How Realty Income Corp. Makes Money

Source: Realty Income annual report.

Realty Income is a popular stock for dividend investors. But do you know exactly what you're getting into when you buy shares of this REIT? Here's the beginner's guide to how Realty Income creates returns for its investors.

Leasing in a nutshell

As a triple-net REIT, Realty Income specializes in leasing contracts that place the burden of property maintenance, insurance, and taxes on its tenants (97.7% of its leases are triple-net leases). The net-lease model allows it to have an extremely lean operation -- the company employs only 104 people to manage more than 3,500 properties.

You might be thinking that, since Reality Income doesn't offer the full management services of other REITs, it must be losing out on customers, right? Not exactly. While some tenants may prefer that a leasing company manage a leased building, Reality Income has other advantages that attract long-term tenants:

Scale, which allows it to raise capital for real estate investments at a lower interest rate than its tenants.

An investor base that likes real estate investments -- unlike its tenants' shareholders, who may not want real estate on their companies' balance sheets.

A geographically diverse portfolio that makes Realty Income a one-stop shop for customers who want to open many new locations simultaneously.

A big balance sheet for sale-leaseback transactions, wherein companies sell property to Realty Income, then subsequently sign a long-term lease on the building from its new owner.

The company takes a very involved position in its real estate investments, asking its tenants to provide location-specific data on sales to ensure that it knows about any potential default or contract termination ahead of time.

Its top customers include household names like FedEx, LA Fitness, Walgreen, Family Dollar, and AMC Theaters.

Looking under the hood of the real estate portfolio

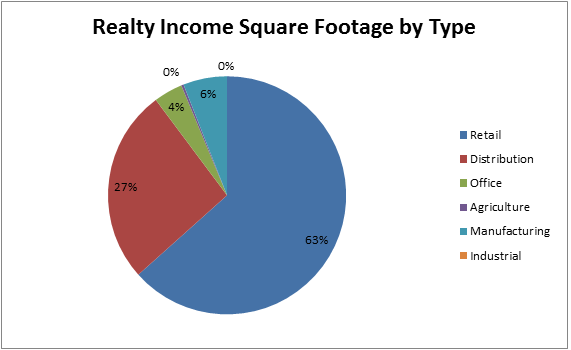

Realty Income's massive portfolio of real estate investments focuses on stand-alone retail buildings, differentiating it from office and industrial REITs.

As of its June 30 earnings report, 77.7% of Realty Income's revenue came from retail stores, 11.7% from distribution centers, and 5.3% from office buildings located in 49 U.S. states and Puerto Rico.

Realty Income 2Q 2013 earnings press release.

The company prefers retail buildings because they're located in high-traffic areas, and demand a premium price per square foot compared to other types of real estate. Also, because retailers invest heavily in marketing their location, they are less likely to move to save money on rental payments. Thus, many of Realty Income's leases are renewed, even after their initial 10- and 20-year contracts expire.

Realty Income grows its real-estate portfolio with stock acquisitions, which allows it the freedom to send virtually all of its cash flow back to shareholders.

It is in acquisitions that Realty Income really shines. Despite the fact that share count has grown from 71 million shares in 2003, to 196 million shares as of the last quarter, the company's dividends per share have grown in every single year, up from $1.20 per year 10 years ago, to $2.179 per share in expected dividends in 2013, for an average of 6.1% per year.

Other net-lease retail REITs like National Retail Properties haven't kept up with Realty Income's dividend growth. During the 2003-2013 period, National Retail Properties increased its dividend only modestly to the tune of just 2.3% per year. The company is a veritable dividend growth stock, however, as it has a consistent record of small dividend increases going back 24 consecutive years.

National Retail Properties is just as aggressive in acquisitions. Share count grew from 43 million shares in 2003, to 112 million in 2013, but its acquisition strategy hasn't led to robust dividend growth when compared to Realty Income's success.

How it plays in your portfolio

When property values and commercial rents rise, Realty Income investors make money. As a shareholder, you should root for low, but sustained, inflation, which drives rental increases while having only a modest effect on the company's cost of borrowing.

In the best-case scenario, interest rates should be lower than reported CPI-U inflation, because rental increases are largely based on that index's readings. When interest rates rise faster than inflation, Realty Income's borrowing costs surge higher than its annual rent increases, driving down total returns.

Investing is never without its risks. Because Realty Income focuses on retail property, changes in business-to-consumer commerce have a big impact on earnings. The rise of Amazon and eBay present a long-term risk to the business model, as shoppers turn online to make purchasing decisions. Likewise, the decline of offline retailers like Best Buy, Sears, or J.C. Penney could free up millions of retail square feet, driving down prices in local markets. The company's long-term leases help displace some of this risk, however.

The company is best suited for investors who want monthly income from commercial real estate exposure. Consider it a convenient proxy for real estate investing: You don't have to pick your own properties, or find tenants. As a public shareholder, you just have to wait for the monthly dividend payments to roll into your brokerage account. The hands-off appeal and diversified portfolio is why so many investors prefer Realty Income as an income play from commercial real estate.

More Premium Stock Picks from The Motley Fool

Well-managed REITs and dividend stocks can make you rich. It's as simple as that. While they don't garner the notoriety of high-flying growth stocks, they're also less likely to crash and burn. And over the long term, the compounding effect of the quarterly payouts, as well as their growth, adds up faster than most investors imagine. With this in mind, our analysts sat down to identify the absolute best of the best when it comes to rock-solid dividend stocks, drawing up a list in this free report of nine that fit the bill. To discover the identities of these companies before the rest of the market catches on, you can download this valuable free report by simply clicking here now.

The article How Realty Income Corp. Makes Money originally appeared on Fool.com.

Fool contributor Jordan Wathen has no position in any stocks mentioned. The Motley Fool recommends Amazon.com and eBay. The Motley Fool owns shares of Amazon.com and eBay. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.