Is Weatherford Destined for Greatness?

Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Weatherford fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Weatherford's story, and we'll be grading the quality of that story in several ways:

Growth: are profits, margins, and free cash flow all increasing?

Valuation: is share price growing in line with earnings per share?

Opportunities: is return on equity increasing while debt to equity declines?

Dividends: are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Weatherford's key statistics:

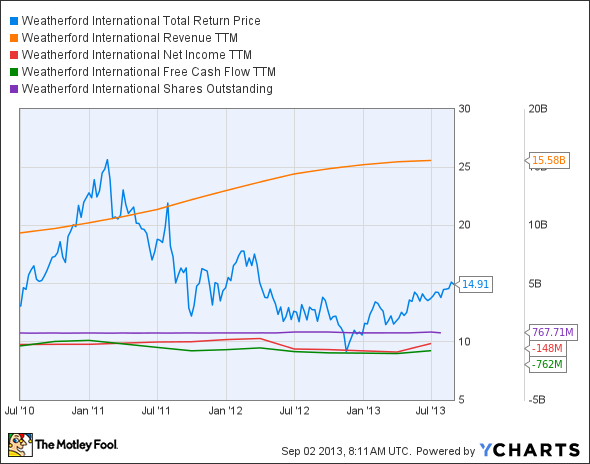

WFT Total Return Price data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | 66.7% | Pass |

Improving profit margin | 62.3% | Pass |

Free cash flow growth > Net income growth | (114.9%) vs. 37.3% | Fail |

Improving EPS | 41% | Pass |

Stock growth (+ 15%) < EPS growth | 13.5% vs. 41% | Pass |

Source: YCharts. * Period begins at end of Q2 2010.

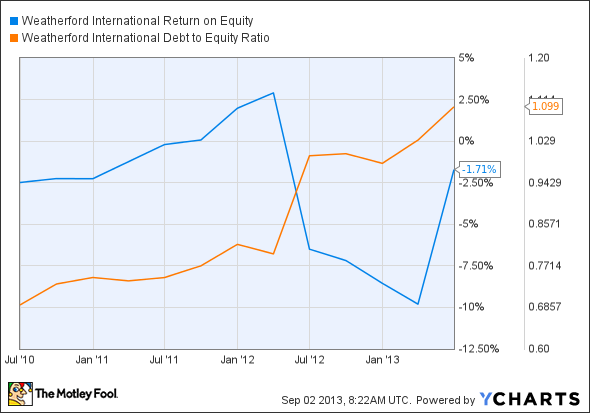

WFT Return on Equity data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving return on equity | 31.3% | Pass |

Declining debt to equity | 59.3% | Fail |

Source: YCharts. * Period begins at end of Q2 2010.

How we got here and where we're going

Weatherford started off on a solid note, but it's had difficulties improving its free cash flow -- a weakness that appears to be partially behind the consistent growth of debt. Despite these related shortfalls, Weatherford still mustered five out of seven passing grades, and it could certainly gain a perfect score if free cash flow finally nudges into positive territory. But how possible is that? Let's dig a little deeper to find out.

Falling natural gas prices have forced many North American oil and gas companies to shift their focus toward the production of crude oil and natural gas liquids. However, the oil drilling rig counts have been declining in recent months, but crude oil production has continued to rise.

In fact, Weatherford technology might be at least partly responsible for the rig-count drop: Fool contributor Arjun Sreekumar notes that Weatherford's Microflux control system provides a competitive advantage over rival Schlumberger , and it has effectively reduced the number of drilling days from 31 to 16 in Forest Oil's Haynesville Shale holdings. Oil-field services companies are aggressively investing in R&D to build more efficient drilling equipment. Weatherford's $270 million in trailing 12-month R&D spending can't match Schlumberger's $1.2 billion in spending over the same period. As a smaller player, Weatherford will have to spend smarter, and Microflux is certainly a step in the right direction.

The recent shale-gas boom in China also offers more lucrative opportunities for services like Weatherford and Schlumberger. Schlumberger has recently partnered with China National Petroleum to build a shale gas pipeline in the country, but Weatherford's opportunity remains largely unexplored. However, Weatherford may want to tread carefully in the Middle Kingdom -- Fool analyst Taylor Muckerman points out that the SEC has launched an investigation against the company for potentially selling goods to Iran and Syria in 2012. The company has also been found to have taken a few improper liberties with its contracts with Iraq.

Putting the pieces together

Today, Weatherford has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

Record oil and natural gas production is revolutionizing the United States' energy position. Finding the right plays while historic amounts of capital expenditures are flooding the industry will pad your investment nest egg. For this reason, the Motley Fool is offering a comprehensive look at three energy companies set to soar during this transformation in the energy industry. To find out which three companies are spreading their wings, check out the special free report, "3 Stocks for the American Energy Bonanza." Don't miss out on this timely opportunity; click here to access your report -- it's absolutely free.

The article Is Weatherford Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.