Does U.S. Bancorp's Stock Deserve a Deeper Look?

Source: Wikimedia Commons

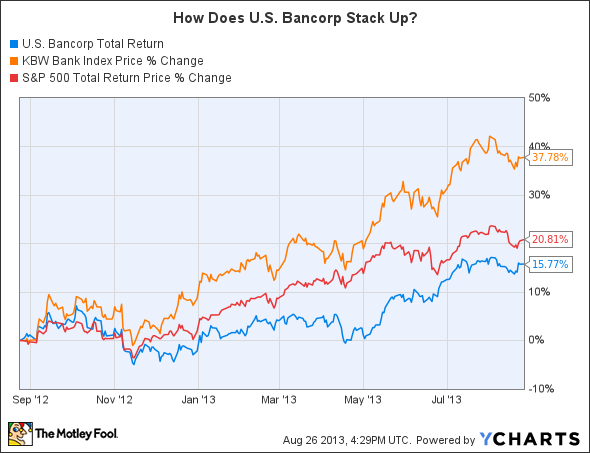

Over the past 12 months, shares of U.S. Bancorp have been walloped by both its peers on the KBW Bank Index and the broader market's S&P 500. Its total return of 16% underperforms KBW by roughly 22 percentage points and the S&P by 5 percentage points. In light of this lackluster performance, should current and prospective investors expect its shares to rebound or continue to lag?

The answer to this question is far from clear when you examine the collective insight of banking analysts. The median target price of the 28 analysts surveyed by Standard & Poor's Capital IQ is $39 a share, with a high estimate of $43 and a low of $33.50. As of the time of writing, U.S. Bancorp actually trades for $37.30 per share. Consequently, if the analysts are to be believed, which is admittedly a big "if," then there's an anticipated upside of 4.6%.

Metric | U.S. Bancorp | KBW Bank Index |

|---|---|---|

Price to Tangible Book Value | 2.77 | 1.82 |

Price to Book Value | 1.97 | 1.25 |

Price to Earnings | 12.70 | 15.21 |

Source Standard & Poor's Capital IQ.

The modest upside is largely a result of U.S. Bancorp's current valuation. Thanks to its reputation for conservative banking and a fortress-like balance sheet, its shares trade for 2.77 times tangible book value and 1.97 times book value. These are 52% and 58%, respectively, above the average of the 24 banks in the KBW bank index, leaving seemingly little room for outperformance relative to its peers.

At the end of the day, this is a quick and rudimentary analysis that shouldn't be relied upon singularly when deciding whether to buy or sell shares of U.S. Bancorp. What it shows us instead is that a deeper look at the massive regional lender's shares may very well be in order given its well-defended position in the industry and the, at least at this stage in the analysis, comparatively underwhelming opportunity for share price appreciation.

Bargains of a lifetime are still available in bank stocks, but it's critical to understand what makes the best banks tick. The Motley Fool's new report "Finding the Next Bank Stock Home Run" demystifies the perils of investing in banks and reveals how savvy investors can win. It's completely free -- click here to get started.

The article Does U.S. Bancorp's Stock Deserve a Deeper Look? originally appeared on Fool.com.

John Maxfield has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.