show you why investing is so important and what you need to do to get started. Click here to get your copy today -- it's absolutely free.

The article Why You're Spending Less at Olive Garden and Red Lobster originally appeared on Fool.com.

Fool contributor Demitrios Kalogeropoulos owns shares of Buffalo Wild Wings. The Motley Fool recommends Buffalo Wild Wings, Chipotle Mexican Grill, and Panera Bread and owns shares of Buffalo Wild Wings, Chipotle Mexican Grill, Darden Restaurants, and Panera Bread. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.