Speculative Stocks Are Hitting Bubblicious Levels

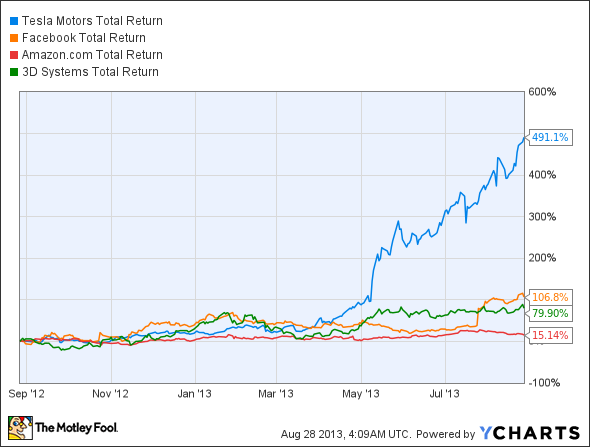

Four of the most talked about companies on the stock market show some of the strongest signs of irrational exuberance I've seen in a long time. Tesla Motors has been on a tear since May, Facebook and Amazon are up 106% and 80% respectively in the past year, and even 3D Systems is maintaining a lofty stock price.

TSLA Total Return Price data by YCharts

The challenge for each of these companies is living up to the market's high expectations. For each company, I think there will be challenges living up to the hype, and investors will eventually be brought back down to earth.

Tesla Motors

There's nothing wrong with Tesla as a company. In fact, I think it's one of the great start-ups of the last two decades, and has a great chance to revolutionize the auto industry. My problem is that a company making 20,000 cars annually is now worth over $20 billion. That's $1 million in value for every car made.

Even some back-of-the-napkin calculations show what an absurd valuation the company has. Let's say Tesla will make 100,000 cars in five years or more, sell them for $50,000 apiece, and generate the 25% gross margin Elon Musk has targeted. At that point -- at lease five years down the road -- Tesla's gross margin would be $1.25 billion. That's before including operating expenses like sales and administration, and wouldn't pay for the debt needed to expand plants. Trading at 16 times a hypothetically possible gross margin is crazy, no matter how great a company is.

Facebook

The Facebook fad is over. I hate to break it to everyone, but once grandma is "liking" a high school students photos, the cache is gone. Sure, the company has found new ways to monetize traffic, especially on mobile, but if you're a Facebook user, are you happy about those ads?

The simple fact is that no social network has stayed on top for long and, outside of Google, most websites have a short shelf life in the spotlight. Facebook doesn't have the same utility as Google, and won't be able to branch into as many parts of our lives without annoying everyone. Just look at what a dud Facebook Home was! The software was supposed to make Facebook the center of a user's mobile experience, but, a little more than a month after launching the first Facebook Home phone -- the HTC First -- Facebook Home was virtually dead.

From a stock standpoint, Facebook is absurdly priced at 16 times revenue. To put that in perspective, Facebook would have to grow 42% annually for the next 10 years to reach Microsoft's current price/revenue multiple of 3.6. This is at a time when investors can buy Microsoft, Intel, or Apple for about 12 times earnings, and walk away with between a 2.4% and 4% dividend yield.

Amazon.com

I love using Amazon, because with Prime, I get free shipping and streaming content (which I don't use) for a relatively low $79 per year. What investors shouldn't love about Amazon's Prime service is that it squeezes margins that are already incredibly low. When you include shipping and content costs -- which Amazon hides below the gross margin line -- Amazon's margins have actually fallen slightly over the past two years, from 7.6%, to 6.8%. High content costs are driving the decrease, a factor that won't change because content is only becoming more expensive.

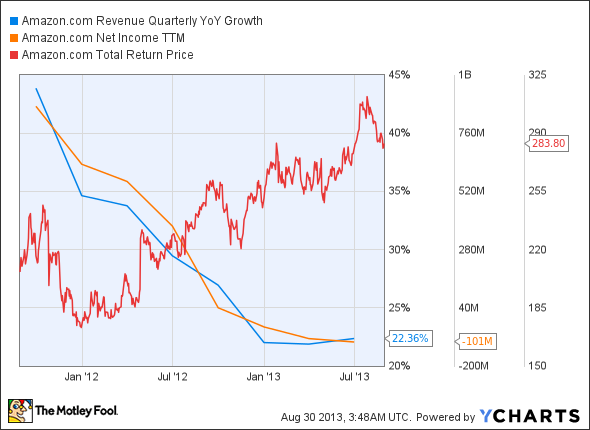

Also concerning is that Amazon's stock has been on a tear over the past two years, despite the company's net income and sales growth both dropping rapidly.

AMZN Revenue Quarterly YoY Growth data by YCharts

To live up to a $130-billion market cap, Amazon is going to have to make a profit eventually. CEO Jeff Bezos doesn't seem to have any interest in making that happen, and investors bidding up the stock without the prospect of income in the future are creating a bubble that's bound to burst.

3D Systems

3-D printing is the future. Someday, we'll be printing cars and houses from our own home printing machine.

OK, that might be farfetched, but it's easy to see how the mind can wander when imagining the possibilities that 3-D printing unlocks. But most people don't realize that this technology has actually been around for decade;, it just hasn't been economical to have on your desk. That's what 3D Systems is changing, and what drove the company's 44.5% growth over the past year.

But we also need to remember that acquisitions have played a large roll in growth as the industry has consolidated. Organic growth was only 30.1%, a strong level, but not enough to justify a price/revenue multiple of 13, and a price/earnings multiple of 122.

3D Systems has a solid future, but it's priced in the stratosphere right now. The company will need years of 30% organic growth to live up to its lofty valuation, and any hiccups along the way could burst the bubble.

Boring may be the right plan for now

The notoriety of high-flying growth stocks also come with a strong possibility they'll crash and burn. And over the long term, the compounding effect of the quarterly dividends, as well as their growth, may be a better play considering the strong yields you can find on the market. With this in mind, our analysts sat down to identify the absolute best of the best when it comes to rock-solid dividend stocks, drawing up a list in this free report of nine that fit the bill. To discover the identities of these companies before the rest of the market catches on, you can download this valuable free report by simply clicking here now.

The article Speculative Stocks Are Hitting Bubblicious Levels originally appeared on Fool.com.

Travis Hoium is short shares of Amazon.com. The Motley Fool recommends 3D Systems, Amazon.com, Facebook, and Tesla Motors. The Motley Fool owns shares of 3D Systems, Amazon.com, Facebook, and Tesla Motors and has the following options: short January 2014 $36 calls on 3D Systems and short January 2014 $20 puts on 3D Systems. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.