Investing in This Specialty Retailer Would Be a Risky Proposition

When you think of electronic retailers, it's not likely that you think of Conn's . Conn's goes beyond just electronics, selling home appliances, furniture, home-office products, and more. But what's most important is this company's strategy, which is unique.

Strategy

Conn's generates approximately 75% of its retail sales through its in-house finance program. Through this program, consumers with credit ratings between 550 and 650 have an opportunity to purchase items that they otherwise wouldn't be able to afford. The consumer buys the product through a finance program and is charged interest on that purchase.

Of course, the biggest threat here is delinquencies. Currently, Conn's is trying to reduce its delinquencies through more effective collection methods. Conn's CEO, Theodore M. Wright, stated:

"The performance of our credit segment for the second quarter was below our expectations due to short-term execution issues in our collection operations. Corrective actions were taken and negative delinquency trends rapidly reversed. Early stage delinquency at the end of August had declined 12% from peak levels earlier in the month. At August 31, early stage delinquency was below the levels experienced at the end of each of the past nine quarters. We expect further improvement in overall delinquency rates over the next several months."

If a consumer has good credit, then that consumer has the option of going on a long-term, no-interest payment plan. This had been made possible by Conn's partnership with GE Capital.

Considering the nature of the business, it's important that you pay more attention to the bottom line than anything else. While the concept is great, and Conn's has located itself in areas that will target the right consumer, there's no reason to become enthusiastic unless consistent bottom-line growth is present.

Earnings and revenue growth

With that in mind, let's take a look at Conn's earnings-per-share trend over the past five years.

Conn's EPS diluted (trailing 12 months) data by YCharts

At first glance, this looks like a big positive, but this chart can be deceiving. While recent EPS growth has been impressive, keep in mind that Conn's was coming from two consecutive years of losses. And diluted EPS in FY 2013 was still zero. (Source: Zacks.com)

Peer comparisons

You might have noticed Wal-Mart Stores and Best Buy on the chart above. Clearly, Wal-Mart is the only company that has shown consistent earnings growth over the years. And despite Wal-Mart's warnings about a weakening consumer, it's still by far the largest and most resilient company of this bunch.

Thanks to its deep pockets, Wal-Mart can always return more capital to shareholders, and/or acquire smaller companies to fuel growth. Since Conn's only has $3.8 million in cash and short-term equivalents, it's not capable of such luxuries. With that in mind, consider the comparisons below.

Metric | Forward P/E | Net Margin | ROE | Dividend Yield | Debt-to-Equity Ratio | Short Position |

|---|---|---|---|---|---|---|

Conn's | 15 | 7.23% | 15.48% | None | 0.63 | 18% |

Best Buy | 14 | (0.97%) | (8.43%) | 1.80% | 0.47 | 8.20% |

Wal-Mart | 13 | 3.61% | 23.45% | 2.60% | 0.74 | 1.30% |

Conn's has a significant short position of 18%, and as noted earlier, it doesn't pay any dividends. However, net margin and ROE are solid. While Wal-Mart might be big and boring, it offers the best valuation, the highest ROE, and it has the fewest people betting against it.

Best Buy is the weakest of the group on a fundamental basis. Best Buy bulls will say that this leaves a lot of upside potential for a turnaround, but Best Buy faces a consistent direct threat from online retailers, especially Amazon. You could even make an argument that without Amazon in the picture, Best Buy would be hitting on all cylinders right now. Currently, Best Buy's expenses and plummeting sales growth may be wreaking havoc on its margins.

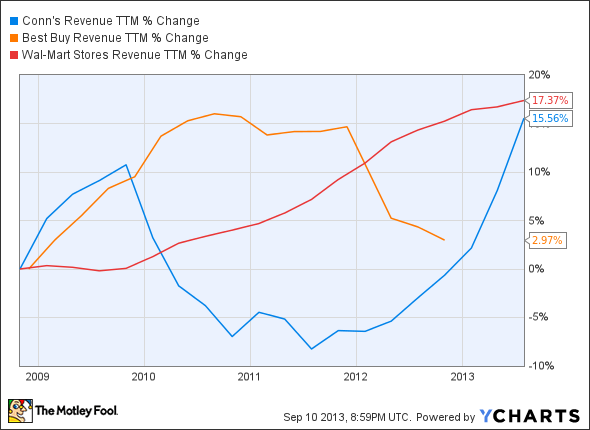

Below are revenue growth comparisons for these three companies over the past five years.

Conn's revenue (trailing 12 months) data by YCharts

Conn's has turned its top-line performance around, but the company is prone to volatility. Wal-Mart is the only consistent top-line performer here .

Looking ahead

At the moment, Conn's has 70 retail locations in Texas, La., N.M., and Ariz. These locations offer approximately 2,300 branded products from about 200 manufacturers.

In the first half of the year, Conn's opened new Conn's HomePlus stores in Mesa, Phoenix, Las Cruces, and Tulsa. And it plans on opening six to eight more stores by the end of FY 2014. Additionally, Conn's is remodeling its existing stores and expanding its product offerings in order to boost growth. Conn's closed 13 stores over the past two years due to underperformance, which should aid the bottom line.

The bottom line

Conn's turned itself around on the top line in 2012. That turnaround must be completed on the bottom line as well. Interestingly, a weak consumer might actually benefit Conn's on the top line, but delinquencies are always going to be a concern. That being the case, and considering the stock is up over 1,000% over the past three years (yes, you read that correctly), it's relatively safe to assume that you missed the majority of this stock's run.

If you want to gamble and you believe in a broad consumer turnaround, then Best Buy would make a good speculative play. If you believe the consumer will weaken, and you prefer capital preservation (recommended), then Wal-Mart will be a safer place to be. Wal-Mart might be boring, but you will collect healthy dividends, and you can always buy on dips, knowing that Wal-Mart isn't going anywhere and it's only a matter of time before the stock rebounds.

Looking for the best positioned retailers?

The retail space is in the midst of the biggest paradigm shift since mail order took off at the turn of last century. Only those most forward-looking and capable companies will survive, and they'll handsomely reward those investors who understand the landscape. You can read about the 3 Companies Ready to Rule Retail in The Motley Fool's special report. Uncovering these top picks is free today; just click here to read more.

The article Investing in This Specialty Retailer Would Be a Risky Proposition originally appeared on Fool.com.

Dan Moskowitz has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.