Financial Stocks Lead the Dow Higher

Although we don't believe in timing the market or panicking over daily movements, we do like to keep an eye on market changes -- just in case they're material to our investing thesis.

Financial stocks are pushing the Dow Jones Industrial Average up as positive economic reports and widening credit spreads benefit lenders. As of 1:20 p.m. EDT the Dow is up 16 points to 14,947. The S&P 500 is up 0.2% to 1,656.

There were five U.S. economic releases today.

Report | Period | Result | Previous |

|---|---|---|---|

ADP National Employment Report | August | 176,000 | 198,000 |

New unemployment claims | Aug. 24 to Aug. 31 | 323,000 | 332,000 |

Productivity | Q2 | 2.3% | 0.9% |

ISM Non-Manufacturing Index | August | 58.6% | 56% |

Factory orders | July | (2.4%) | 1.6% |

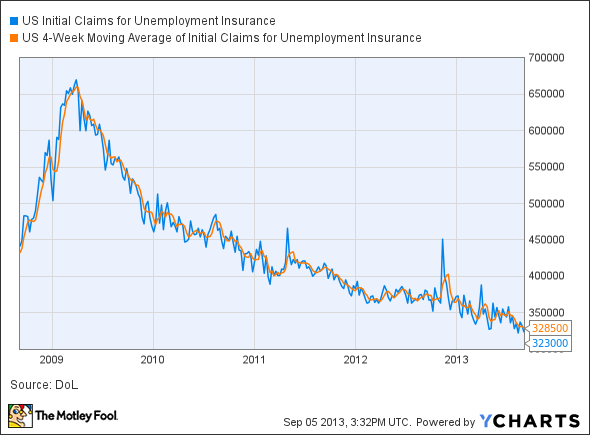

New unemployment claims fell by 9,000 to a seasonally adjusted 323,000 -- near a five-year low and below analyst expectations of 330,000. The less volatile four-week moving average fell by 3,000 to a seasonally adjusted 328,500, which is the lowest level since October 2007.

US Initial Claims for Unemployment Insurance data by YCharts.

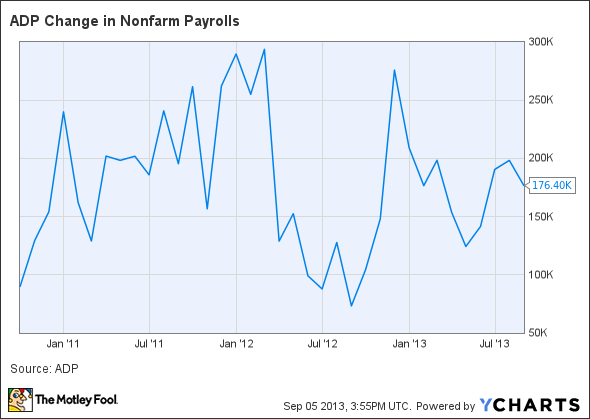

While Americans are filing for unemployment at the lowest rate in years, hiring has yet to really pick up. ADP reported its private-sector employment report today, showing that the private sector added 176,000 jobs in August, falling short of July's 198,000 and analyst expectations of 185,000. Jobs mainly came from small and medium-sized companies -- roughly 70,000 each -- while large companies added just 32,000 jobs.

ADP Change in Nonfarm Payrolls data by YCharts.

Tomorrow the government reports its nonfarm payrolls report, which includes both public and private-sector jobs. Last month the government reported that the economy added 162,000 jobs in July, and economists expect the government to report jobs growth of 173,000.

The last key report of the day is the ISM Non-Manufacturing Index. The index rose by 2.6 points in August, indicating that activity in the services sector expanded at a faster rate than in July. Particularly positive for the economy was a 3.8-point jump in the employment index, indicating that more businesses are expanding hiring and at a faster rate than in July.

Source: Institute for Supply Management.

Jobs growth and employment trends are important to pay attention to, as the Federal Reserve is closely watching employment levels to determine when it will begin paring back its monthly asset purchases.

Today's Dow leaders

The financial sector is leading the Dow higher today, with American Express, Bank of America, and JPMorganChase all up around 1%. Financials are rising as long-term rates continue to rise. The below chart is current as of last Thursday' the 10-year Treasury rate is now at 2.98%.

10 Year Treasury Rate data by YCharts.

Lenders profit from borrowing money at short-term rates. The federal funds rate is at 0.25%, and banks can offer longer-term loans in the form of mortgages and other loans at higher rates. As the economy improves and rates rise, financial firms will do well as more people gain confidence to take out loans.

The golden age of banking is over. If you want to learn how to take advantage of the impending bank renaissance, click below to discover the one company leading the way. You see, this fast-growing company is poised to disrupt big banking's centuries-old practices. And it stands to make early investors like -- a fortune -- if you act now. Our brand-new investor alert "Big Banking's Little $20.8 Trillion Secret" lays bare every banker's darkest secret for the world to see. Simply click click here for instant access!

The article Financial Stocks Lead the Dow Higher originally appeared on Fool.com.

Dan Dzombak can be found on Twitter @DanDzombak or on his Facebook page, DanDzombak. He owns shares of Bank of America. The Motley Fool recommends American Express and Bank of America. The Motley Fool owns shares of Bank of America and JPMorgan Chase. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.