The Dow's Dividend Aristocrat: Procter & Gamble

I recently explained that the Dow Jones Industrial Average has nine stocks that are considered dividend aristocrats, defined as having paid an annually increasing dividend to shareholders for the past 25 years. Part of their continued success is that they try to make everyone on the planet a customer. They don't operate in niche markets of only a few hundred thousand consumers; they want everyone to buy their products. Coca-Cola, Chevron, and ExxonMobil are just a few of the names that sell their products to the masses.

To learn more about the Dow's aristocrats, click here. And then come back here to learn more about one of them -- Procter & Gamble .

What has made Procter & Gamble great

Two brothers-in-law, William Procter and James Gamble, began P&G on April 12, 1837. Their company started out as a soap and candle operation, which is actually one of the most important reasons P&G is still around today, and why the company has become a dividend aristocrat. In 1837, everyone used candles to light their homes. Once you burned through your candles, you had to buy more. And people have always needed soap. These were items that had a short life span but were household necessities. P&G's customers kept coming back week after week to replenish their supplies, and it didn't matter what the economy was doing -- which was a good thing, considering P&G began its life at the start of the Panic of 1837, one of the worst depressions in American history.

Since then, P&G has survived the Great Depression, the most recent recession, and countless other periods of economic stress -- and it's still manged to grow its revenue by an annual rate of 9.3% since 1932. That's what happens when you sell products consumers need, and will make repeat purchases of, during good times and bad. You can put off buying a car or a home, but even if times are tough, you still need more soap, cleaning products, razor blades, and toilet paper.

The dividend

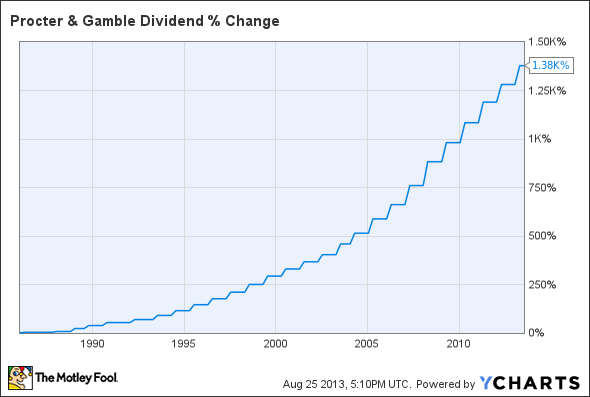

P&G is the oldest dividend aristocrat on the Dow, having increased its dividend every year since 1957. Let's look at how that dividend has grown over the past several years.

PG Dividend data by YCharts

In 1985 P&G was paying a quarterly dividend of $0.04063 per share. Today that dividend is $0.602 per share. That's an increase of 1,380%.

Over that same period, the stock price has increased 11.5% annualized, or 2,173%. But if you'd owned shares and reinvested those dividends back into the stock, your total return since 1985 would have been 4,578.9%, or an annualized return of 14.4%.

In short, this is an aristocrat that's made millionaires out of its dividend.

While I like knowing what a company has done in the past, I'm more concerned about what it can do in the future. And since P&G has a proven track record of surviving recessions and depressions, I don't see any reason this company won't be around for another 50, or even 150, years, still paying and increasing its dividend. Considering how this company has performed for its shareholders just since 1985, think about the wealth it might create over an even longer period into the future.

Dividend stocks can make you rich. It's as simple as that. While they don't garner the notability of high-flying growth stocks, they're also less likely to crash and burn. And over the long term, the compounding effect of the quarterly payouts, as well as their growth, adds up faster than most investors imagine. With this in mind, our analysts sat down to identify the absolute best of the best when it comes to rock-solid dividend stocks, drawing up a list in this free report of nine that fit the bill. To discover the identities of these companies before the rest of the market catches on, you can download this valuable free report by simply clicking here now.

The article The Dow's Dividend Aristocrat: Procter & Gamble originally appeared on Fool.com.

Fool contributor Matt Thalman has no position in any stocks mentioned. Check back Monday through Friday as Matt explains what caused the Dow's winners and losers of the day, and every Saturday for a weekly recap. Follow Matt on Twitter: @mthalman5513. The Motley Fool recommends Chevron, Coca-Cola, and Procter & Gamble. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.