Viacom's Massive Buyback Signals Good Times Ahead

Back when it released its Q2 2013 earnings report, Viacom (NASDAQ: VIAB) announced that it would double its stock buyback plan to $20 billion from the previous $10 billion. Most investors have a negative view of stock buybacks, but research shows that significant buybacks that reduce share counts tend to outperform the market.

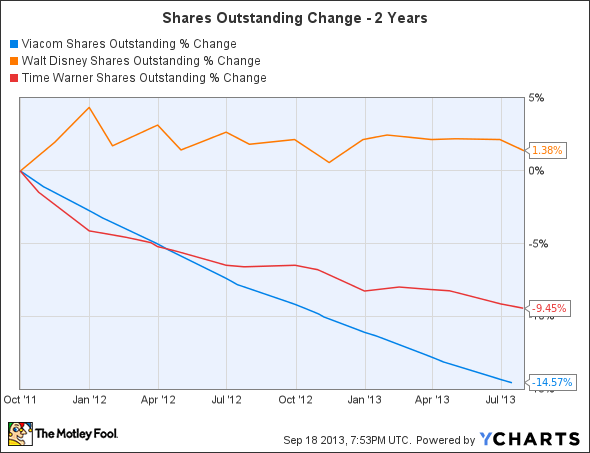

The diversified media entertainment sector appears overly competitive, but the sector in general has outperformed the S&P 500 over the last couple of years. One thing that the general group has shared as a whole is the desire to buy shares back over time. Some of the companies like Walt Disney (NYSE: DIS)and Time Warner (NYSE: TWX)weren't as aggressive in the last year, but the buybacks have continued to set the group apart.

New buyback plan

Viacom has been on a plan of spending roughly $700 million on stock buybacks each quarter. The company announced an enhanced plan during the last quarterly report that provides for an increase in the buyback plan by $10 billion. The intention is to continue the existing repurchase pace of around $700 million per quarter with the intention of augmenting that with purchases of an additional $2 billion in the next couple of months.

In essence, the company plans to continue the roughly $3 billion per year plan that amounts to roughly 7.5% in share reductions each year. The interesting nugget in the updated plan is the desire to augment the normal pace with a special $2 billion spent in the next few months that would amount to 5% of the outstanding shares. That spike in buybacks could make Viacom's buyback yield for the trailing twelve months more than an incredibly high 12%.

Improved fundamentals

In general, the results in the diversified entertainment sector have probably been better than most had expected a few years ago. The shift to online entertainment and the massive competition between entertainment properties hasn't slowed down growth. In fact, Viacom generated 14% revenue growth last quarter. Even more important is that its adjusted net earnings increased by 24% with diluted earnings per share surging 33%.

Viacom not only generated impressive growth, it also managed costs and reduced shares outstanding in order to improve the bottom line per share by more than double.

While Time Warner is seeing limited revenue growth, the operator of HBO and other media properties continues to see surging earnings-per-share due partially to controlled costs, but also reduced share count. Analysts expect earnings to continue growing at nearly four times the company's meager 3.7% revenue growth.

Disney as well has limited revenue growth in the 6% range, but the operator of Disney and ESPN cable networks expects earnings to grow over 10%. The media conglomerate even plans to increase an existing buyback that has purchased around $2 billion to $5 billion worth of shares a year in the last few years to over $6 billion for fiscal 2014. Even with the buybacks, shares outstanding have actually risen fractionally in the last year.

Surging sector

The stocks in the sector in general have surged over the last two years. All three of the stocks gained around 100% compared to only a 50% gain for the S&P 500 over that time period. These exceptional gains would typically make an investor consider selling a mega cap stock. Common sense and the rules of large numbers suggests that these stocks can't keep surging and the share reductions will become harder to maintain with a larger market cap. Remember that it takes twice the cash for an equal share reduction after a stock doubles. Considering this, the enhanced buyback by Viacom is even more impressive.

See the below chart with the percentages of outstanding shares reduced in the last two years:

VIA Shares Outstanding data by YCharts

Bottom line

A key to using the buyback yield concept is limiting its use to mega cap stocks with market values in excess of $20 billion. The ability to manipulate the markets and deceive investors is greatly diminished with stocks of that size. On top of that, companies such as Viacom, Disney and Time Warner are so massive with multiple divisions that the entities become virtually impossible for small investors to effectively analyze.

A big takeaway is that these important buybacks from a few years back provided key signals that the sector in general was set to outperform. The guess is that very few people predicted that Viacom would easily outperform Apple over the past two years. The news flow now suggests that both will perform well in the next year, as Apple joins these entertainment stocks in massive buybacks. The good times at Viacom appears set for another year.

The article Viacom's Massive Buyback Signals Good Times Ahead originally appeared on Fool.com.

Mark Holder and Stone Fox Capital Advisors, LLC own shares of Time Warner. The Motley Fool recommends Walt Disney. The Motley Fool owns shares of Walt Disney. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.