Markets Don't Fear the Fed Today

Although we don't believe in timing the market or panicking over daily movements, we do like to keep an eye on market changes -- just in case they're material to our investing thesis.

Mixed economic reports have the Dow Jones Industrial Average slightly higher as we wait for the Federal Reserve's policy statement tomorrow. As of 1:25 p.m. EDT the Dow is up 0.35%, while The S&P 500 is up 0.41%.

There were two U.S. economic releases today.

Report | Period | Result | Previous |

|---|---|---|---|

BLS Consumer Price Index | August | 0.1% | 0.2% |

BLS Core CPI | August | 0.1% | 0.2% |

NAHB Housing Market Index | September | 58 | 58 |

The Bureau of Labor Statistics' Consumer Price Index rose a seasonally adjusted 0.1% in August for a 12-month change of 1.5%. The core CPI, which excludes food and energy, rose by 0.2% for a 12-month rise of 1.8%.

US Consumer Price Index data by YCharts.

Both are well below the Federal Reserve's targets of 2% to 2.5% inflation -- which is significant, considering the Federal Open Market Committee is meeting today and tomorrow to decide whether to continue the Fed's $85 billion-per-month long-term asset purchases.

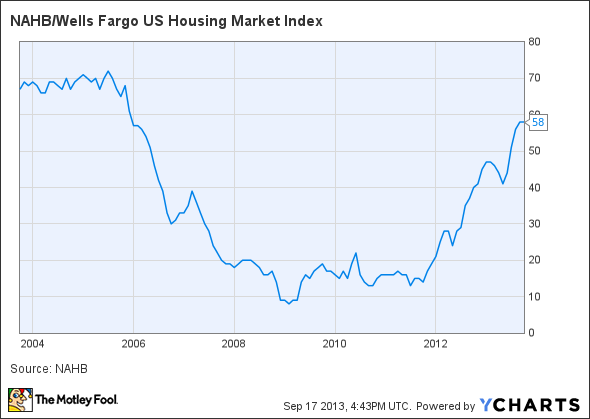

The second economic report was the National Association of Home Builders' Housing Market Index, which measures homebuilder confidence. The index remained unchanged in September, at its highest level in five years.

NAHB/Wells Fargo US Housing Market Index data by YCharts.

A level below 50 indicates that more builders see conditions as negative than do positive. NAHB Chairman Rick Judson had this to say: "While builder confidence is holding at the highest level in nearly eight years, many are reporting some hesitancy on the part of buyers due to the sharp increase in interest rates. Home buyers are adjusting to the fact that, while mortgage rates are still quite favorable on a historic basis, the record lows are probably a thing of the past."

Mortgage rates are indeed still historically low but have risen more than 50% in the past five months alone, giving consumers and builders alike some sticker shock.

US 30 Year Mortgage Rate data by YCharts.

The big news this week will be the FOMC's statement tomorrow at 2 p.m. EDT. It will be interesting to see how the market reacts to the Federal Reserve's plan of action. Analysts generally expect the Fed to announce some slight tapering of QE but otherwise leave in place most of the asset purchases. That said, only the committee members know what the Fed will do -- and if your investment process depends on the outcome of the meeting, you're doing it wrong. Have a plan and invest for the long term.

Dividend stocks can make you rich. While they don't garner the notoriety of highflying growth stocks, they're also less likely to crash and burn. And over the long term, the compounding effect of the quarterly payouts, as well as their growth, adds up faster than most investors imagine. With this in mind, our analysts sat down to identify the absolute best of the best when it comes to rock-solid dividend stocks, drawing up a list of nine that fit the bill. To discover the identities of these companies before the rest of the market catches on, you can download this valuable free report by simply clicking here now.

The article Markets Don't Fear the Fed Today originally appeared on Fool.com.

Dan Dzombak can be found on Twitter @DanDzombak or on his Facebook page, DanDzombak. He has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.