The 1 Income Statement Number You Shouldn't Ignore

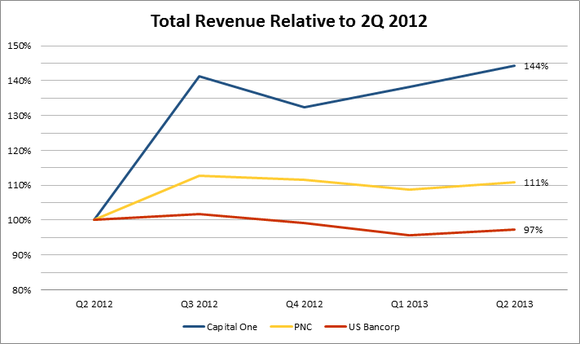

A quick check of Capital One's top-line revenue reveals a dramatic change from the second quarter of 2012 to the second quarter of 2013:

Source: Company SEC filings.

Its 44% revenue growth year over year bested regional banking counterparts PNC and US Bancorp , which clocked in at 15% and -0.4%, respectively. It also topped the nation's largest bank, JPMorgan Chase, which saw revenue grow at 14%.

Source: S&P Capital IQ

How did Capital One generate that amazing growth? Let's take a closer look.

Sources of Revenue

Banks generate revenue from two major sources: interest and non-interest income. Banks make interest income from loans to consumers and companies, while non-interest income comes from fees, trust and asset management services, and other ancillary activities.

An enormous percentage of Capital One's revenue comes from the basic banking operations of interest income, rather than extra fees or special services.

Revenue Type | Capital One | PNC | US Bancorp |

|---|---|---|---|

Interest Income | 82% | 58% | 57% |

Non-interest Income | 18% | 42% | 43% |

Source: SEC filings.

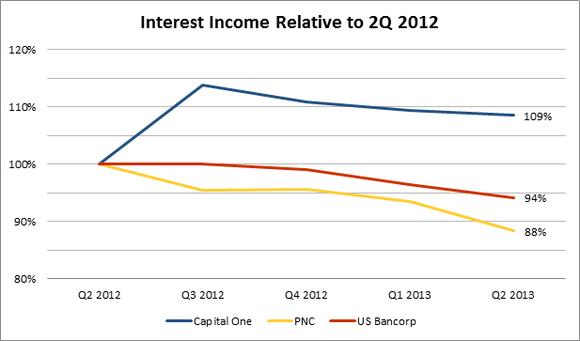

Over the past year, Capital One has seen impressive growth in its interest income from other loans and investments. That slice of its revenue has risen by 9%, while peers US Bancorp and PNC have each seen their interest income fall over the past year.

Source: S&P Capital IQ

Still, remember that Capital One gets far more of its revenue from this interest income than its two rivals. To get a complete picture of these businesses' growth, you also need to see how their non-interest income has measured up:

Source: S&P Capital IQ

As you can see, while Capital One has seen slight growth in this area, the real winner in this exploration appears to be PNC, whose Asset Management, Consumer Services, and Corporate Services divisions have all expanded. However, its second-quarter results in 2012 included a one-time charge of $470 million in its mortgage banking unit -- excluding that charge, PNC experienced much slower revenue growth.

How does 9% + 3% = 44%?

As we saw earlier, Capital One's interest income grew by 9%, and its non-interest income increased by 3%. But how did those two numbers combine to equal the 44% growth in its total revenue? The answer lies in an often-overlooked income-statement line item.

"Provision for Credit Losses" is a forward-looking estimate of what the bank expects to lose on its loans; this number gets subtracted from a bank's total revenue calculation.

If a bank has flat interest and non-interest income, but its provision for loan losses goes down, its total revenue will rise. In the last year, Capital One has seen its provision for credit losses plummet by more than $1 billion as the result of a safer, less-risky business climate, and the removal of a one-time charge. These lowered loss provisions have directly contributed to the company's revenue.

Source: S&P Capital IQ

Capital One's falling provisions for credit losses and rising revenue certainly look appealing. But you'll get a clearer picture of any bank's top-line growth by looking at its revenue before the provision for credit losses.

That figure is a more telling measure for a bank because it removes any accounting alterations, and instead displays the actual growth in its current operations.

In this light, Capital One's growth looks significantly less dramatic:

Not so fast

Company | Q2 2012 | Q2 2013 | % Change |

|---|---|---|---|

Capital One | $5,055 | $5,638 | 12% |

PNC | $3,623 | $4,020 | 11% |

US Bancorp | $4,893 | $4,765 | -3% |

Source: S&P Capital IQ. In millions.

Here we see that Capital One's growth clocked in at a much more tepid pace of 12%. Again, PNC's growth looks more dramatic to do a one-time charge in the second-quarter of last year.

While revenue growth alone doesn't drive most investors' decisions, 44% top-line growth will definitely draw their attention. However, you'll need to take a closer look at the numbers to see whether that apparent growth matches up to reality.

More Premium Advice on Banking Stocks!

Bargains of a lifetime are still available in bank stocks, but it's critical to understand what makes the best banks tick. The Motley Fool's new report, "Finding the Next Bank Stock Home Run," demystifies the perils of investing in banks, and reveals how savvy investors can win. It's completely free -- click here to get started.

The article The 1 Income Statement Number You Shouldn't Ignore originally appeared on Fool.com.

Patrick Morris owns shares of US Bancorp. The Motley Fool owns shares of PNC Financial Services. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.