How Family Dollar Could Make Dividend Investors Even Happier

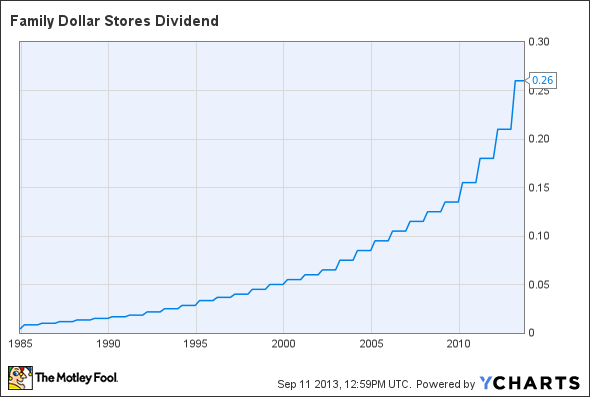

Dividend investors like to see an ongoing commitment from companies to raise their payouts over time, and Family Dollar has delivered on that score for 37 straight years. That track record is good enough to put Family Dollar into the elite ranks of the Dividend Aristocrats, which extends membership to the small number of companies that have succeeded in posting a quarter-century of consecutive annual dividend increases.

But one thing every investor needs to understand about the Dividend Aristocrats is that there's no requirement that a stock pay a particularly large dividend -- only that it increase whatever dividend it chooses to pay. With just a 1.5% yield, Family Dollar shareholders aren't necessarily entirely happy with the company's capital allocation decisions despite its enviable dividend track record. Let's take a closer look at Family Dollar to see whether it's likely to be able to sustain or even improve on its dividend growth.

Dividend Stats on Family Dollar

Current Quarterly Dividend Per Share | $0.26 |

Current Yield | 1.5% |

Number of Consecutive Years With Dividend Increases | 37 years |

Payout Ratio | 24% |

Last Increase | March 2013 |

Source: Yahoo! Finance. Last increase refers to ex-dividend date.

Boom times for Family Dollar

One big reason Family Dollar investors probably haven't been too disappointed about its meager payout is that its stock has posted impressive long-term gains. The dollar-store retailer really came into its own during the 2008 recession, when the stock managed to climb nearly 40% even as the broader stock market plunged by roughly that amount. The reason was simple: Cash-strapped consumers suddenly found themselves having to stretch their budgets to the limit, and even traditional big-box discount retailers had price points above what many consumers could afford. Family Dollar met the deep-discount needs of those customers, and even as the recession has given way to a modest economic recovery, shoppers have continued to see the value proposition that Family Dollar and its peers provide.

Family Dollar's most recent earnings announcement demonstrates its continued success. Same-store sales rose 2.9% as part of the company's 9% gain in overall revenue. In particular, it has chosen to rely on increased sales of food, tobacco, over-the-counter medical goods, and beauty products. Getting almost 70% of revenue from those products, Family Dollar stands out from rival Dollar Tree , which got just more than half of its sales from that category last year. The trade-off is that Dollar Tree has been able to maintain better margins, as food and similar goods carry lower markup potential than other items that dollar stores traditionally sell.

The biggest threat to Family Dollar, though, is heightened competition. Dollar General has aggressively expanded with new stores, already boasting the biggest market capitalization in the industry and operating more than 10,000 locations. With plans for more than 600 new stores and about 550 store remodeling or relocation projects, Dollar General wants to boost its presence in the industry. In addition, Wal-Mart has identified the competitive force of deep discounters and is fighting back with supercenter expansions designed at enticing shoppers with one-stop shopping opportunities. Greater grocery availability should help increase the number of recurring visits it gets from customers, potentially diverting business from Family Dollar and its peers.

Family Dollar Dividend data by YCharts.

Despite its stingy yield, it's hard to fault Family Dollar on its dividend growth. The company has accelerated the growth pace in its annual increases, with its most recent boost earlier this year adding 24% to its previous payout after increases of 15% to 17% in each of the preceding three years. The stock price has simply increased at an even faster pace, making it difficult for Family Dollar's dividend to keep up.

When will Family Dollar boost its payout?

With Family Dollar having made its last boost in March, investors can expect to see the company step up with another increase early next year. Its low payout ratio gives it plenty of room to consider another big increase, with amounts anywhere in the range of $0.30 to $0.35 per share seemingly perfectly reasonable. The question will be whether Family Dollar chooses to keep capital for faster expansion or errs on the side of returning more cash to shareholders. Either way, investors can expect dividend growth to continue to supplement share-price appreciation into the future.

Dividend stocks like Family Dollar can make you rich. It's as simple as that. With this in mind, our analysts sat down to identify the absolute best of the best when it comes to rock-solid dividend stocks, drawing up a list in this free report of nine that fit the bill. To discover the identities of these companies before the rest of the market catches on, you can download this valuable free report by simply clicking here now.

Click here to add Family Dollar to My Watchlist, which can find all of our Foolish analysis on it and all your other stocks.

The article How Family Dollar Could Make Dividend Investors Even Happier originally appeared on Fool.com.

Fool contributor Dan Caplinger has no position in any stocks mentioned. You can follow him on Twitter @DanCaplinger. The Motley Fool has no position in any of the stocks mentioned, either. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.