The Dow Is Down, but There's Good News for Investors

Although we don't believe in timing the market or panicking over daily movements, we do like to keep an eye on market changes -- just in case they're material to our investing thesis.

The market is down slightly today, but that doesn't mean there's no news. Long-term investors should take note of today's reports on the housing market, which showed that new construction is staying resilient despite the higher mortgage rates. After yesterday's 1.47% drop, the Dow Jones Industrial Average is relatively flat today, down 0.26% as of 1:20 p.m. EDT while the S&P 500 is down 0.37%.

There were four U.S. economic releases today.

Report | Period | Result | Previous |

|---|---|---|---|

Housing starts | July | 896,000 | 846,000 |

Building permits | July | 943,000 | 918,000 |

Productivity | Q2 | 0.9% | (1.7%) |

Consumer Sentiment Index | August | 80 | 85.1 |

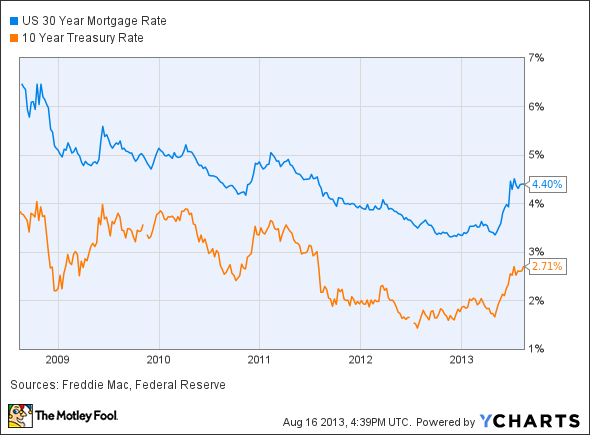

While the Thomson Reuters/University of Michigan Consumer Sentiment Index dropped in August after hitting a five-year high in July, the three other economic reports are more positive signs for the economy. Earlier this summer Bernanke's talk of tapering spooked the bond and mortgage markets, leading to a sell-off and a jump in rates.

US 30 Year Mortgage Rate data by YCharts.

Since then there has been a lingering worry that higher rates could put a damper on the housing market's recovery. Today's reports show that so far this is not the case, at least when it comes to new building. Housing starts rose to a seasonally adjusted annual rate of 896,000 in July, up from 846,000 in June, though they fell short of analyst expectations of 915,000. Building permits, a sign of future housing starts, rose to a seasonally adjusted annual rate of 943,000. That's better than June's 918,000, though slightly worse than analyst expectations of 953,000. The big question that remains is whether the rise in mortgage rates will affect housing prices. Later next week we'll get more information, with June's FHFA home price index coming out on Thursday and July's new-home sales report coming out on Friday.

The last economic release was the productivity report, which showed that productivity rose at a 0.9% annual rate, reflecting a 2.6% rise in output and a 1.7% rise in hours worked. Low productivity gains are among the reasons growth has been sluggish coming out of the recession. Higher productivity would mean higher growth and higher employment -- both positives for the economy but perhaps negatives for the market, as they could prompt the tapering of the Federal Reserve's asset purchases.

So what's an investor to do in this Fed-dominated market? Long-term investors would do well to ignore the market's ups and downs, focus on their investing plans, and keep their wits about them. If the drop continues, opportunities will arise for long-term investors to pick up undervalued companies.

With so much of the financial industry getting bad press these days, it may be a "greedy when others are fearful" moment. Not surprisingly, some of Warren Buffett's biggest investments are in that space. In the Motley Fool's free report "The Stocks Only the Smartest Investors Are Buying," you can learn about a small, under-the-radar bank that's too tiny for Buffett's billions -- too bad for him, because it has better operating metrics than his favorites. Just click here to keep reading.

The article The Dow Is Down, but There's Good News for Investors originally appeared on Fool.com.

Dan Dzombak can be found on Twitter @DanDzombak or on his Facebook page, DanDzombak. He has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.