Is Costco Wholesale Destined for Greatness?

Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Costco Wholesale fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Costco's story, and we'll be grading the quality of that story in several ways:

Growth: Are profits, margins, and free cash flow all increasing?

Valuation: Is share price growing in line with earnings per share?

Opportunities: Is return on equity increasing while debt to equity declines?

Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Costco's key statistics:

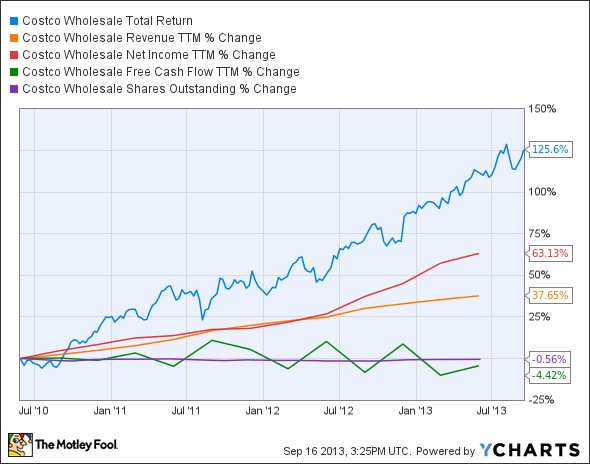

COST Total Return Price data by YCharts.

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | 37.7% | Pass |

Improving profit margin | 18.5% | Pass |

Free cash flow growth > Net income growth | (4.4%) vs. 63.1% | Fail |

Improving EPS | 65% | Pass |

Stock growth (+ 15%) < EPS growth | 125.5% vs. 65% | Fail |

Source: YCharts. * Period begins at end of Q2 2010.

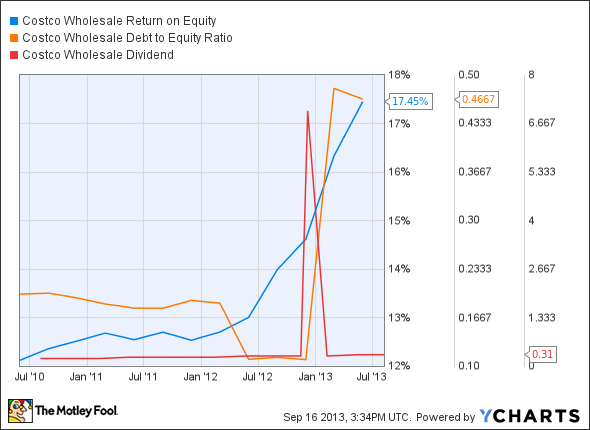

COST Return on Equity data by YCharts.

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving return on equity | 44% | Pass |

Declining debt to equity | 134.8% | Fail |

Dividend growth > 25% | 51.2% | Pass |

Free cash flow payout ratio < 50% | 214.3% | Fail |

Source: YCharts. * Period begins at end of Q2 2010.

How we got here and where we're going

Costco doesn't quite come through with flawless performance, but five out of nine passing grades is respectable for a well-established enterprise. Over the past three years, Costco's free cash flow has remained flat while net income has soared, which has combined with the company's huge onetime special dividend to result in two failing grades. Despite this apparent weakness, Costco's shareholders have enjoyed robust growth over the past three years, and stock gains have outpaced the growth in earnings per share by a rather substantial margin. Can Costco push its fundamentals back into line with investor sentiment? Let's dig a little deeper to see what's in store for this wholesaler.

Over the past few quarters, retail giants Wal-Mart and Target have been severely affected by both a wobbling economy and an increase in U.S. payroll taxes. Meanwhile, Costco remains largely unaffected by the ongoing retail malaise, largely due to a top-tier shopping experience across its stores combined with geographical and product diversification. Last quarter, Costco achieved a solid 5% increase in comparable-store sales, outpacing both Wal-Mart and Target, which saw comp-store growth of 2% and 1.2%, respectively. My fellow Fool Lior Cohen notes that Costco has also outperformed rivals Wal-Mart and Target in terms of revenue and per-store sales growth, which increased by 7.9% and 4.2% year over year, respectively.

Costco has also been aggressively expanding into global markets, especially those in Asia. It now operates 170 warehouses internationally, which produce around 50% of Costco's total revenue, much more percentage-wise than Wal-Mart's international revenue. Fellow Fool Andrew Marder notes that the company has an ambitious plan to open 28 new overseas locations this year, more than double the 12 warehouses it opened in 2012. Costco has also completed five of its 13 planned locations in Japan. However, Wal-Mart's aggressive international expansion might crimp Costco's profitability and sales per store. Target's PFresh grocery initiative could also hinder Costco's growth wherever the two superstores happen to enter into close competition.

Fool Adrian Campos points out that Costco is highly exposed to macroeconomic cycles, but has been able to lock in the majority of its profits in advance through membership packages. The company had around 69 million customer memberships across eight countries in the latest quarter, and despite a recent increase in membership fees, it continues to grow its global customer base. My Foolish colleague Nathaniel Matherson also notes that Costco has sustained an impressive 93.9% renewal rate for memberships. This high level of retention is an excellent sign of a defensible business, which makes it unlikely that Wal-Mart or Target might be able to significantly erode Costco's sales.

Putting the pieces together

Today, Costco has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

Looking for other retail superstars?

The retail space is in the midst of the biggest paradigm shift since mail order took off at the turn of the last century. Only those most forward-looking and capable companies will survive, and they'll handsomely reward those investors who understand the landscape. You can read about the "3 Companies Ready to Rule Retail" in The Motley Fool's special report. Uncovering these top picks is free today; just click here to read more.

The article Is Costco Wholesale Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes has no position in any stocks mentioned. The Motley Fool recommends and owns shares of Costco Wholesale. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.