Is This Retail Giant Increasing Its Sales?

Retail giant Wal-Mart continues to maintain its profitability by opening new stores and expanding its reach outside of the U.S. However, is the company maintaining its growth solely by adding new stores? Does it also have organic growth -- i.e., does its average store sell more? How is the company doing in terms of revenue growth and profits per store compared to other leading retailers? Let's explore these issues.

Profitability by store

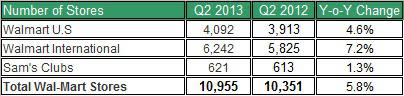

To better understand Wal-Mart's profit centers, I have divided the company's three main operations into Wal-Mart U.S, Wal-Mart international and Sam's Club. Let's first examine the changes in the number of stores in each business segment.

Source: Wal-Mart's quarterly earnings report.

As seen in the table above, the international segment grew the fastest in the past quarter -- a 7.2% rise year over year. Conversely, Sam's Club stores grew the slowest at 1.3%.

Now let's turn to the company's changes in sales and operating profit for each segment.

Source: Wal-Mart's quarterly earnings report.

Wal-Mart U.S is the most profitable at 8%. Sam's Club is the least profitable at 3.8%. Net sales grew in all segments, with Wal-Mart international leading the way slightly with a 2.9% gain.

Dividing the revenue and operating earnings by the number of stores in each segment, however, a different picture is revealed.

Source: Wal-Mart's quarterly earnings report.

The table above shows the changes in revenue and operating profit per average store per segment.

Both Wal-Mart U.S and Wal-Mart International's average revenues per store declined in the second quarter. Moreover, Wal-Mart International's average operating profit per store tumbled by 7.9% during the quarter. Only Sam's Club's average revenue per store grew in the past quarter.

This means Wal-Mart hasn't done well in the past quarter, as its earnings report might suggest. The rise in revenues in Wal-Mart's U.S. and International segments was solely due to an increase in the number of stores. On average, stores have done worse in the second quarter compared to the same quarter in 2012.

How is the competition doing?

Let's consider two other retail giants and see how they have done compared to Wal-Mart. Costco Wholesale has done much better than Wal-Mart in terms of revenue growth. The company's net sales increased by 7.9% in the past quarter. After examining Costco's growth in the number of stores, it seems the company has also done well in terms of growth in sales per store.

Source: Costco's quarterly earnings report.

The table above shows the company's growth in sales was partly due to an increase in the number of stores (4.2% growth) and partly due to a rise in sales per store (3.6%). So not only has the company expanded its reach with new stores, its average store also sold more than it had in the past.

Moreover, Costco's operating profit increased by a sharp 15.9% in total, and by 11.3% per store. Despite the sharp rise in operating profit, the company's profitability is still well below Wal-Mart's: Costco's profitability reached 3% in the second quarter; Wal-Mart's profitability, 6%.

But this isn't the case for Target . As seen in the table below, the company's sales per store slipped by 0.7% during the recent quarter. Furthermore, the operating earnings per store tumbled by 13.9%. In other words, the average store is not only selling less but also earns less. Based on the performance of these two companies, this puts Wal-Mart in the middle of the pack in terms of growth in sales and operating profit per store.

Source: Target's quarterly earnings report.

Takeaway

The above comparison should give you a clearer picture of Wal-Mart's performance in the past quarter, and a comparison with other leading retailers. This analysis also puts Wal-Mart's growth into perspective. It shows that the retail giant didn't perform well in the past quarter and its average store has been making less money than in the past.

Finally, Wal-Mart's decision to expand outside of the U.S. might eventually lower its profit margin and reduce its revenue per store, which would lower the company's attractiveness as an investment.

If you're looking to learn about retail investments with especially good prospects outside of the big-box behemoth, take a look at The Motley Fool's special free report: "The Death of Wal-Mart: The Real Cash Kings Changing the Face of Retail." In it, you'll see how these two cash kings are able to consistently outperform and how they're planning to ride the waves of retail's changing tide. You can access it by clicking here.

The article Is This Retail Giant Increasing Its Sales? originally appeared on Fool.com.

Fool contributor Lior Cohen has no position in any stocks mentioned. The Motley Fool recommends Costco Wholesale. The Motley Fool owns shares of Costco Wholesale. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.