Crude Oil Supplies Drop 0.4%, Gasoline Down 1.8%

U.S. crude oil supplies fell 1.4 million barrels (0.4%) for the week ending Aug. 16, according to an Energy Information Administration report (link opens a PDF) released today.

After dropping off 0.8% the previous week, this newest report marks the third straight week of crude oil contraction. This latest drop was a result of increased refinery inputs, up 234,000 thousand barrels per day (bbpd) from last week. Crude supplies of 359.1 million barrels are 0.5% below year-ago levels.

Source: eia.gov.

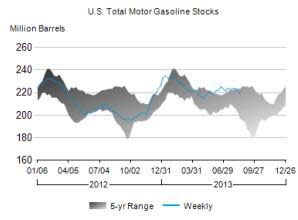

Gasoline inventories also fell, down 4.0 million barrels (1.8%) after tapering off 1.2 million barrels the week before. Demand for motor gasoline is up a seasonally adjusted 2% for the last four-week period compared to the year-ago period, although supplies "remain in the upper limit of the average range for this time of year." Gasoline supplies of 218.4 million barrels are 7.7% more than year-ago levels.

Over the past week, retail gasoline pump prices fell around $0.011 to $3.550 per gallon.

Source: eia.gov.

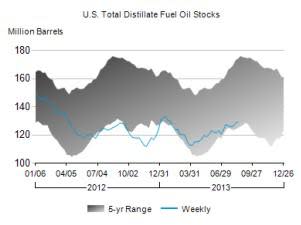

Distillates supplies, which include diesel and heating oil, made for the only increase this week, up 0.9 million barrels for the third consecutive week of inventory expansion. Distillates demand is up a seasonally adjusted 2.8% for the last four-week period, compared to the year-ago period, and supplies are "near the lower limit of the average range for this time of year," according to the EIA.

Source: eia.gov

-- Material from The Associated Press was used in this report.

The article Crude Oil Supplies Drop 0.4%, Gasoline Down 1.8% originally appeared on Fool.com.

Fool contributor Justin Loiseau has no position in any stocks mentioned. You can follow him on Twitter @TMFJLo and on Motley Fool CAPS @TMFJLo.The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.