Dow Futures Flat With Housing Data on Tap

Although we don't believe in timing the market or panicking over market movements, we do like to keep an eye on big changes -- just in case they're material to our investing thesis.

The Dow Jones Industrial Average is set to open slightly higher this morning after yesterday's plunge sent the index down to a two-month low. Stock futures as of 7:10 a.m. EDT point to a negligible one-point drop at the opening bell. Markets in Europe and Asia continued to tumble as geopolitical worries captured investors' attentions and pushed oil prices up.

Housing data

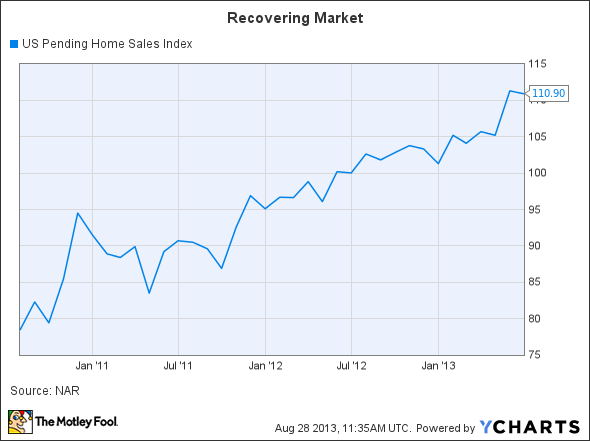

At 10 a.m EDT, investors will get the clearest picture yet of how rising interest rates may be impacting the recovering housing market. The pending-home-sales report from the National Association of Realtors is expected to show a small dip in July after sales hit their highest levels since 2006 this spring.

Yes, mortgage rates have spiked over the last month, which may have cooled the market down. However, the overall trend shows a healthy recovery in pending sales activity so far.

US Pending Home Sales Index data by YCharts.

That's been great news for home improvement retailer Home Depot . It announced a banner quarter last week, with profit up 23% on a scorching 11.4% rise in comparable-store sales. And rising rates haven't spoiled the party yet. In the conference call with analysts, Home Depot CFO Carol Tome pointed out that despite the recent bounce in mortgage rates, housing is still more affordable than it has been historically. "If rates were to move up," she said, "it would peak that affordability index, but we have a long way to go before it would have a dramatic impact."

New highs

Meanwhile, yesterday's new stock-specific highs are a good reminder that market jitters have zero impact on the ability of strong businesses to improve their competitive positions. On a day in which nearly all Dow stocks closed in the red and the broader S&P 500 fell by 1.6%, two retailers, Tiffany and DSW , set new 52-week highs.

For its part, Tiffany's cost cuts and increased sales of expensive jewelry helped gross margin improve to 57.5% from 56.3% a year ago. Global sales growth was key, with the company's Asia-Pacific region logging a 20% spike in revenue. And DSW had success at the other end of the market. The shoe retailer's focus on value helped bring more customers into its stores last quarter, leading to a 9.7% jump in revenue and a 4.4% rise in comparable sales. Neither company was affected in the least by geopolitical concerns.

No matter what the market does in the short run, the best investing approach is to choose great companies and stick with them for the long term. The Motley Fool's free report "3 Stocks That Will Help You Retire Rich" names stocks that could help you build long-term wealth and retire well, along with some winning wealth-building strategies that every investor should be aware of. Click here now to keep reading.

The article Dow Futures Flat With Housing Data on Tap originally appeared on Fool.com.

Fool contributor Demitrios Kalogeropoulos has no position in any stocks mentioned. The Motley Fool recommends Home Depot. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.