Buy What You Know... At the Right Price

Peter Lynch suggets that market-beating investment ideas will present themselves to investors in everyday life. To continue a series of articles that takes Lynch's "buy what you know" advice and applies it to real-world examples, this article will illustrate the investing opportunity in athletic apparel.

Growth stories are everywhere

When looking for multi-bagger investment ideas, it can sometimes be as simple as looking at the brands people are wearing at your local gym or on the field of a child's soccer game. Notice a trend? As many will likely confirm, the dominance of established brands like Nike (NYSE: NKE) and Addidas has steadily been eroded by upstart Under Armour (NYSE: UA). There are a number of reasons for Under Armour's impressive growth trajectory, but it ultimately comes down to the product itself; initial success in pioneering "performance gear" for men has rapidly expanded into apparel for women and kids as well as footwear.

This is the quintessential opportunity for the individual investor to test drive the product and make their own conclusions regarding the value proposition of the company's products with more precision than you'll find from a Wall Street analyst. Are the shirts really better at keeping you cool and dry than the competition? How durable are the shoes? How have interactions with customer service been? These are easy questions for potential investors to ask. Assuming a company like Under Armour, Lululemon Athletic (NASDAQ: LULU), or Columbia Sportswear (NASDAQ: COLM) pass these qualitative tests, an investor can then start to look deeper to determine whether the company is worth a spot in a portfolio.

How strong is the growth?

After identifying a brand that stands out among its peers, it is time to dig deeper to understand the growth potential of the company. For comparison, here is how Under Armour, Lululemon, and Columbia compare to a behemoth like Nike:

NKE | UA | LULU | COLM | |

|---|---|---|---|---|

CAPS rating (out of five stars) | 5 stars | 4 stars | 2 stars | 3 stars |

Market capitalization (in billions) | $60.7 | $8.0 | $10.2 | $2.0 |

Growth rate-past 5 years | 8.6% | 42.2% | 57.4% | -0.6% |

Growth rate-next 5 years (estimate) | 11.5% | 20.5% | 18.7% | 8.2% |

Source: Yahoo! Finance-9/16/13 |

The growth story for Under Armour and Lululemon jumps out from the table above; while the growth rate is expected to "slow" to around 20% per year going forward for each company, this rate is still almost double the estimated growth of Nike. As you might expect, this tremendous performance has come with an equally tremendous rise in share price over the past five years:

UA Total Return Price data by YCharts

Worried that it is too late to take part in this growth now that Under Armour and Lululemon's market capitalizations are hovering near $8 billion and $10 billion, respectively? Under Armour's visionary CEO Kevin Plank recently explained to investors that he sees Under Armour as a $10 billion brand, which represents a roughly 500% increase from Under Armour's trailing twelve month revenue of $2.0 billion.

Under Armour expects to get to $10 billion by continuing its relentless expansion geographically, further into women's apparel, and through expansion of direct-to-consumer sales channels. As a point of comparison, reaching $10 billion in revenue would only equate to about 40% of Nike's revenue over the past year.

For Lululemon, the growth potential is just as strong. Experts extrapolate the company's success in its home country of Canada to represent the potential to increase revenue eight times its $1.5 billion total over the past year.

Both companies have significantly larger growth prospects than Columbia, which is relatively mature with a 75 year history of making apparel and equipment for outdoor activities such as hiking. Sales have declined over the past five years, which is clearly not a good sign for investors looking for growth opportunities.

Is the growth worth it?

While often misquoted to imply that identifying a strong company that an investor understands is the end of an investors' homework prior to buying shares, Lynch is adamant that an understanding of earnings and valuation is a prerequisite to any purchase. As this applies to Under Armour and Lululemon, this is where the decision gets complicated; both companies are trading at a clear premium to their apparel peers:

NKE | UA | LULU | COLM | |

|---|---|---|---|---|

TTM revenue (in billions) | $25.3 | $2.0 | $1.5 | $1.7 |

TTM price to sales ratio | 2.4 | 4.1 | 6.6 | 1.2 |

TTM price to earnings ratio | 25.1 | 60.6 | 37.9 | 19.0 |

Forward price to earnings ratio | 19.7 | 41.0 | 27.9 | 18.9 |

PEG ratio | 1.9 | 2.6 | 1.8 | 2.7 |

Debt to equity ratio | 0.12 | 0.06 | 0.00 | 0.00 |

Free cash flow yield | 4.1% | 0.8% | 1.9% | 5.3% |

Dividend yield | 1.3% | 0% | 0% | 1.5% |

Source: Yahoo! Finance 9/16/13 |

Based on the metrics in the table above, a decent argument can be made that all four of these companies are overpriced based on future growth projections. While this may be an indication that today is not the best time to buy stock in these companies, it doesn't mean that strong growth companies like Under Armour and Lululemon shouldn't remain on an investor's radar.

Consider this: if Under Armour and Lululemon were to reach the long-term revenue targets of $10 billion and $12 billion ($1.5 billion times 8), respectively, and assuming that Nike's current price to sales ratio of 2.4 represents a reasonable valuation multiple, the future market capitalizations for Under Armour and Lululemon would be $24 billion and $29 billion, respectively. For reference, this would translate into increases of 200% and 180% for investors from today's "expensive" share prices; while this outcome may take a decade to materialize, these projections translate into a very reasonable 11%-12% annualized return if 10 years is considered a reasonable timeline to achieve this growth.

What to do now?

Thus far, it has been established that Under Armour and Lululemon both remain strong growth stories. While it is difficult to argue that the shares of either company are cheap today, there is still potential for long-term investors to earn solid returns buying at today's prices.

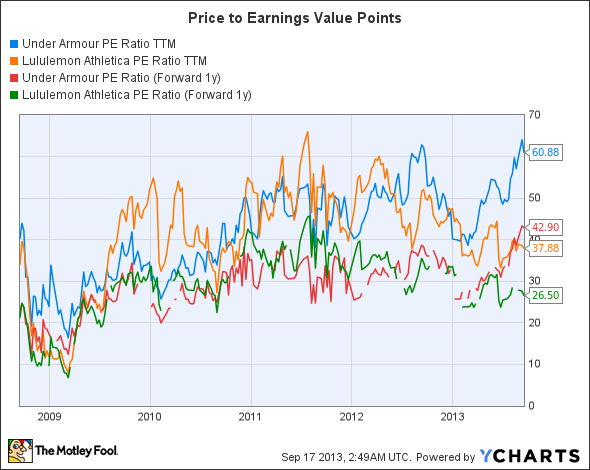

So what is the next step for investors that like the companies but are weary of the price? Waiting for better value points is certainly a reasonable strategy. Both Under Armour and Lululemon have presented investors with numerous opportunities to invest with a forward price to earnings ratio of 25 or less as illustrated by this chart:

UA P/E Ratio TTM data by YCharts

Investors will have this opportunity again in the future. This shouldn't be a groundbreaking prediction given the volatility associated with high-growth companies like Under Armour and Lululemon. An earnings miss, negative news, or an analyst downgrade can have a dramatic effect on these companies. Lululemon's string of bad news regarding product quality issues and the departure of its former CEO earlier this year dropped the company's share price around $20 from its high of $82.50. For investors with a long-term perspective and belief that the negative information is short term in nature, such volatility presents investors with a fantastic opportunity to start (or add to) a position in either of these companies.

The article Buy What You Know... At the Right Price originally appeared on Fool.com.

Brian Shaw owns shares of Under Armour. The Motley Fool recommends Lululemon Athletica, Nike, and Under Armour. The Motley Fool owns shares of Nike and Under Armour. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.